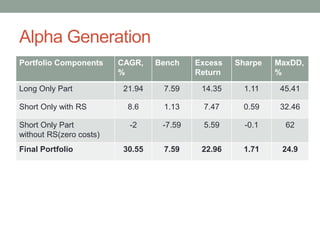

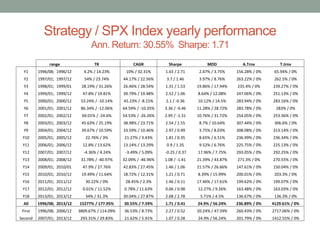

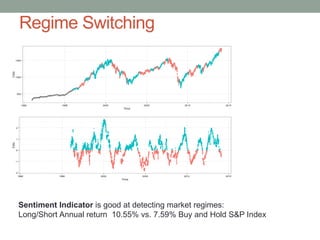

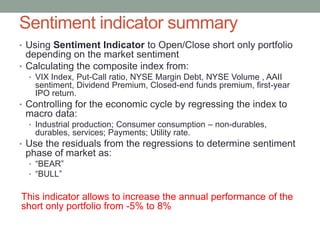

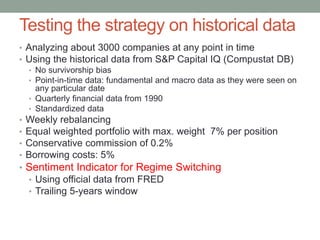

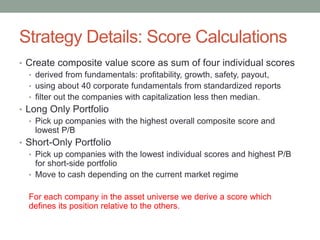

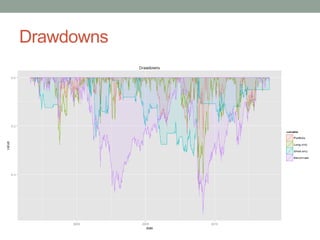

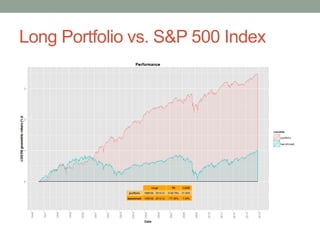

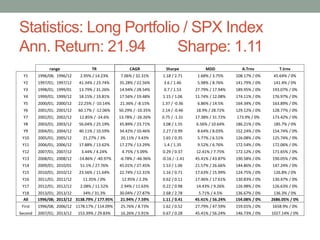

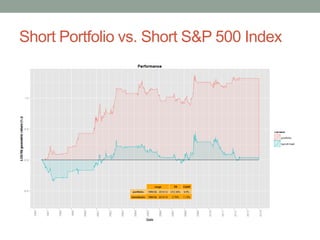

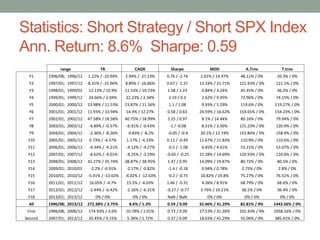

This document describes a systematic stock picking strategy that combines long and short portfolios. It uses a scoring algorithm to select stocks and a regime switching indicator to determine when to include the short portfolio. Simulated backtested performance from 1996-2013 shows an annual return of 30% and Sharpe ratio of 1.71, significantly outperforming the S&P 500 over that period with lower maximum drawdowns.