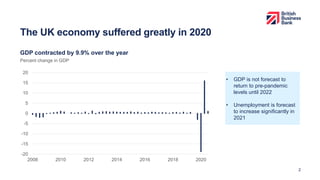

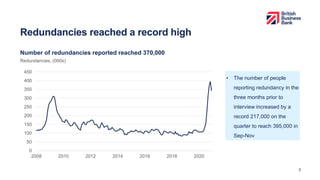

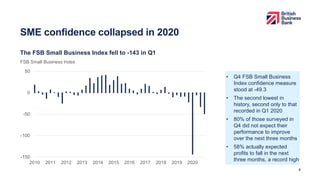

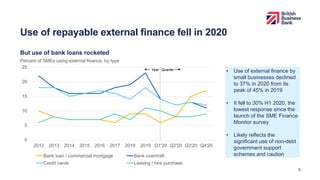

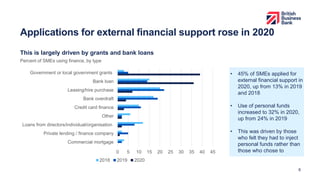

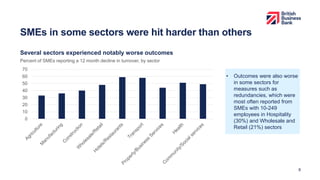

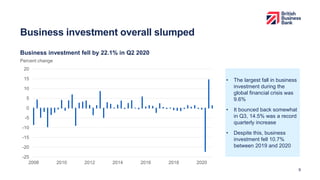

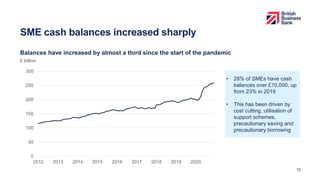

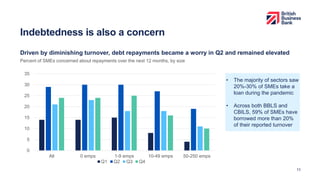

The Small Business Finance Markets Report for 2020/21 highlights the severe economic impact of the COVID-19 pandemic on the UK economy, with a 9.9% GDP contraction and record redundancies. SME confidence plummeted, as evidenced by a significant drop in the FSB Small Business Index and a decline in external financing usage among small businesses. Despite some recovery in cash balances and loan applications, many SMEs, particularly in the hospitality and retail sectors, are struggling financially and face concerns about debt repayment in the coming year.