Embed presentation

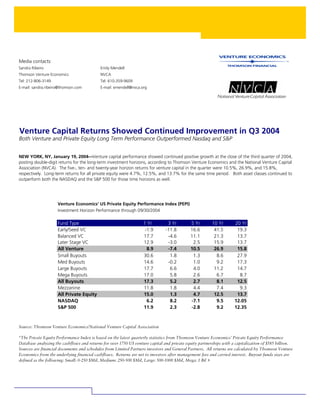

Download to read offline

Venture capital performance showed continued positive growth in Q3 2004, with double-digit returns for 5, 10, and 20-year horizons of 10.5%, 26.9%, and 15.8% respectively. Long-term private equity returns were also positive for all periods. Both asset classes continued to outperform the NASDAQ and S&P 500 indexes. The improvements are due to strengthening exit markets for venture-backed companies, with 24 IPOs and 83 acquisitions in Q3 2004. While some funds experienced losses from the 1999-2000 tech bubble, overall returns are expected to continue improving as post-bubble investments outweigh remaining troubled investments.