The document outlines various exemptions and tax concessions under Pakistan's tax ordinance. It discusses exemptions for agricultural income, income of certain foreign experts in Pakistan, Pakistani seafarers working on Pakistani or foreign vessels, income of individuals with diplomatic privileges, UN pensions, salaries of foreign government employees, income exempt under international agreements, scholarships, alimony, and more. It also discusses deductible allowances for zakat and workers' welfare funds paid. Finally, it outlines tax credits available for charitable donations to educational and relief organizations.

![EXEMPTIONS AND TAX CONCESSIONS

Foreign Government Officials.

Any salary received by an employee of a foreign

government as remuneration for services rendered to

such government shall be exempt from tax under this

Ordinance provided –

(a) the employee is a citizen of the foreign country and not

a citizen of Pakistan;

(b) the services performed by the employee are of a

character similar to those performed by employees of

the Federal Government in foreign countries; 68[and]

(c) the foreign government grants a similar exemption to

employees of the Federal Government performing

similar services in such foreign country;](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-4-320.jpg)

![EXEMPTIONS AND TAX CONCESSIONS

Exemptions Under International Agreements.

1. Any Pakistan-source income which Pakistan is not permitted to tax

under a tax treaty shall be exempt from tax under this Ordinance.

2. Any salary received by an individual (not being a citizen of

Pakistan) shall be exempt from tax under this Ordinance to the

extent provided for in an Aid Agreement between the Federal

Government and a foreign government or public international

organization, where –

(a) the individual is either 1[not a resident] individual or a resident

individual solely by reason of the performance of services under

the Aid Agreement;

(b) if the Aid Agreement is with a foreign country, the individual is a

citizen of that country; and

(c) the salary is paid by the foreign government or public international

organization out of funds or grants released as aid to Pakistan in

pursuance of such Agreement.](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-5-320.jpg)

![EXEMPTIONS AND TAX CONCESSIONS

Profit On Debt.

Any profit received by a non-resident person on a

security issued by a resident person shall be exempt

from tax under this Ordinance where

(a) the persons are not associates;

(

b) the security was widely issued by the resident person

outside Pakistan for the purposes of raising a loan

outside Pakistan for use in a business carried on by

the person in Pakistan

(c) the profit was paid outside Pakistan; and

(d) the security is approved by the 1[Board] for the

purposes of this section.](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-8-320.jpg)

![EXEMPTIONS AND TAX CONCESSIONS

Support Payments Under An Agreement To

Live Apart

Any income received by a spouse as

support payment under an agreement to

live apart] shall be exempt from tax

under this Ordinance](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-10-320.jpg)

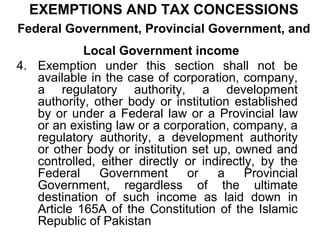

![EXEMPTIONS AND TAX CONCESSIONS

Federal Government, Provincial Government, and

Local Government income

1.

The income of the Federal Government shall be

exempt from tax under this Ordinance.

2.

The income of a Provincial Government or a 5[Local

Government] in Pakistan shall be exempt from tax

under this Ordinance, other than income chargeable

under the head ―Income from Business‖ derived by a

Provincial Government or Local Government] from a

business carried on outside its jurisdictional area.

3.

Subject to sub-section (2), any payment received by

the Federal Government, a Provincial Government or a

Local Government] shall not be liable to any collection

or deduction of advance tax.]](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-11-320.jpg)

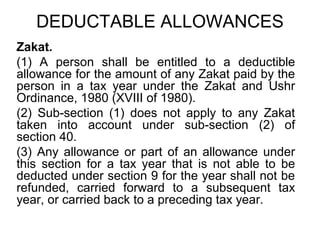

![DEDUCTABLE ALLOWANCES

Workers’ Welfare Fund. A person shall be

entitled to a deductible allowance for the amount

of any Workers‘ Welfare Fund paid by the person

in tax year under Workers‘ Welfare Fund

Ordinance, 1971 (XXXVI of 1971)]

Workers’ Participation Fund.— A person shall

be entitled to a deductible allowance for the

amount of any Workers‘ Participation Fund paid

by the person in a tax year in accordance with the

provisions of the Companies Profit (Workers‘

Participation) Act, 1968 (XII of 1968).]](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-16-320.jpg)

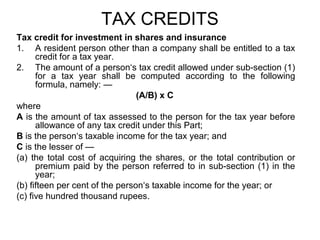

![TAX CREDITS

Charitable donations

1. A person shall be entitled to a tax credit in

respect of any sum paid, or any property given by

the person in the tax year as a donation to (a) any board of education or any university in

Pakistan established by, or under, a Federal or a

Provincial law;

(b) any educational institution, hospital or relief

fund established or run in Pakistan by Federal

Government or a Provincial Government or a

[Local Government]; or

(c) any non-profit organization.]](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-18-320.jpg)

![TAX CREDITS

Charitable donations

2. The amount of a person‘s tax credit allowed under sub-section (1) for a tax

year shall be computed according to the following formula, namely:–

(A/B) x C

where –

A is the amount of tax assessed to the person for the tax year before

allowance of any tax credit under this Part;

B is the person‘s taxable income for the tax year; and

C is the lesser of –

(a) the total amount of the person‘s donations referred to in sub-section (1) in

the year, including the fair market value of any property given; or

(b) where the person is –

(i) an individual or association of persons, thirty per cent of the

taxable income of the person for the year; or

(ii) a company, 1[twenty] per cent of the taxable income of the person

for the year.](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-19-320.jpg)

![TAX CREDITS

Charitable donations

3. For the purposes of clause (a) of component C

of the formula in sub-section (2), the fair

market value of any property given shall be

determined at the time it is given.

4. A cash amount paid by a person as a donation

shall be taken into account under clause (a) of

component C [of] sub-section (2) only if it was

paid by a crossed cheque drawn on a bank.

5. The [Board] may make rules regulating the

procedure of the grant of approval under subclause (c) of clause (36) of section 2 and any

other matter connected with, or incidental to,

the operation of this section.]](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-20-320.jpg)

![TAX CREDITS

Tax credit for investment in shares and

insurance

(3) Where —

(a) a person has been allowed a tax credit under

sub-section (1) in a tax year in respect of the

purchase of a share; and

(b) the person has made a disposal of the share

within thirty six months of the date of

acquisition, the amount of tax payable by the

person for the tax year in which the shares

were disposed of shall be increased by the

amount of the credit allowed.]](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-22-320.jpg)

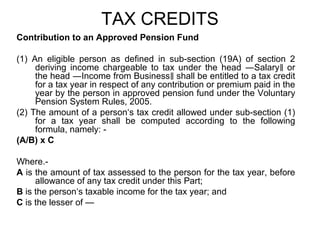

![TAX CREDITS

Contribution to an Approved Pension Fund

(i) the total contribution or premium referred to in sub-section (1) paid

by the person in the year; or

(ii) twenty per cent of the [eligible] person‘s taxable income for the

relevant tax year; Provided that [an eligible person] joining the

pension fund at the age of forty-one years or above, during the

first ten years [starting from July 1, 2006] shall be allowed

additional contribution of 2% per annum for each year of age

exceeding forty years. Provided further that the total contribution

allowed to such person shall not exceed 50% of the total taxable

income of the preceding year.

(3) The transfer by the members of approved employment pension or

annuity scheme or approved occupational saving scheme of their

existing balance to their individual pension accounts maintained

with one or more pension fund managers shall not qualify for tax

credit under this section](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-24-320.jpg)

![TAX CREDITS

Profit on debt

1. A person shall be entitled to a tax credit for a

tax year in respect of any profit or share in rent

and share in appreciation for value of house

paid by the person in the year on a loan by a

scheduled bank or non-banking finance

institution regulated by the Securities and

Exchange Commission of Pakistan or

advanced by Government or the 8[Local

Government] 9[or a statutory body or a public

company listed on a registered stock exchange

in in Pakistan] where the person utilizes the

loan for the construction of a new house or the

acquisition of a house.](https://image.slidesharecdn.com/exemptions9-2-14-140210122553-phpapp02/85/Exemptions-9-2-14-25-320.jpg)