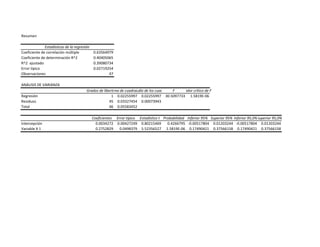

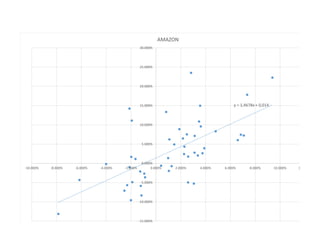

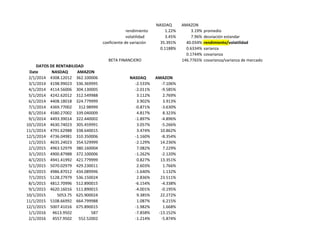

This document summarizes the results of a regression analysis with one independent variable. It finds that the independent variable is positively correlated with the dependent variable with a correlation coefficient of 0.635. The regression model explains 40.4% of the variation in the dependent variable. The analysis of variance shows that the regression is statistically significant.