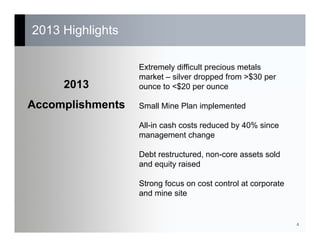

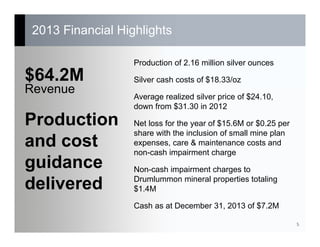

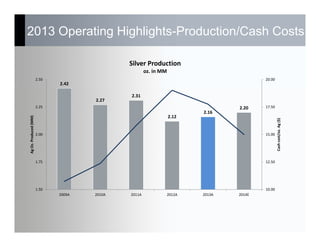

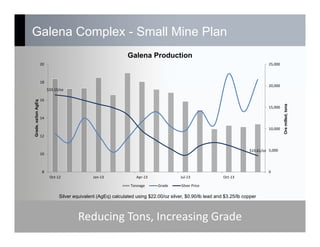

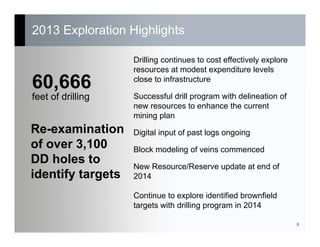

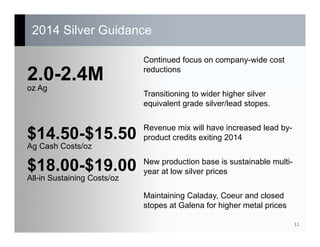

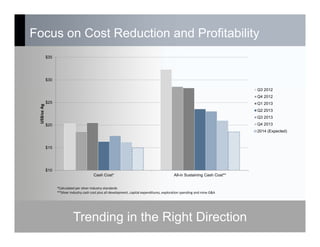

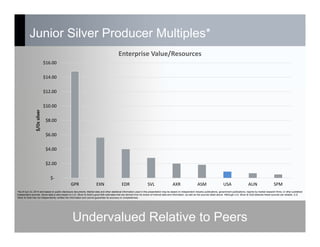

The document summarizes the annual general meeting of U.S. Silver & Gold that was held on May 20, 2014. It discusses the company's 2013 financial results including a net loss of $15.6 million and cash costs of $18.33 per ounce of silver. It also outlines the company's plans for 2014 which include a focus on cost reductions and near-term profitability through increasing production to 2.0-2.4 million ounces of silver at lower costs of $14.50-$15.50 per ounce. The presentation emphasizes the company's potential for growth and highlights its attractive valuation relative to peers.