Embed presentation

Download to read offline

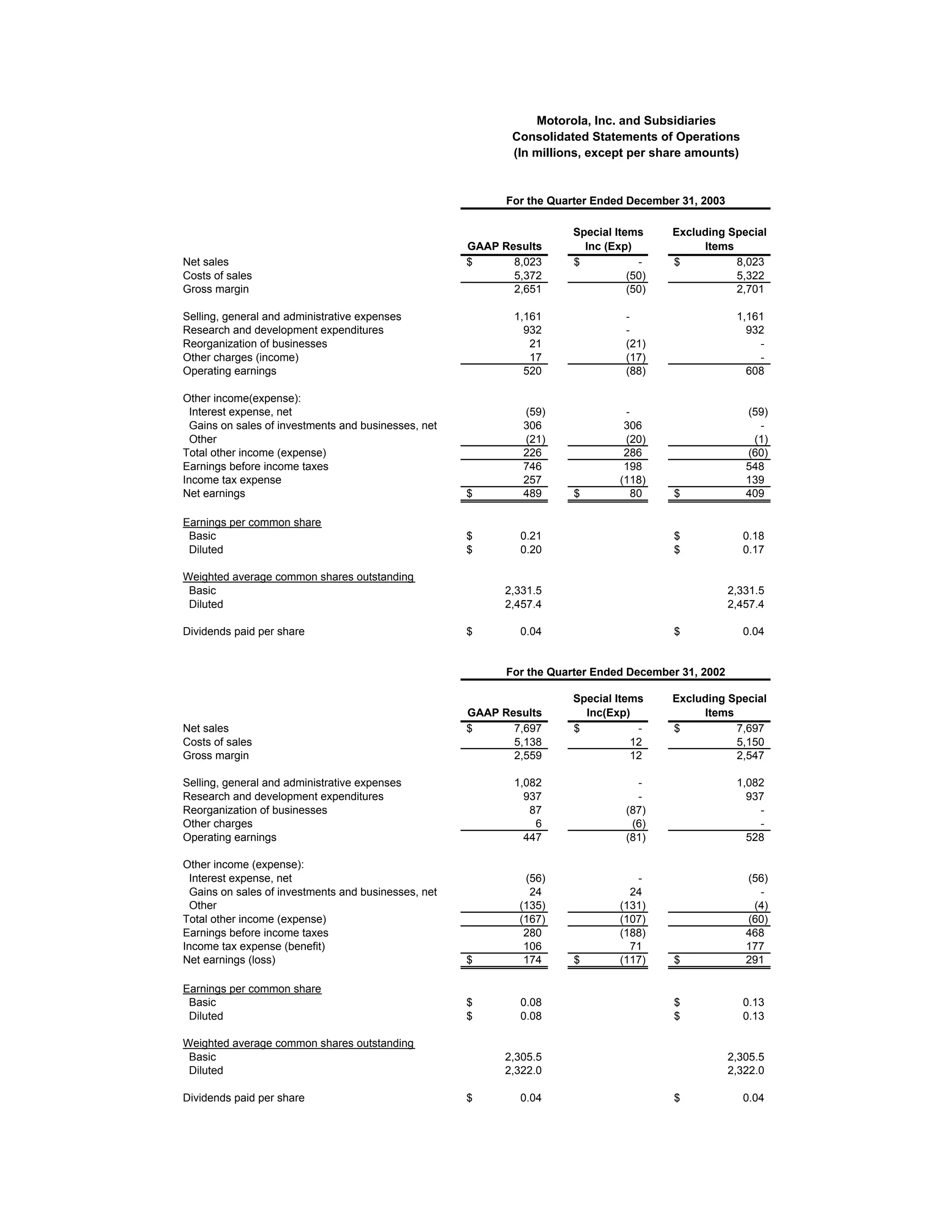

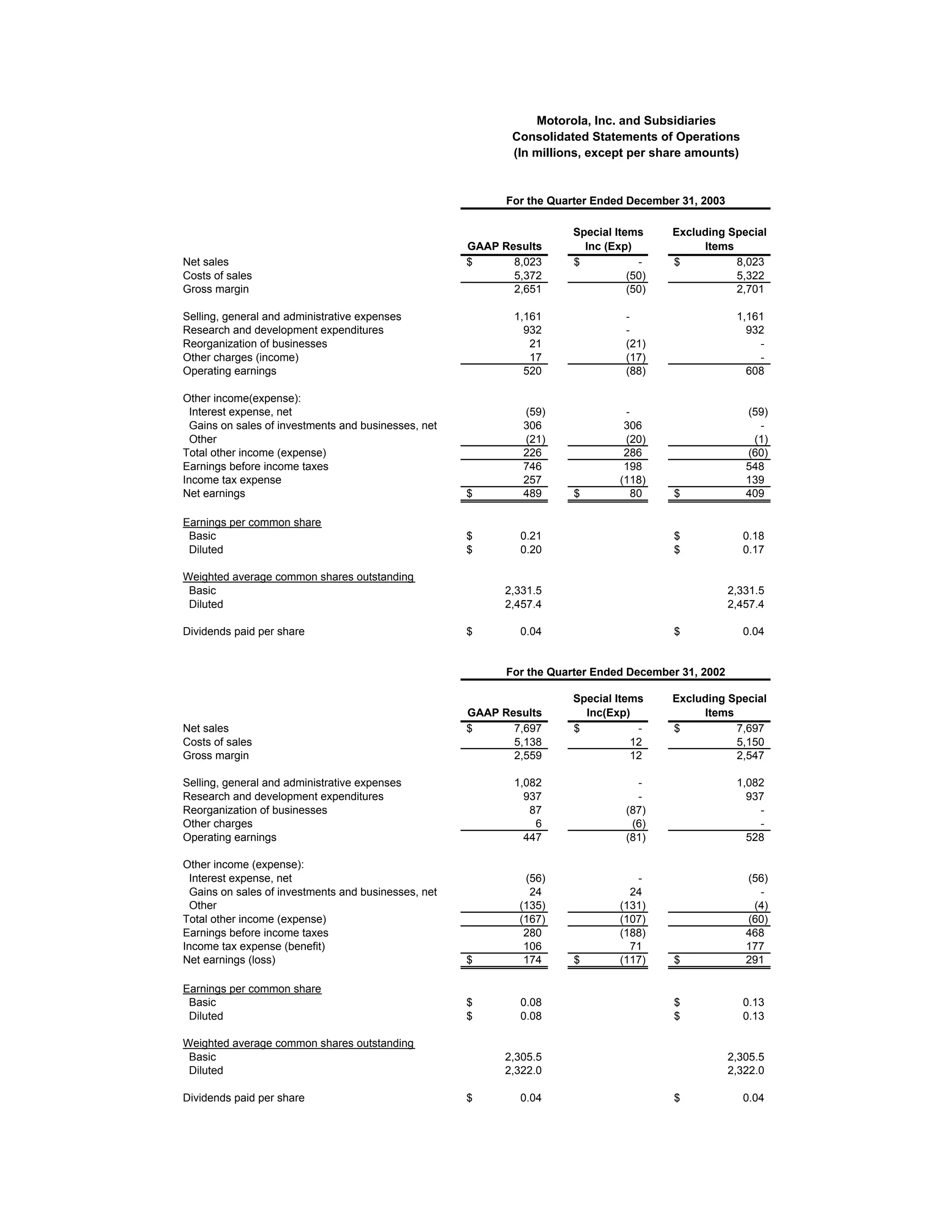

The document contains financial statements and segment information for Motorola for Q4 2003 and full year 2003. It shows that Motorola's net sales were $8.02 billion for Q4 2003, with operating earnings of $520 million. For the full year, net sales were $27.06 billion and operating earnings were $1.08 billion. It provides details on results by business segment and excludes certain special items from GAAP results to show underlying performance.