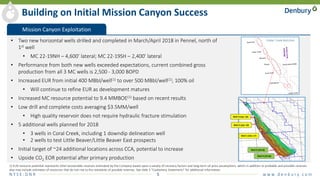

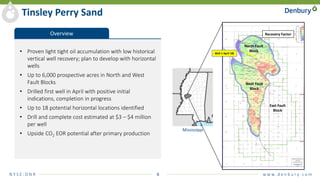

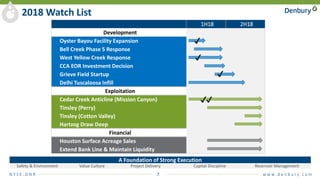

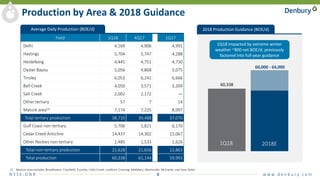

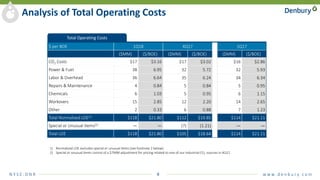

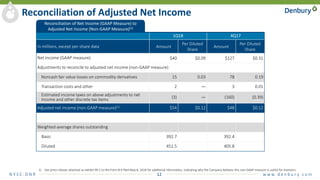

This document appears to be an earnings presentation by Denbury Resources (DNR) for the first quarter of 2018. It provides an overview of DNR's operational activities, including positive results from new horizontal wells drilled in the Mission Canyon field that exceeded expectations. It notes plans to drill additional wells across various fields in 2018. The presentation also provides a production overview by area for the first quarter and full year 2018 production guidance. It outlines DNR's priorities for the remainder of 2018, including further development and exploitation activities as well as financial objectives.