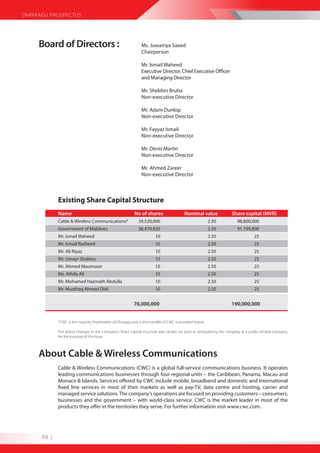

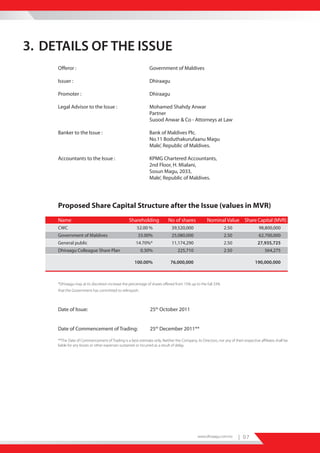

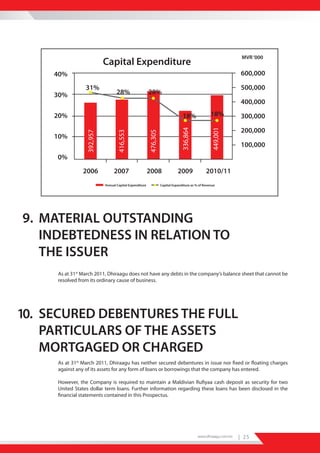

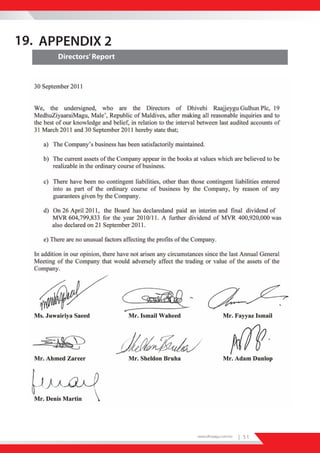

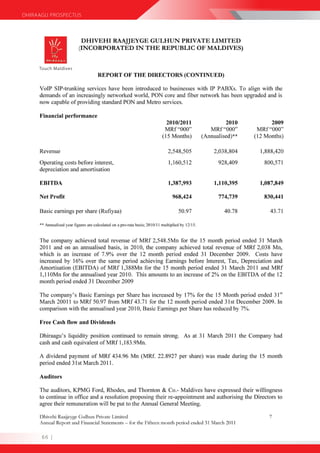

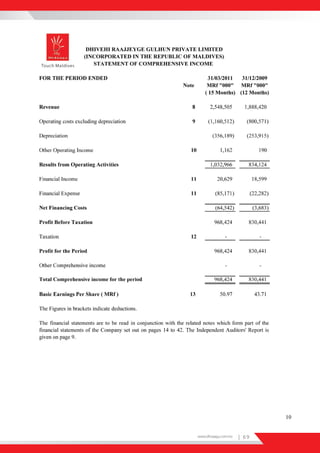

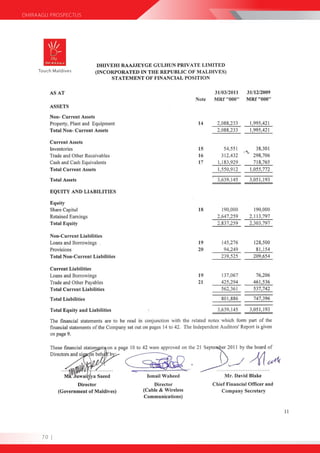

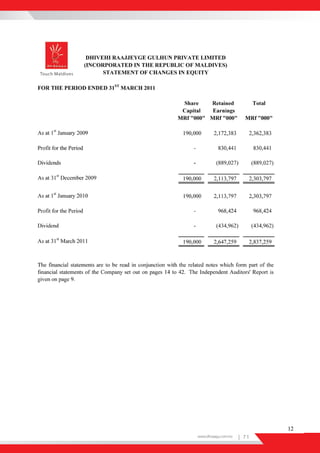

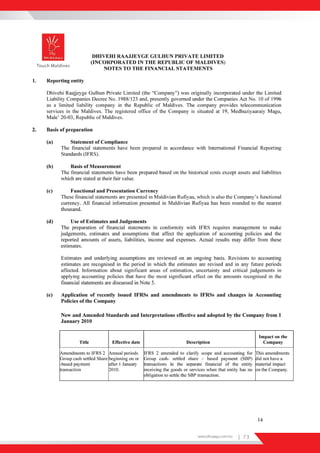

This prospectus provides information about Dhiraagu Plc and its planned share issue. It details the company background, telecom sector in Maldives, Dhiraagu's profile and financials, risks, corporate governance and board of directors. The prospectus seeks to invite investment in 11.4 million shares of Dhiraagu at a price of MVR 80 per share, totaling MVR 912 million. Approvals have been received from relevant authorities for the share issue and listing on the Maldives Stock Exchange.