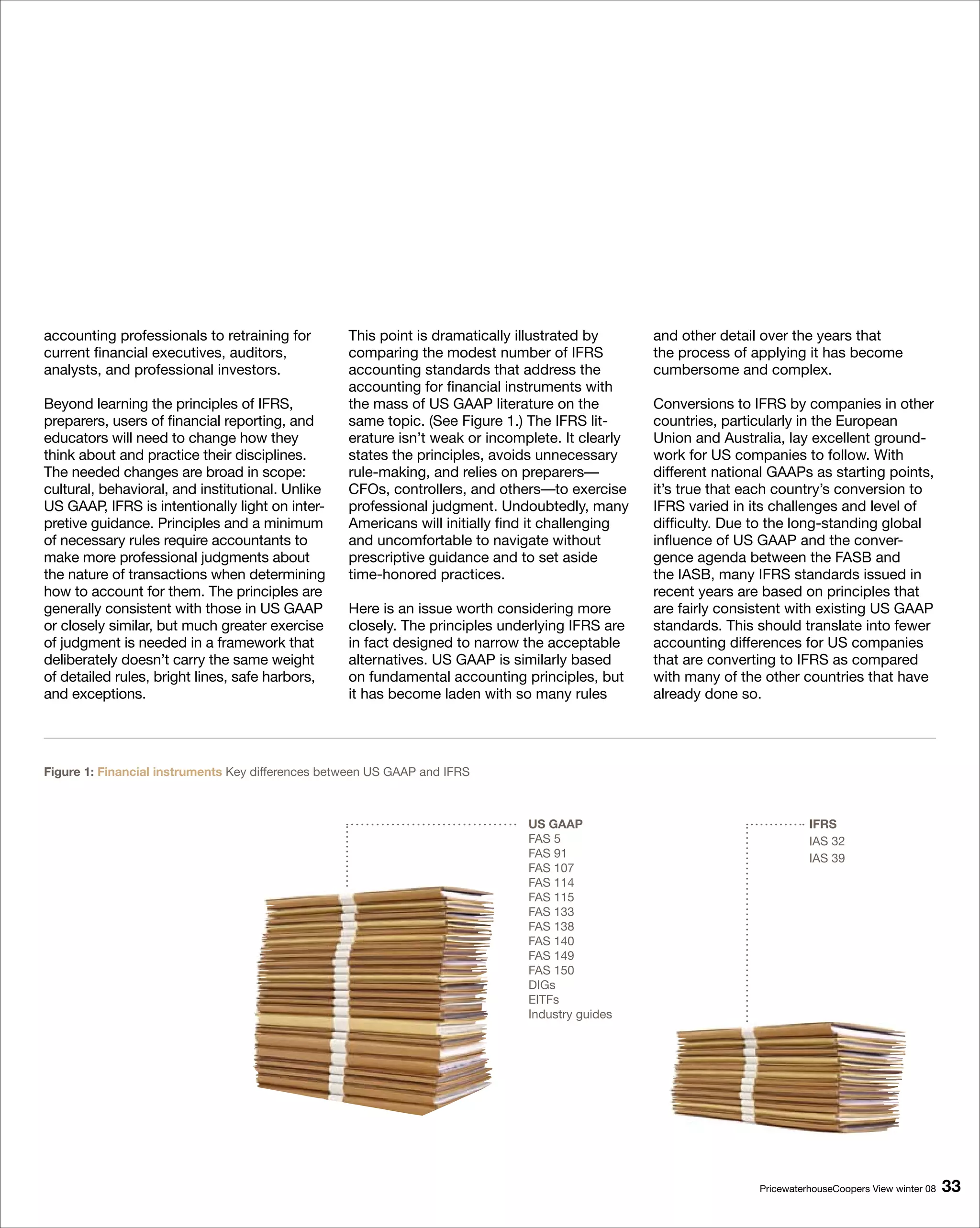

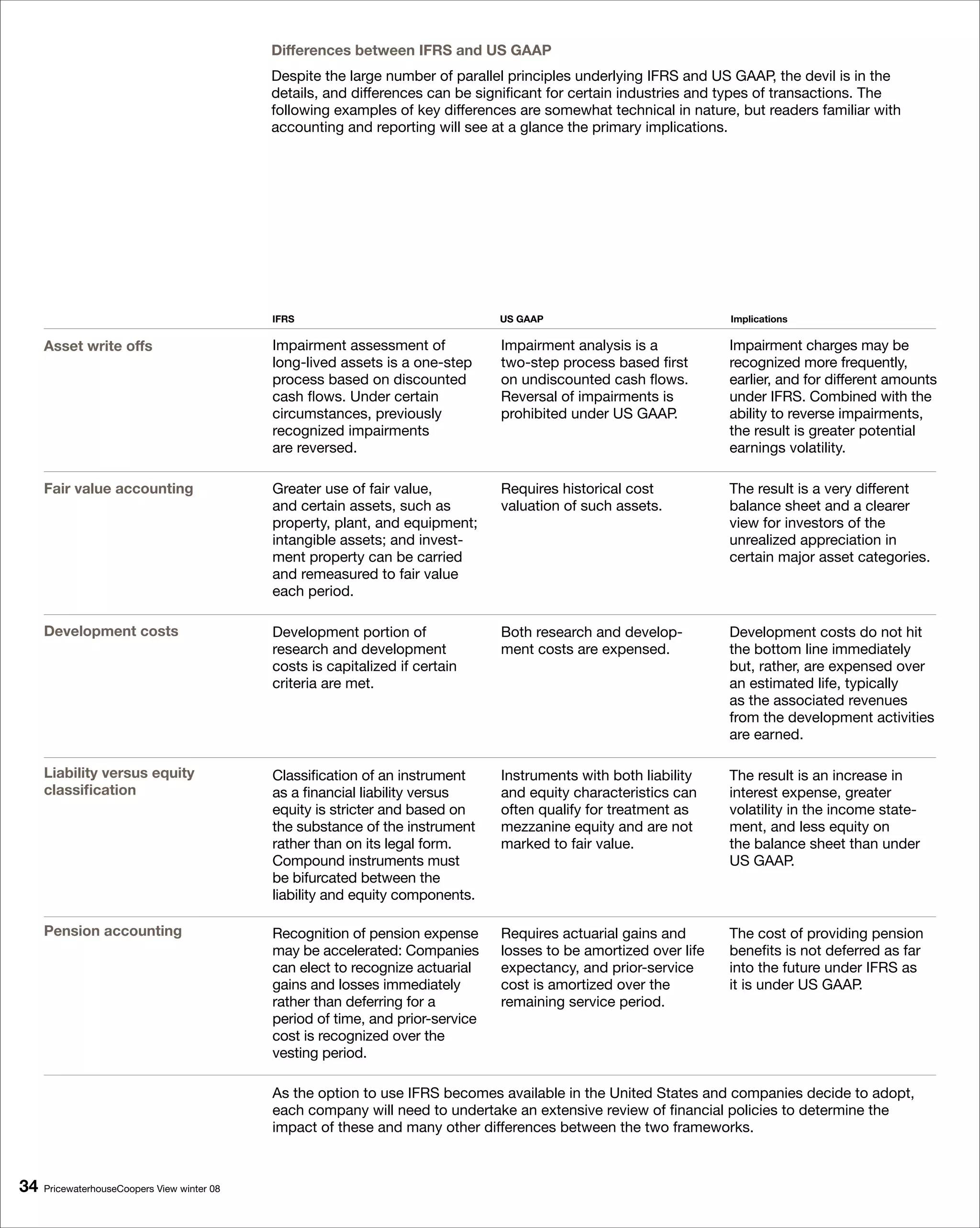

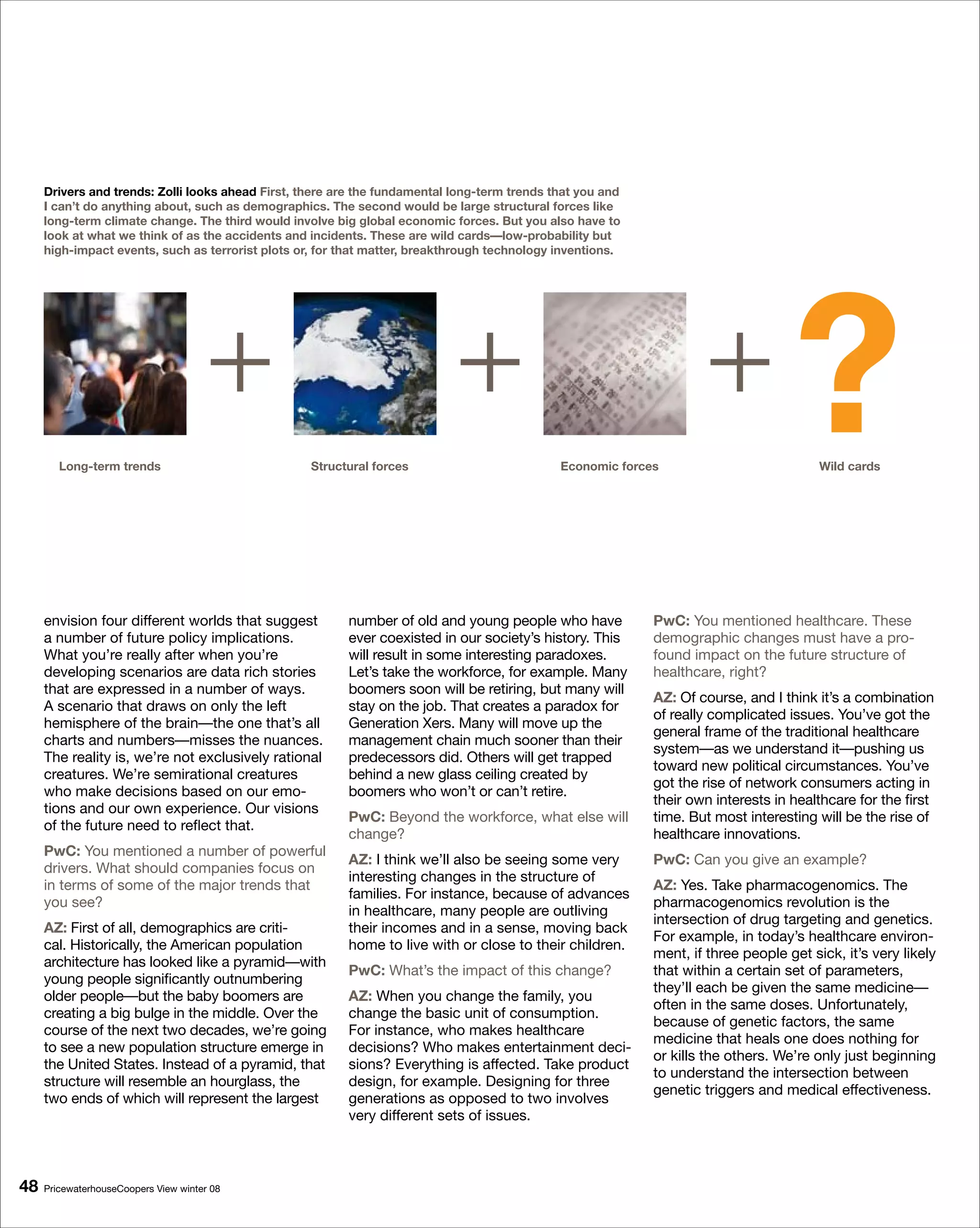

This document is an issue of the PricewaterhouseCoopers publication "View" from winter 2008. It contains articles on topics related to business such as achieving business agility, maximizing talent, health care reform, and an interview with futurist Andrew Zolli. The editorial introduces the new format and approach of View to keep up with changes in business. It also emphasizes the publication's focus on issues that concern business executives as they navigate forces of change.