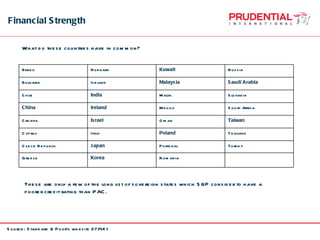

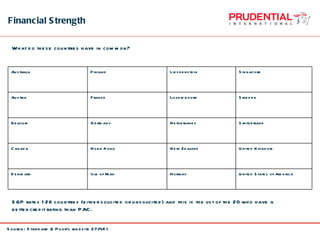

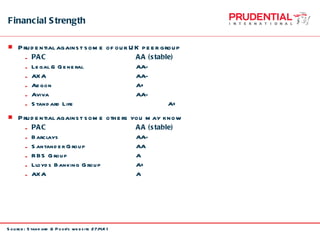

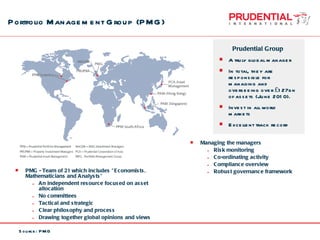

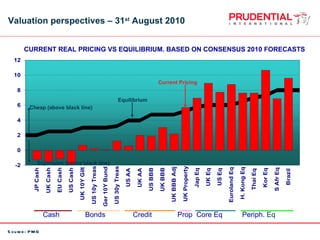

Prudential is a leading international financial services group established in 1848 with a presence in Europe, Asia, and the US. It has a very strong financial position with a AA credit rating from Standard & Poor's. Prudential's Portfolio Management Group manages over £127 billion in assets with an excellent long-term track record in global multi-asset investing.