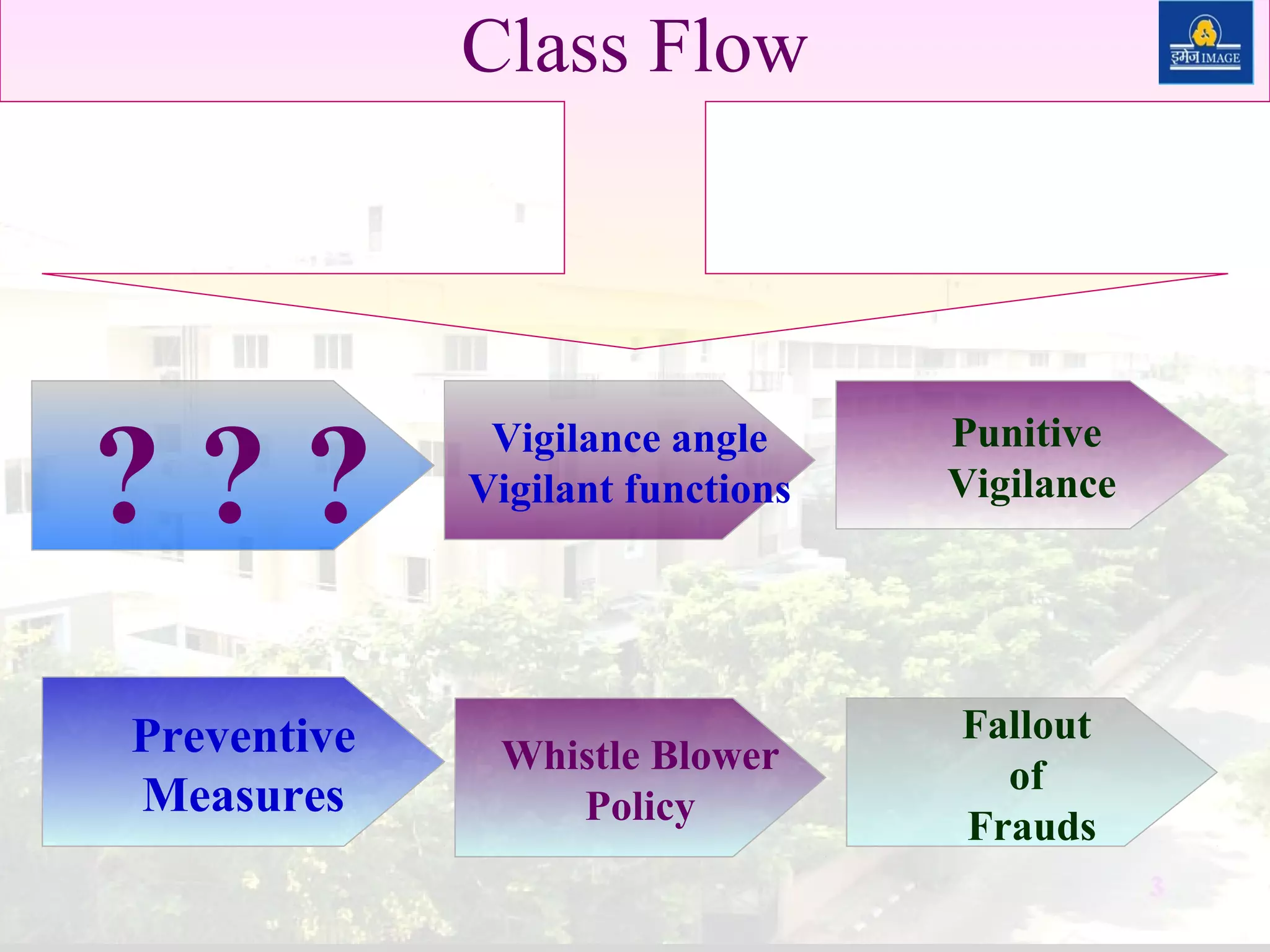

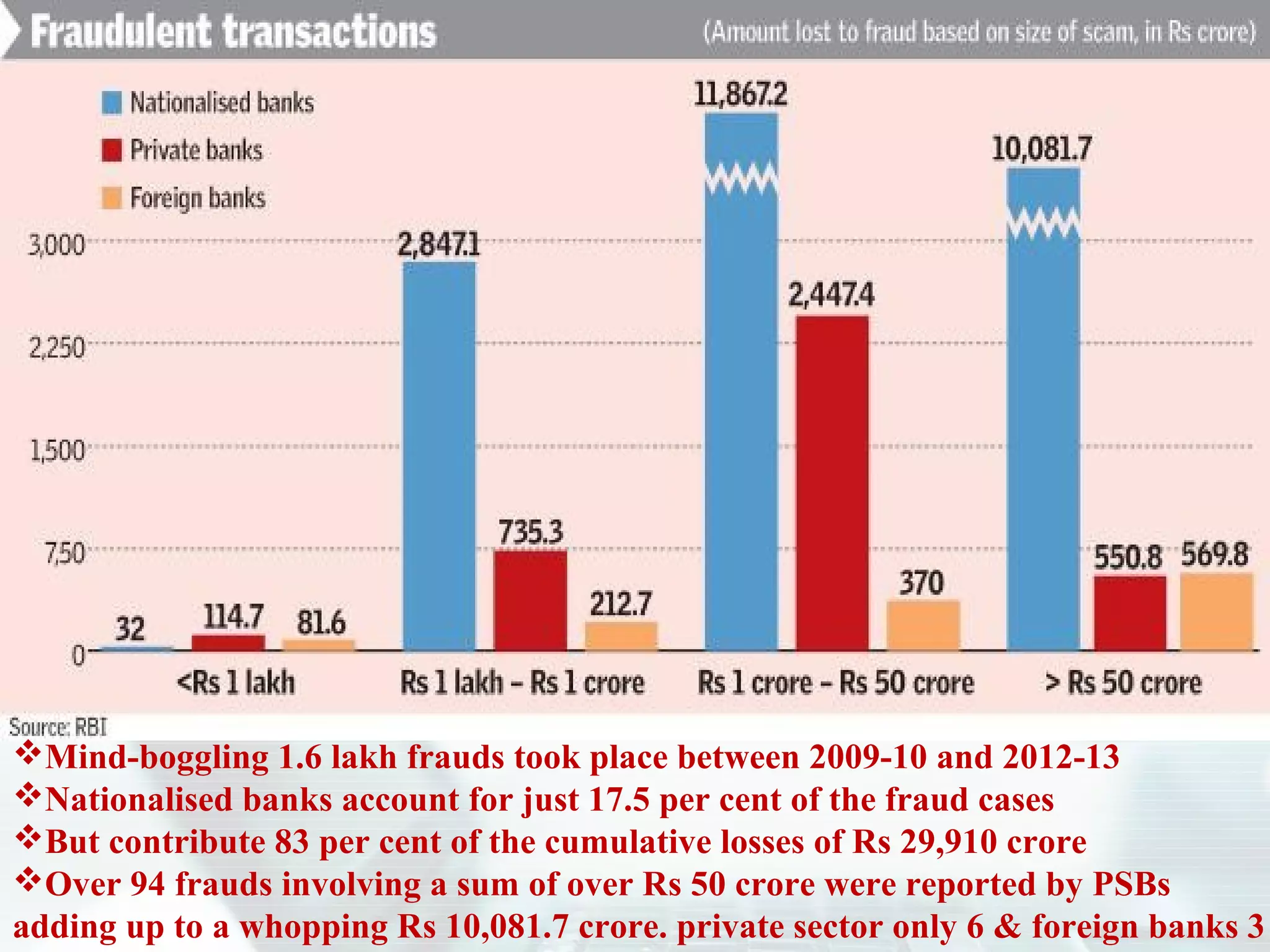

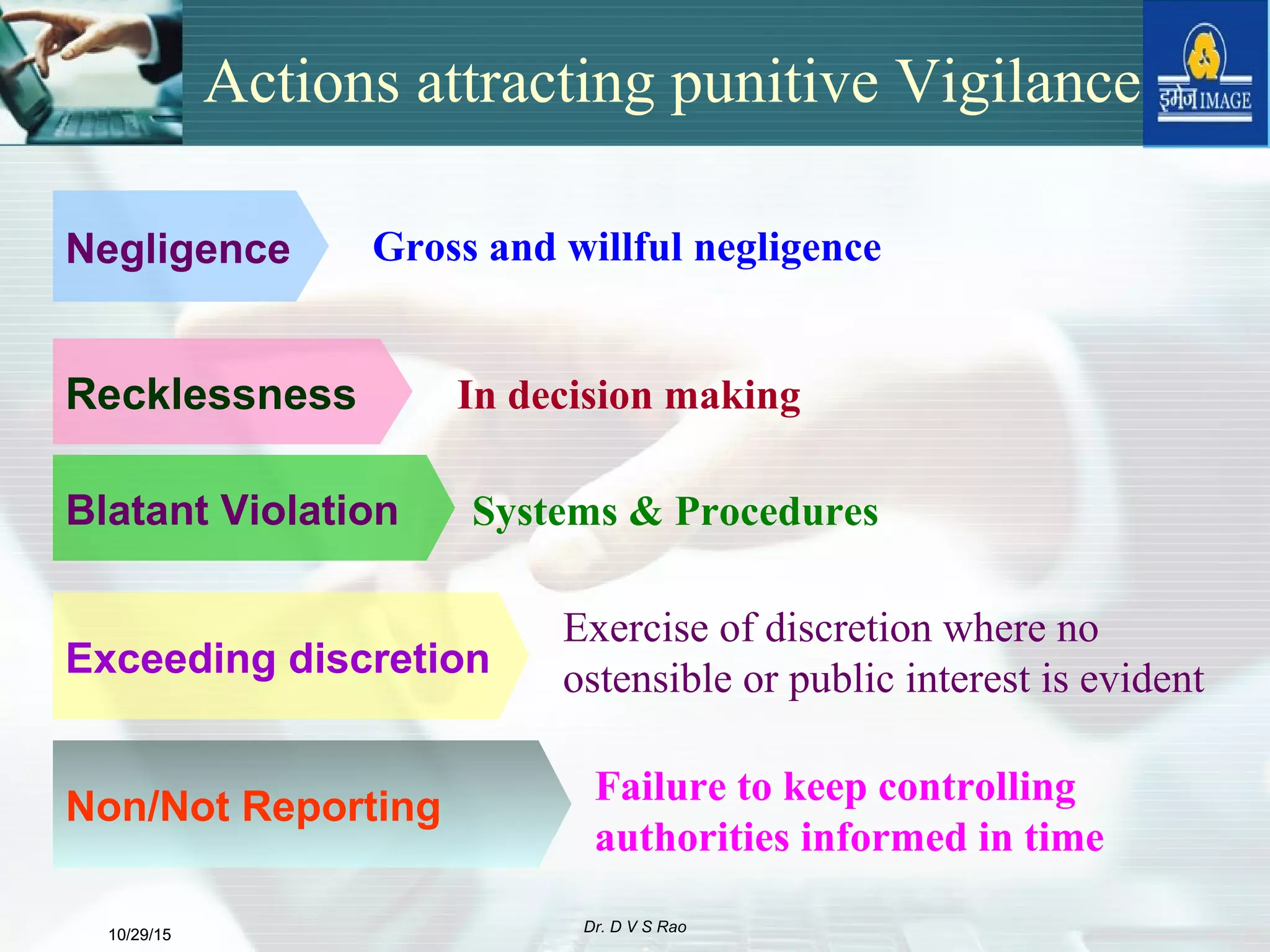

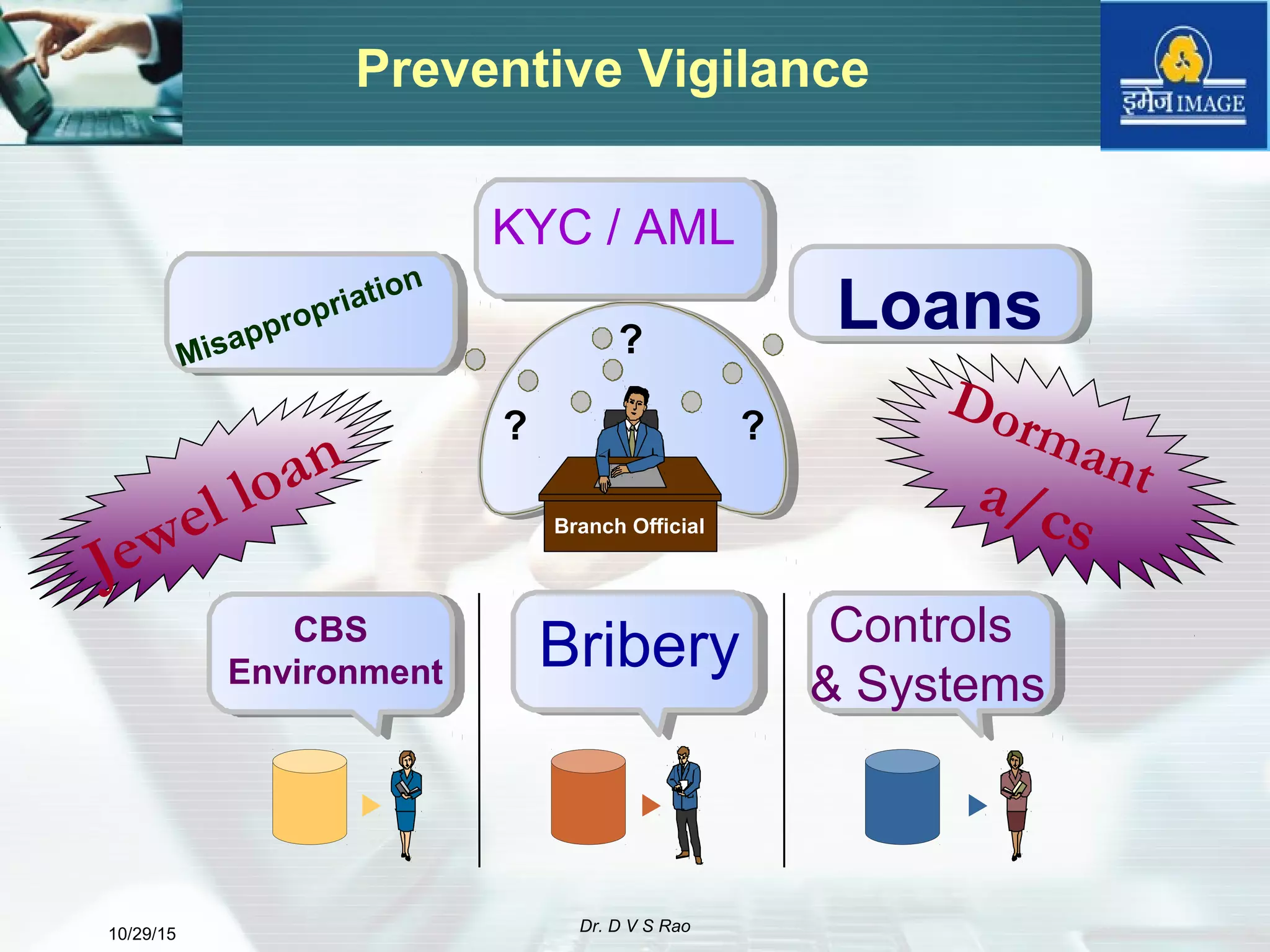

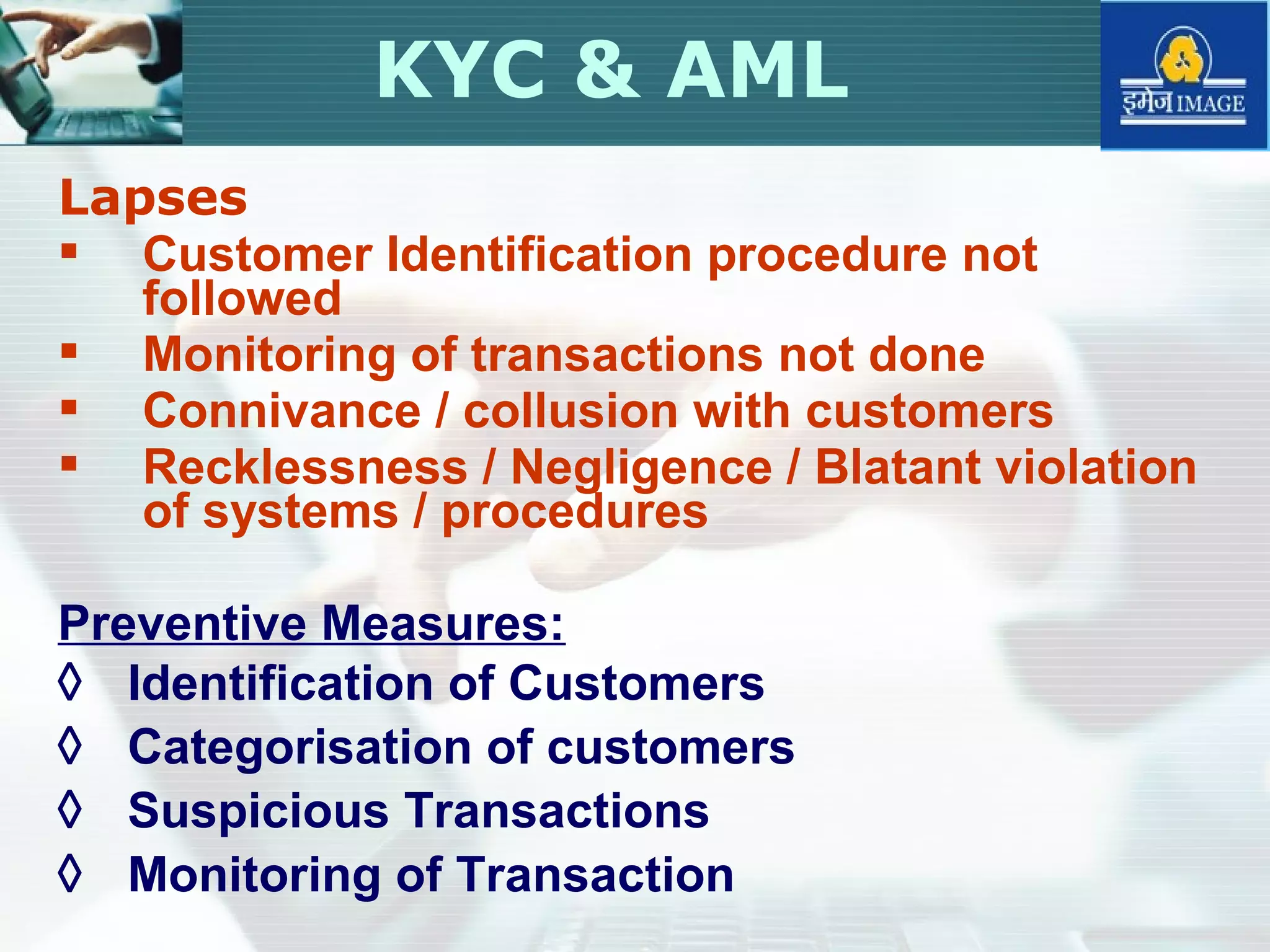

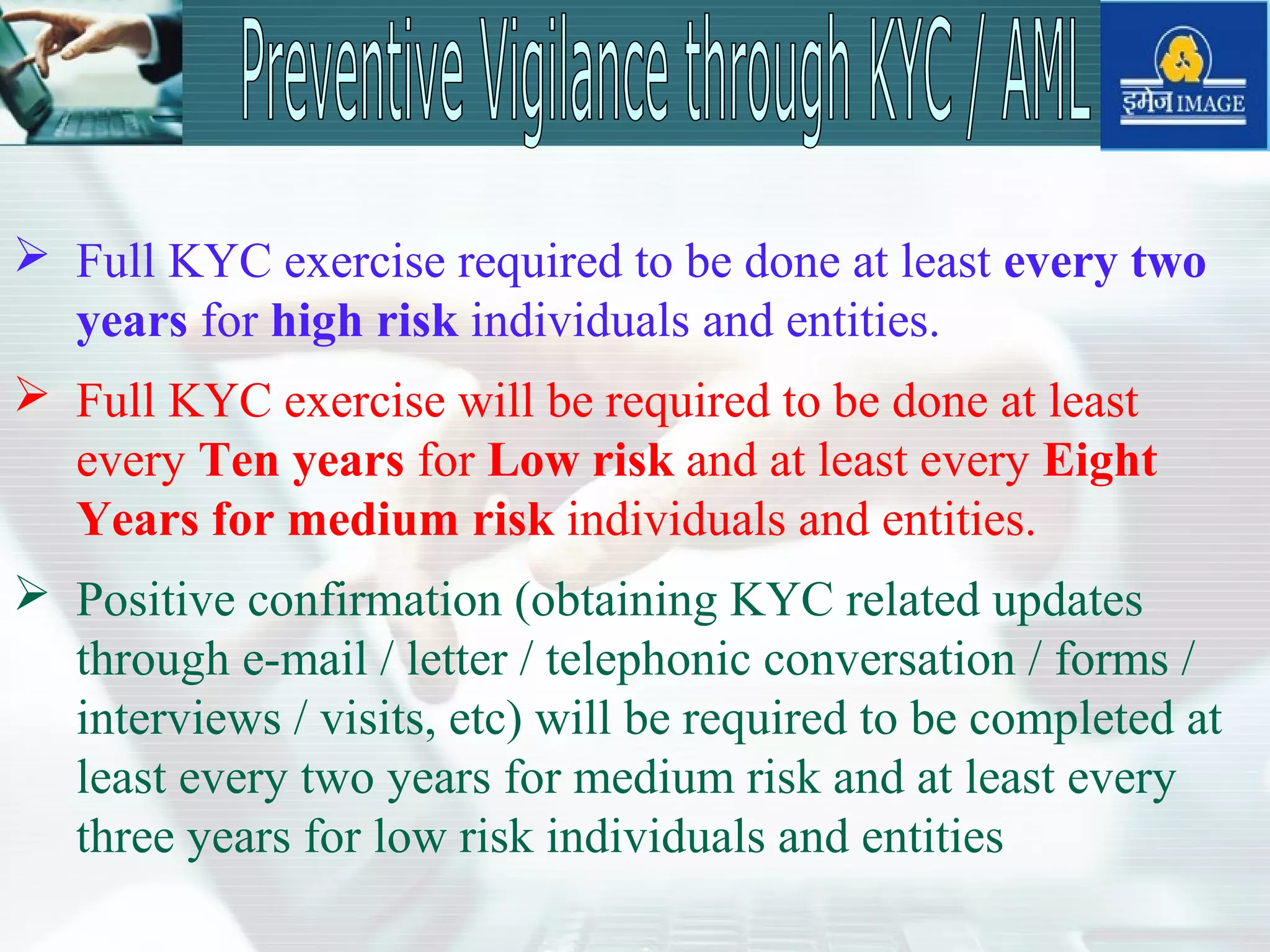

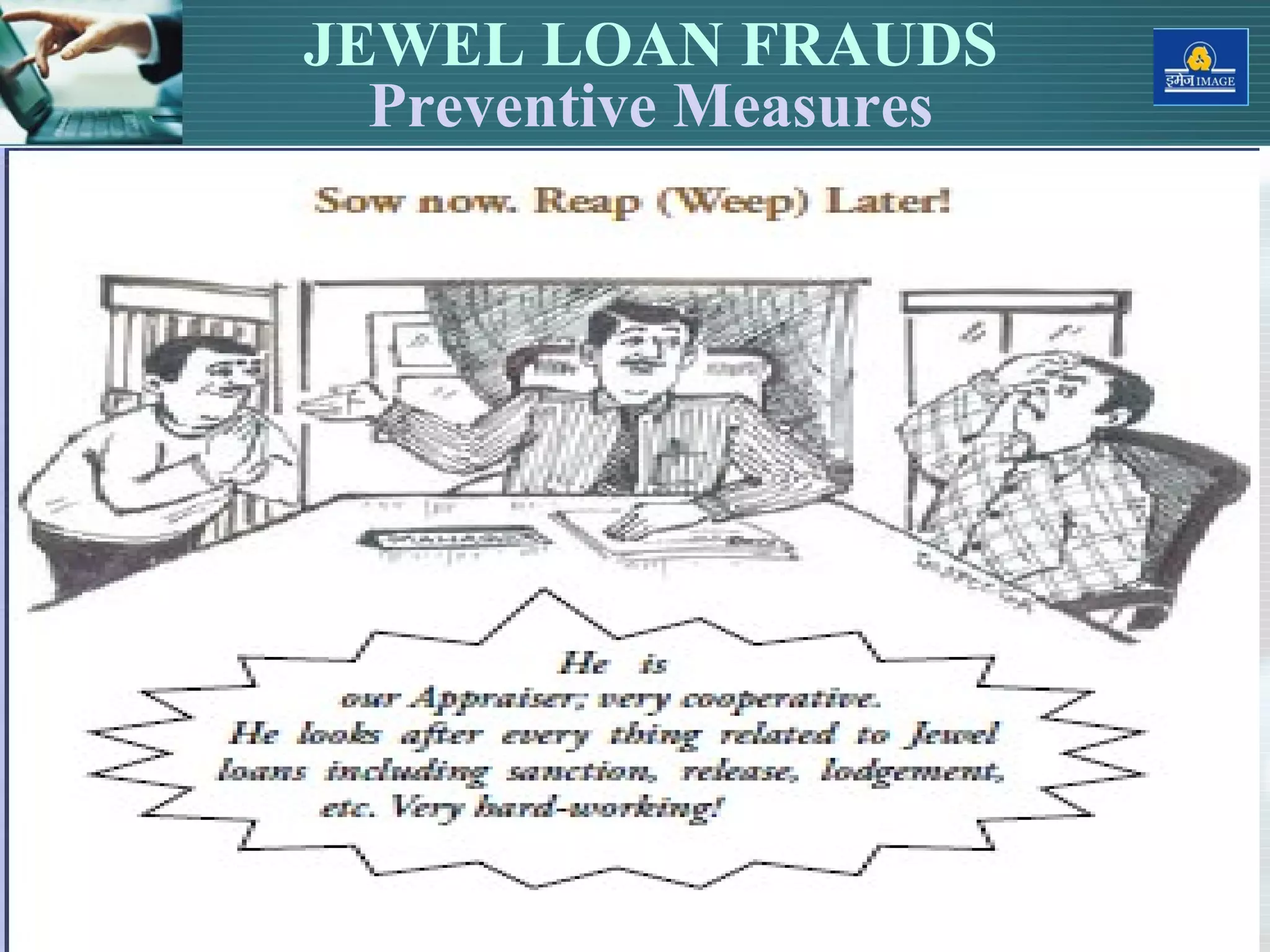

The document discusses preventive vigilance measures to reduce fraud. It outlines why vigilance is important to discipline wrongdoers, protect the honest, and increase transparency. Specific areas that require vigilance are identified, such as transactions with high discretionary powers, complex rules, and opportunities for corruption. Preventive measures are proposed for various types of fraud including loans, mortgages, dormant accounts, and the CBS environment. The importance of honesty, whistleblower policies, and proactive prevention over punitive actions after the fact are emphasized.