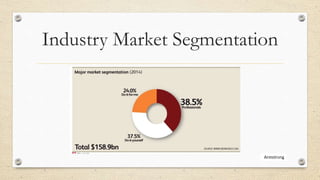

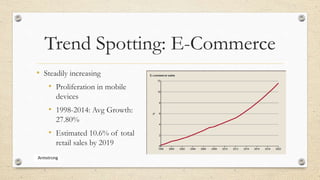

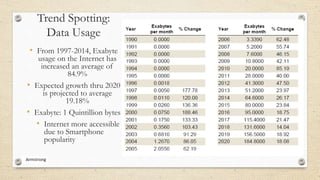

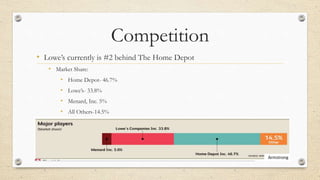

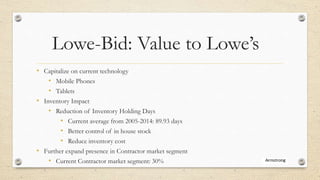

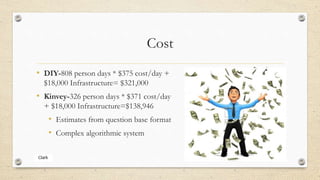

The document provides an overview of a presentation to Lowe's board members by J/B Consulting. It discusses the home improvement industry trends of growth linked to the economy and e-commerce increases. It then summarizes Lowe's 2014 revenue and store locations in the US, Canada and Mexico. Strengths, weaknesses, opportunities and threats are outlined for Lowe's. New mission and vision statements are proposed. Trends in e-commerce growth and data usage are highlighted. Competition and potential areas of growth like an acquisition are discussed. A proposed new service called Lowe-Bid is presented, which would allow homeowners to request bids from contractors on home projects through Lowe's online and mobile platforms.