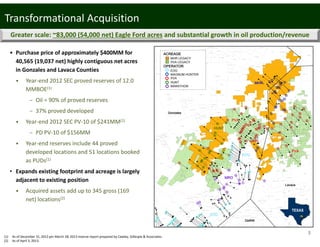

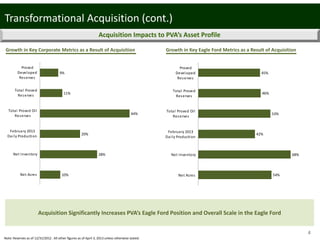

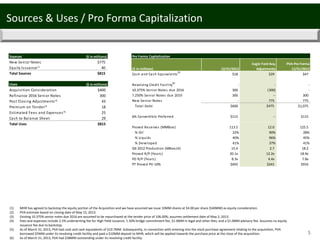

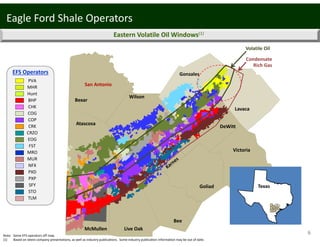

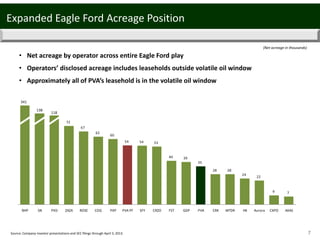

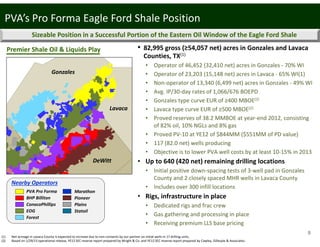

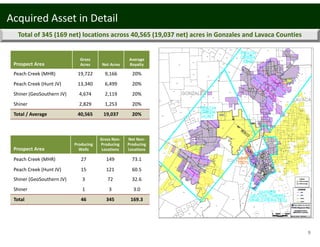

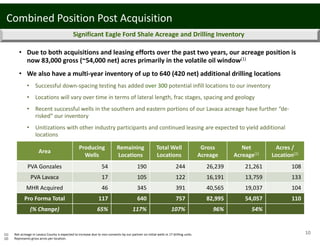

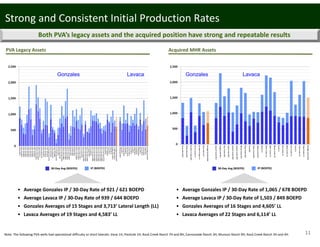

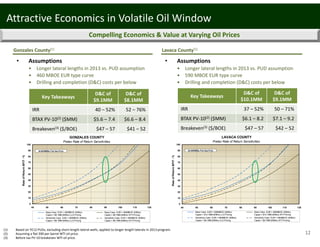

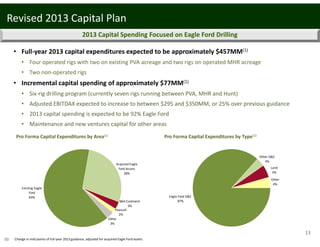

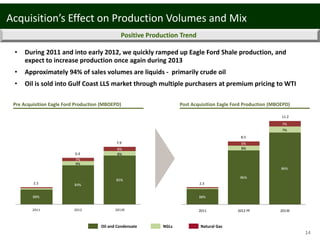

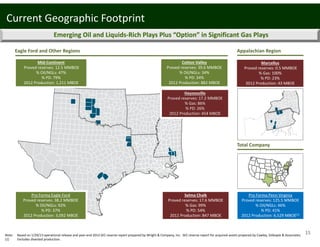

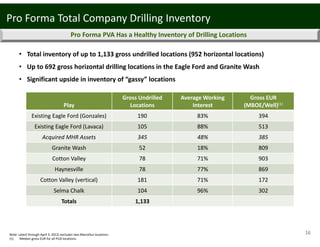

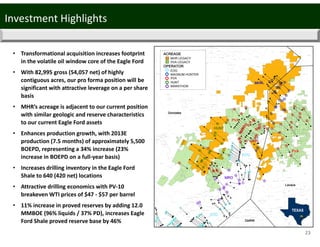

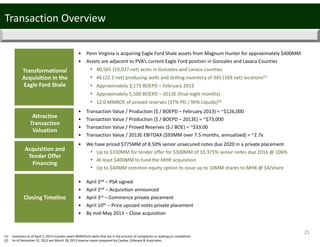

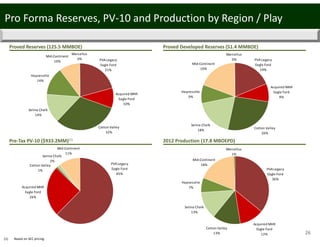

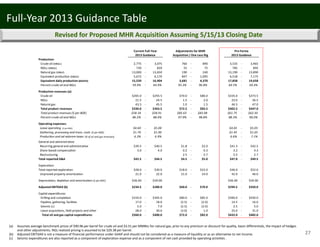

Penn Virginia Corporation is acquiring Eagle Ford Hunter, Inc. (MHR) for $400 million. The acquisition significantly increases Penn Virginia's Eagle Ford position by expanding its acreage to approximately 83,000 net acres across Gonzales and Lavaca Counties. The MHR assets add over 12 million barrels of oil equivalent of proved reserves and 345 gross drilling locations. The acquisition transforms Penn Virginia's asset profile by increasing its Eagle Ford net acreage from 10% to 54%, net inventory from 28% to 68%, and proved developed reserves from 20% to 42%.