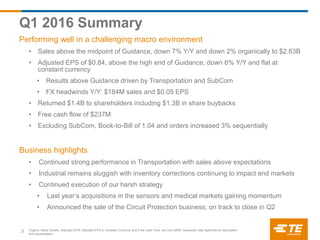

This document provides an earnings summary and outlook for Q1 2016. Some key points:

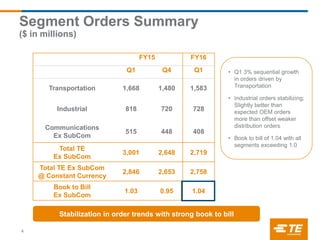

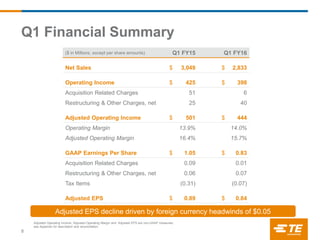

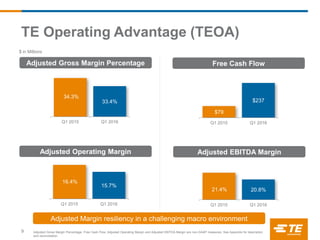

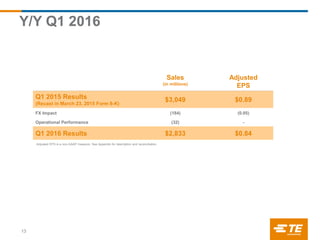

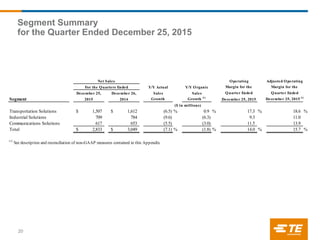

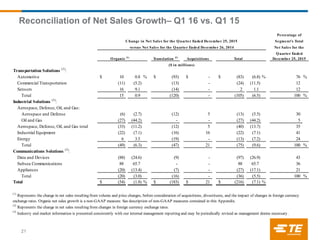

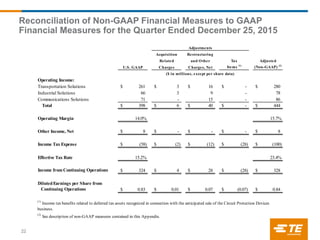

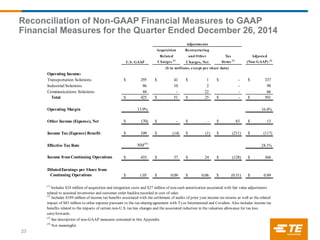

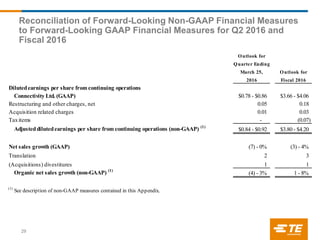

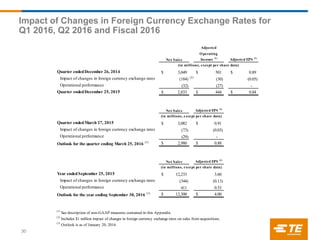

- Sales were $2.83B, above guidance and down 7% year-over-year but down only 2% organically. Adjusted EPS was $0.84, above the high end of guidance and down 6% year-over-year.

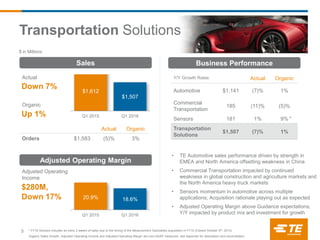

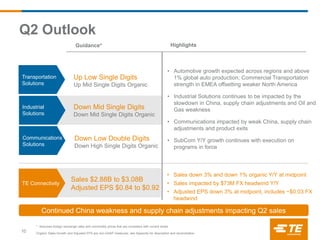

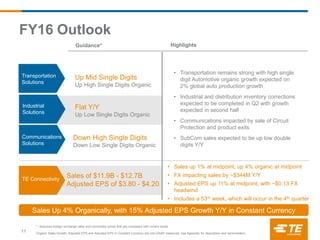

- Transportation sales were above expectations due to strength in automotive. Industrial sales declined due to inventory corrections and weakness in oil and gas. Communications sales declined due to weakness in China, appliances, and data/devices.

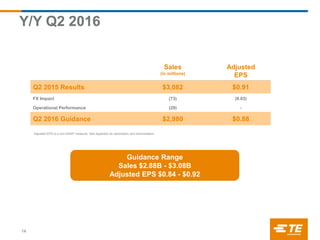

- Guidance for Q2 expects continued challenges in China and supply chain adjustments, with sales of $2.88-3.08B