Embed presentation

Download to read offline

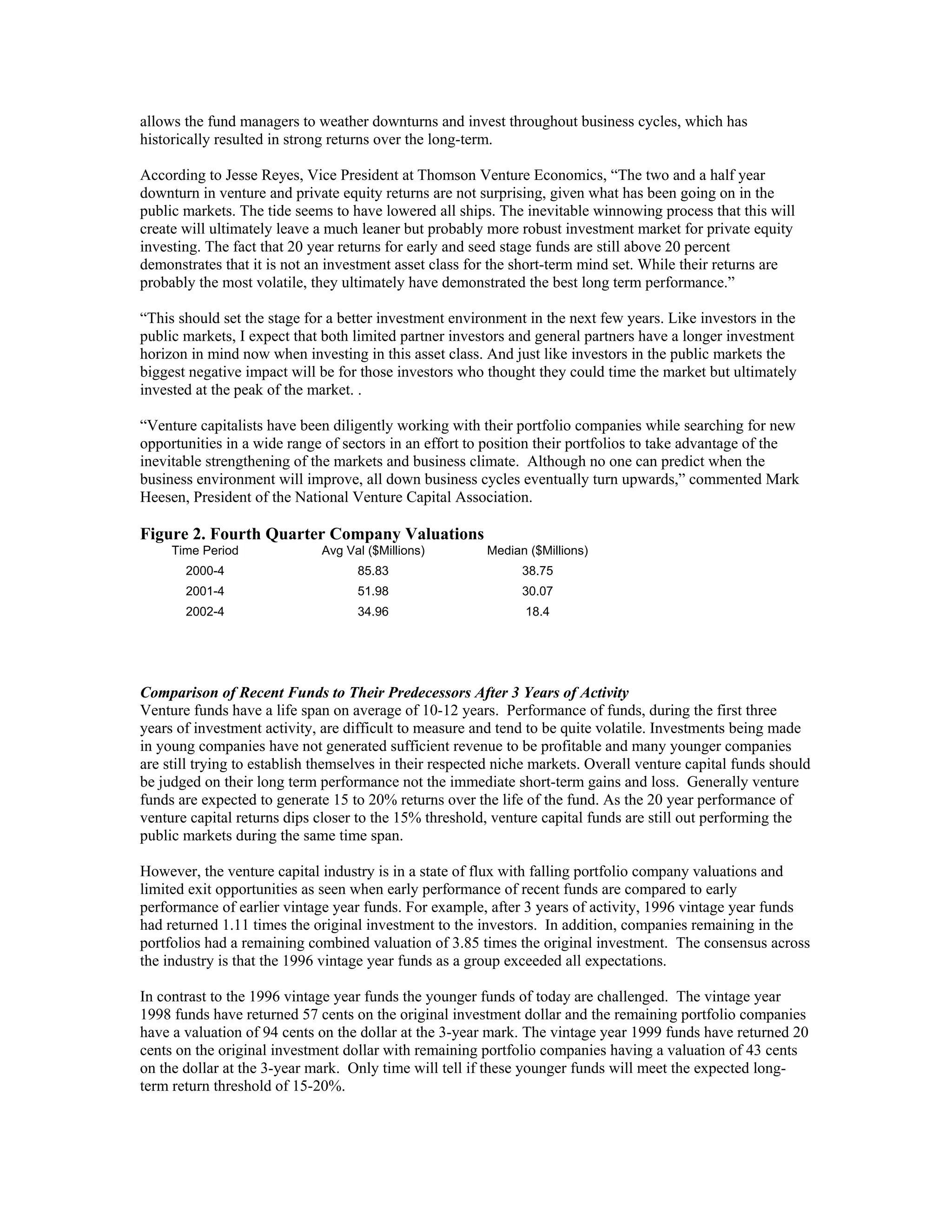

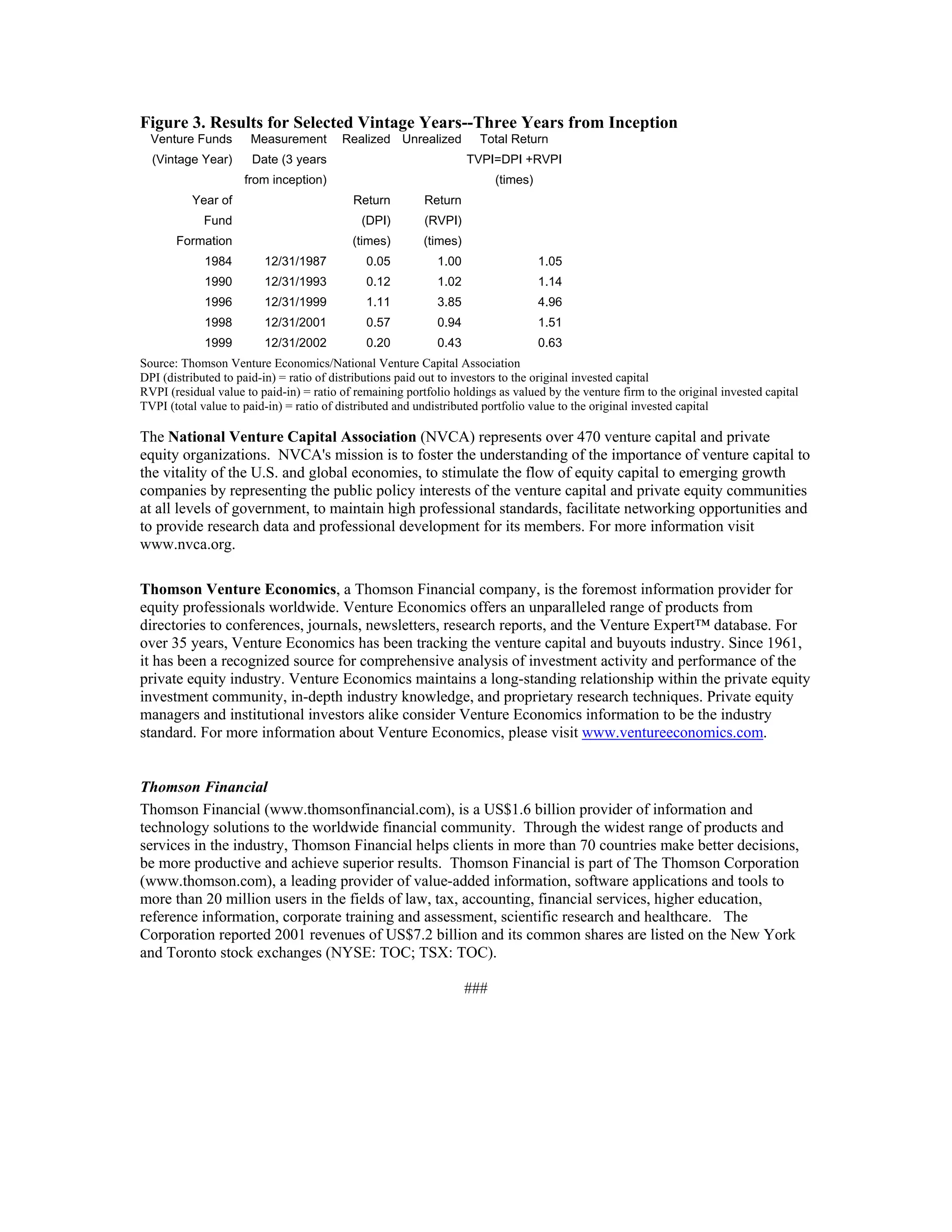

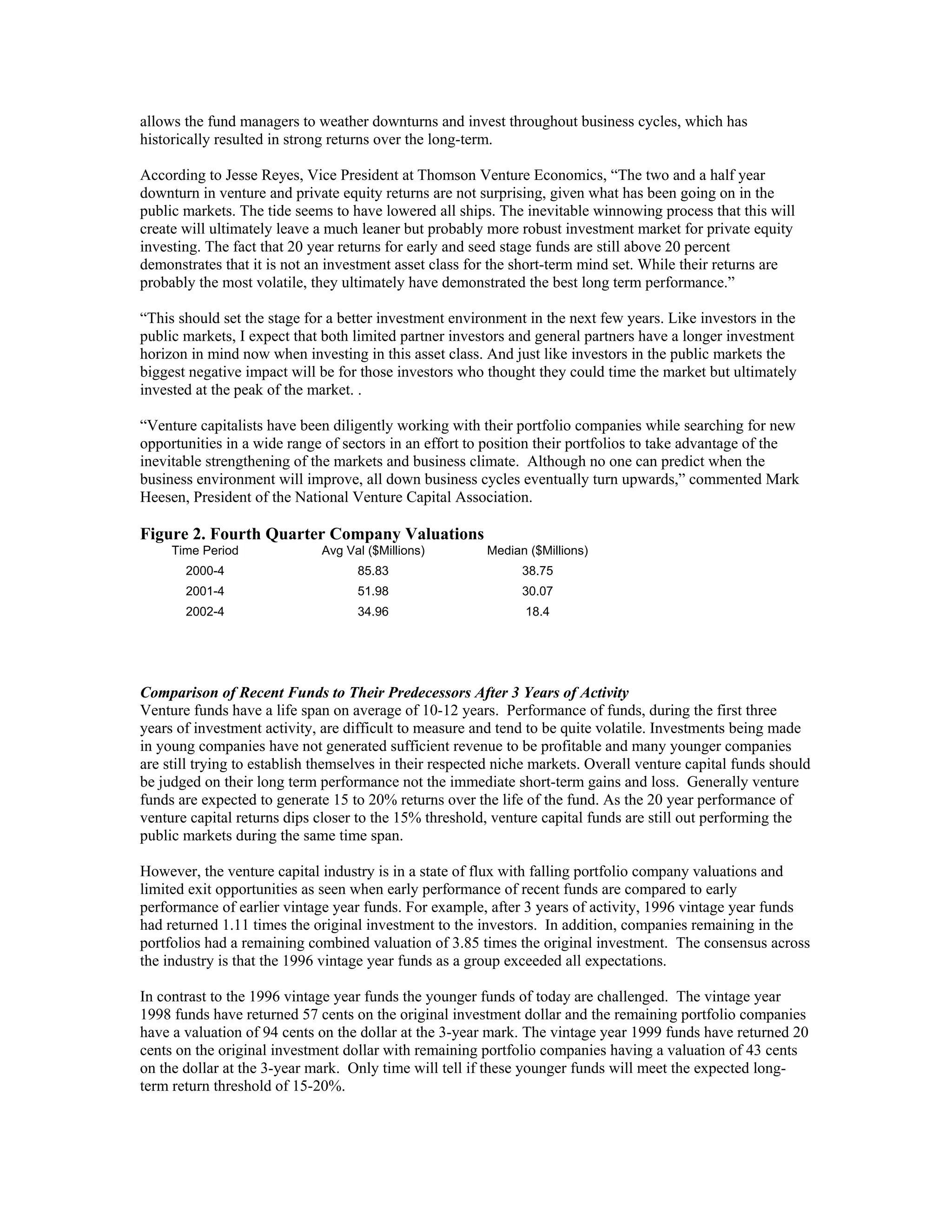

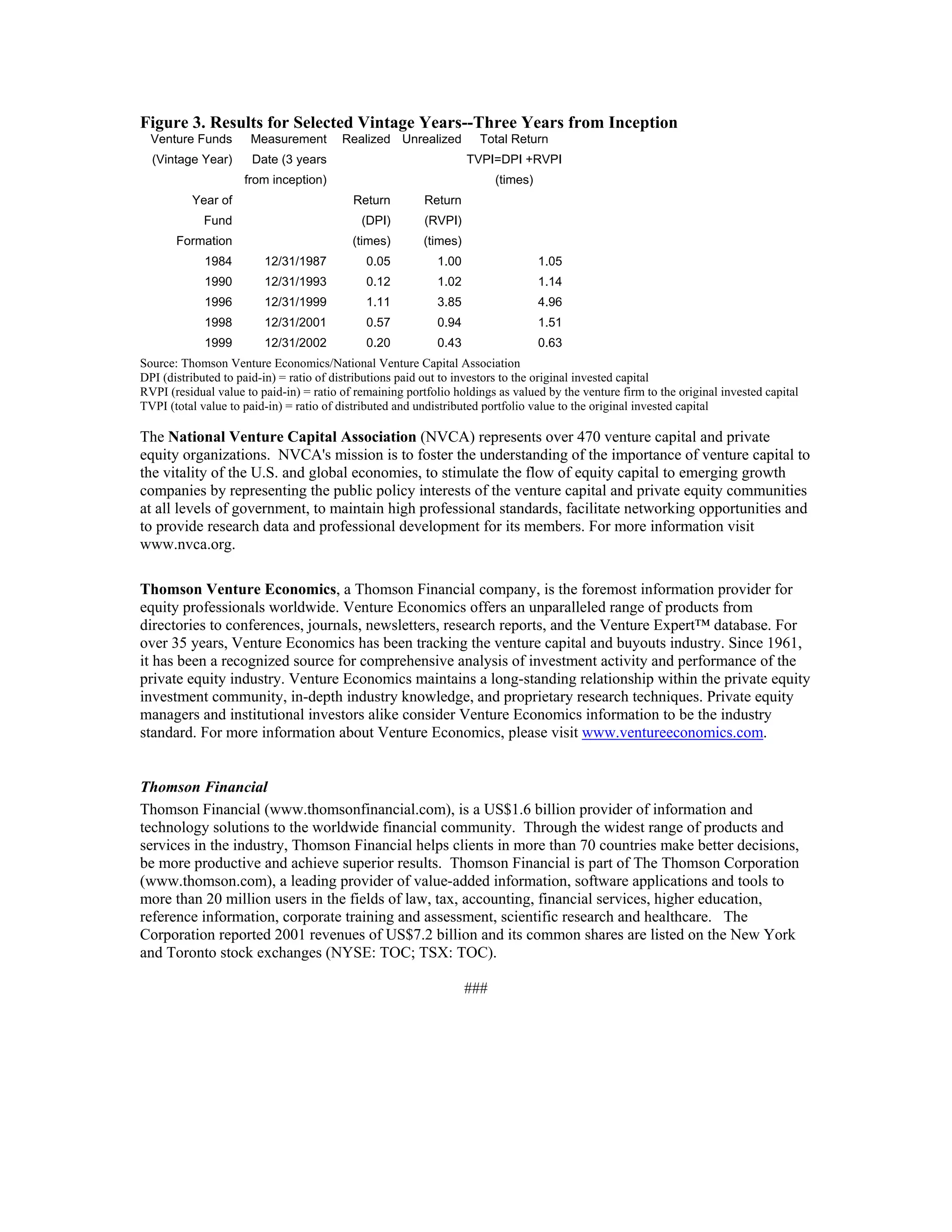

This document summarizes private equity returns for various time periods ending in 2002. It finds that returns continued to be negative for the eighth straight quarter, with venture capital funds experiencing losses of over 20% for two years in a row. This is due to falling company valuations and limited exit opportunities. However, private equity returns have still outpaced public markets like NASDAQ over longer time horizons. While short-term returns are down, private equity maintains strong returns over 10-20 year periods on average. Younger vintage funds are facing challenges with lower returns compared to previous vintages three years after inception, though longer-term performance remains to be seen.