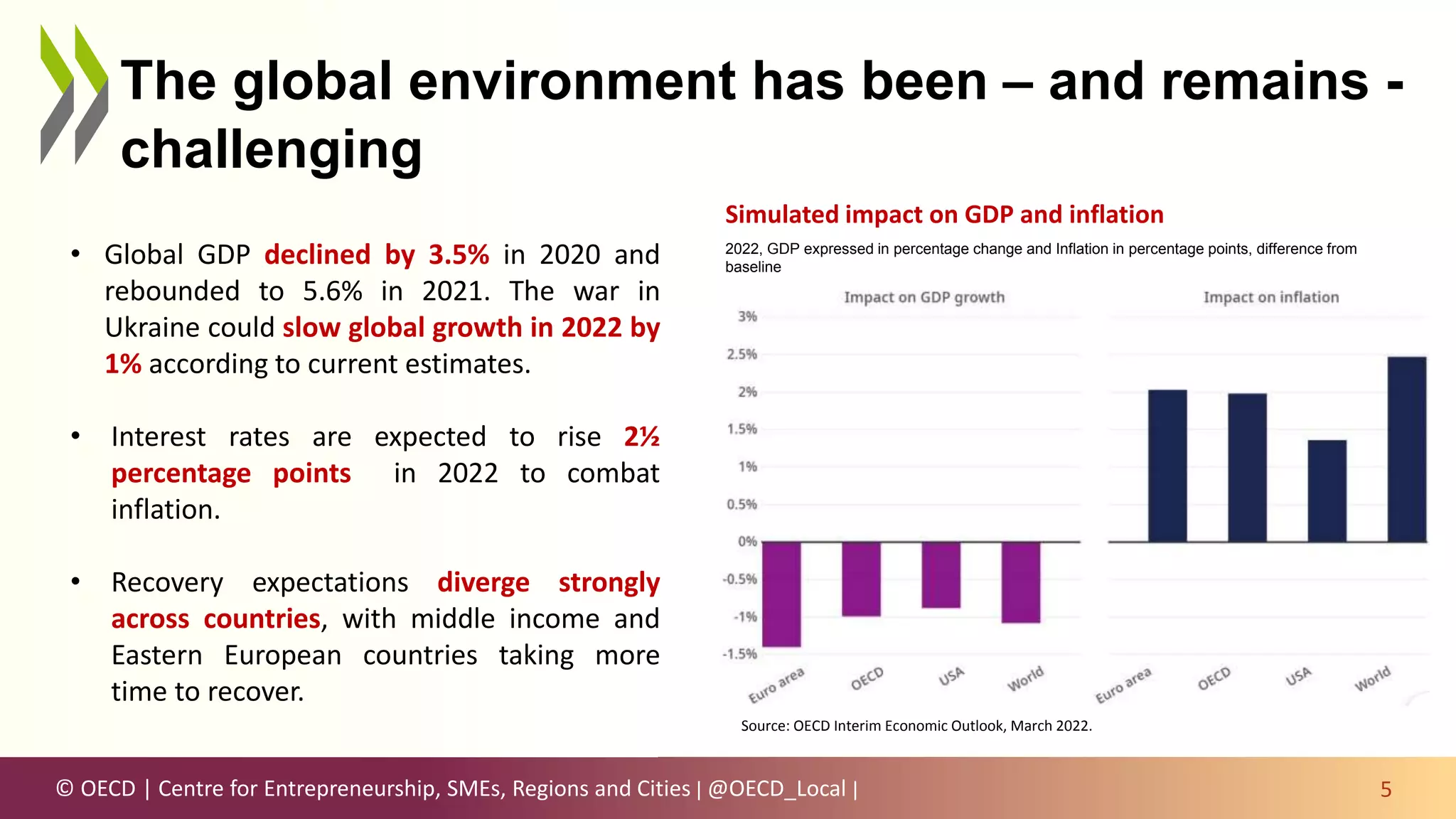

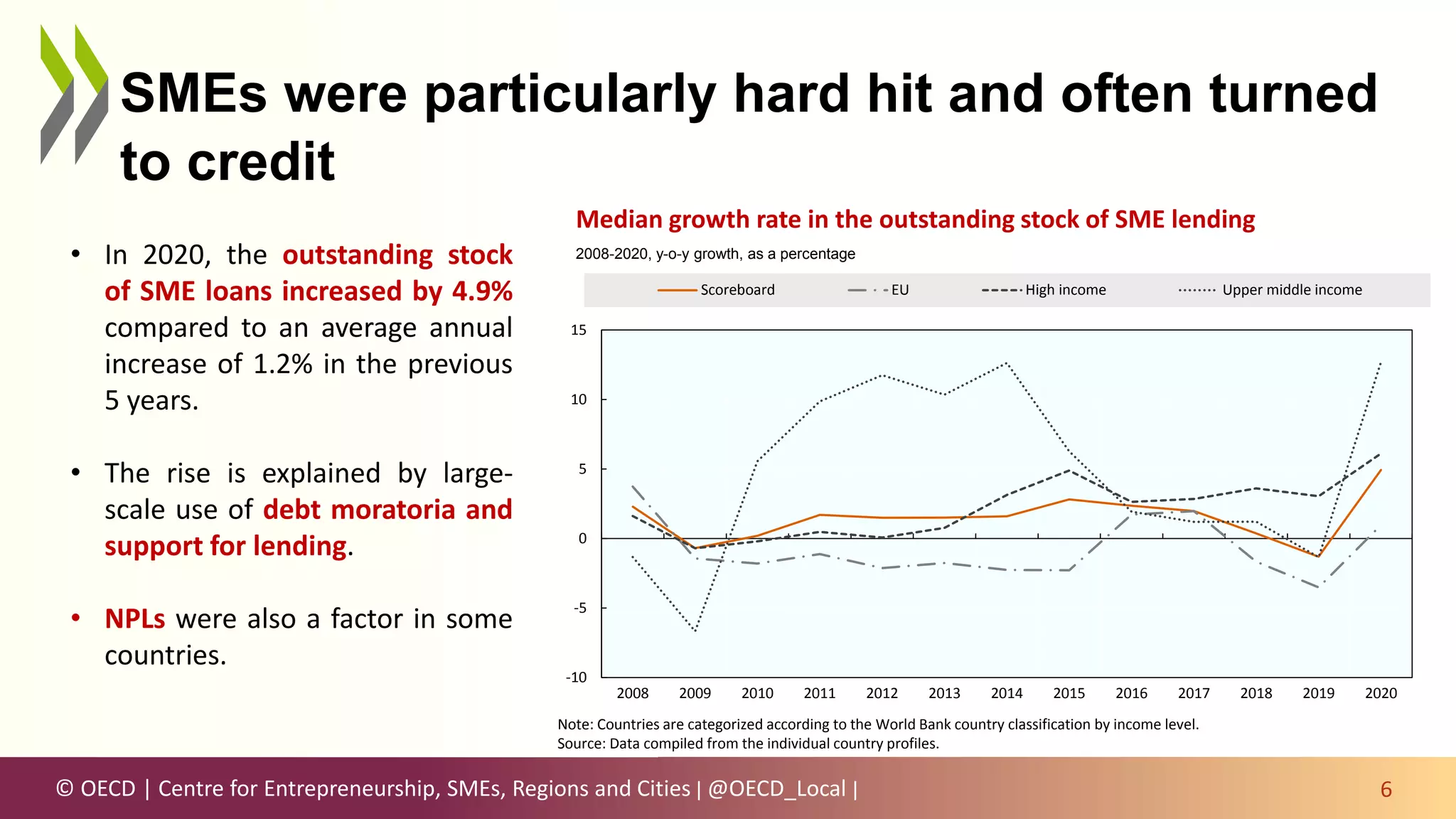

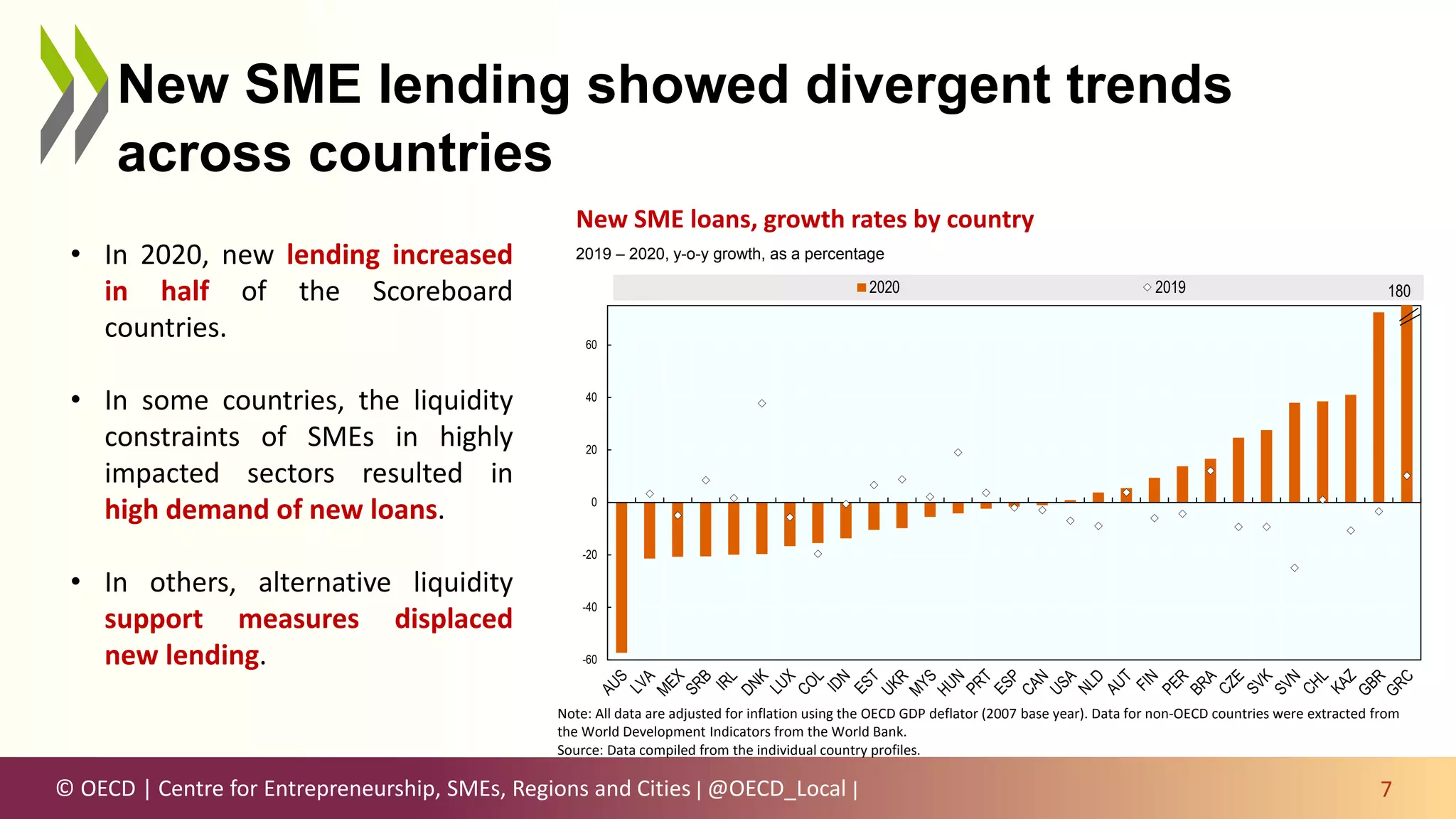

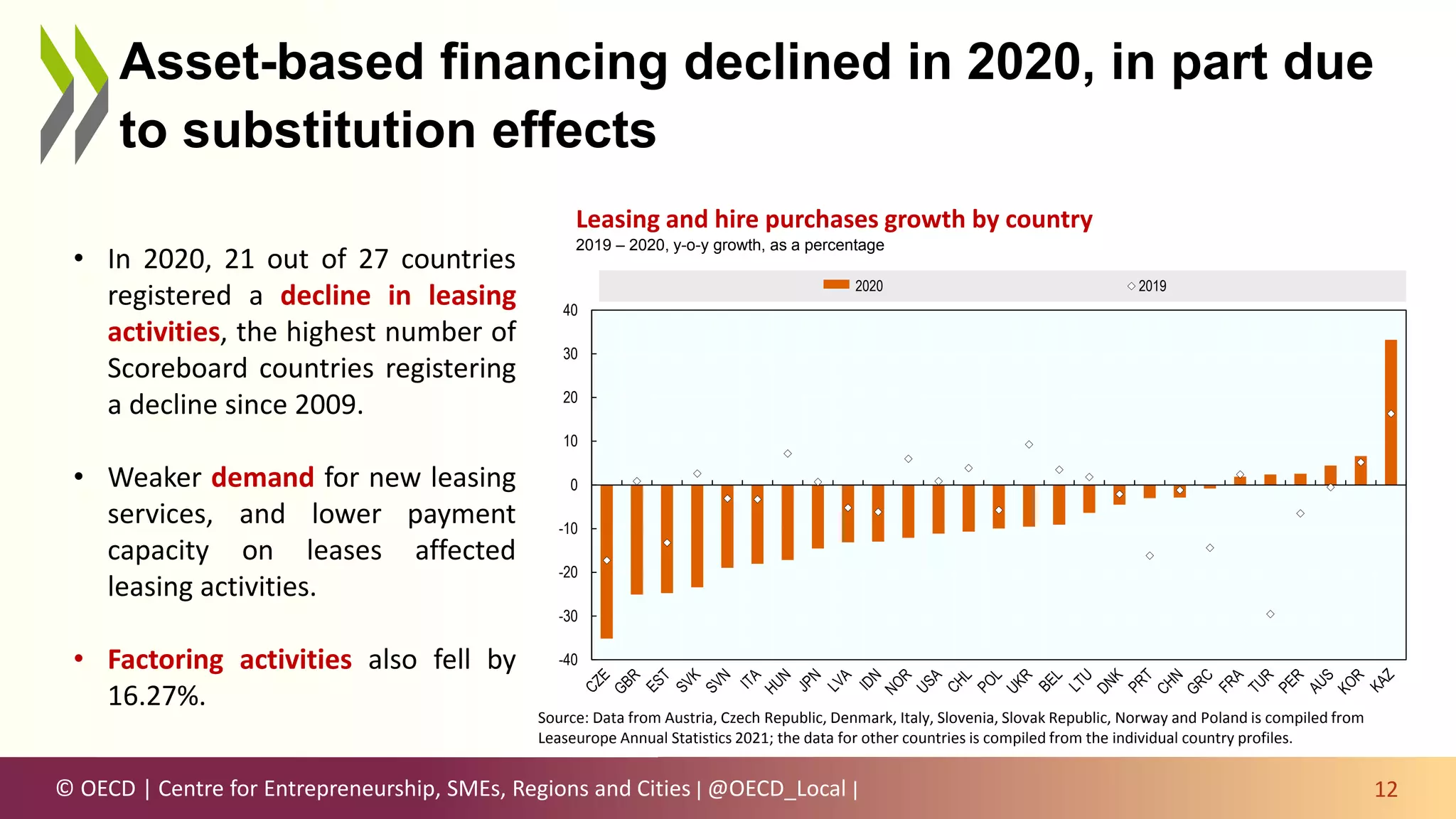

The OECD's 2022 Scoreboard on financing SMEs and entrepreneurs provides an analysis of the impact of the COVID-19 pandemic on SME financing across 48 countries, highlighting trends in lending, bankruptcies, and government support measures. While new lending saw mixed growth rates, overall conditions remained favorable for SMEs due to government-backed credit guarantees and low interest rates. Moving forward, the report emphasizes the importance of monitoring SME access to finance and addressing high debt levels as support mechanisms are phased out.

![© OECD | Centre for Entrepreneurship, SMEs, Regions and Cities | @OECD_Local |

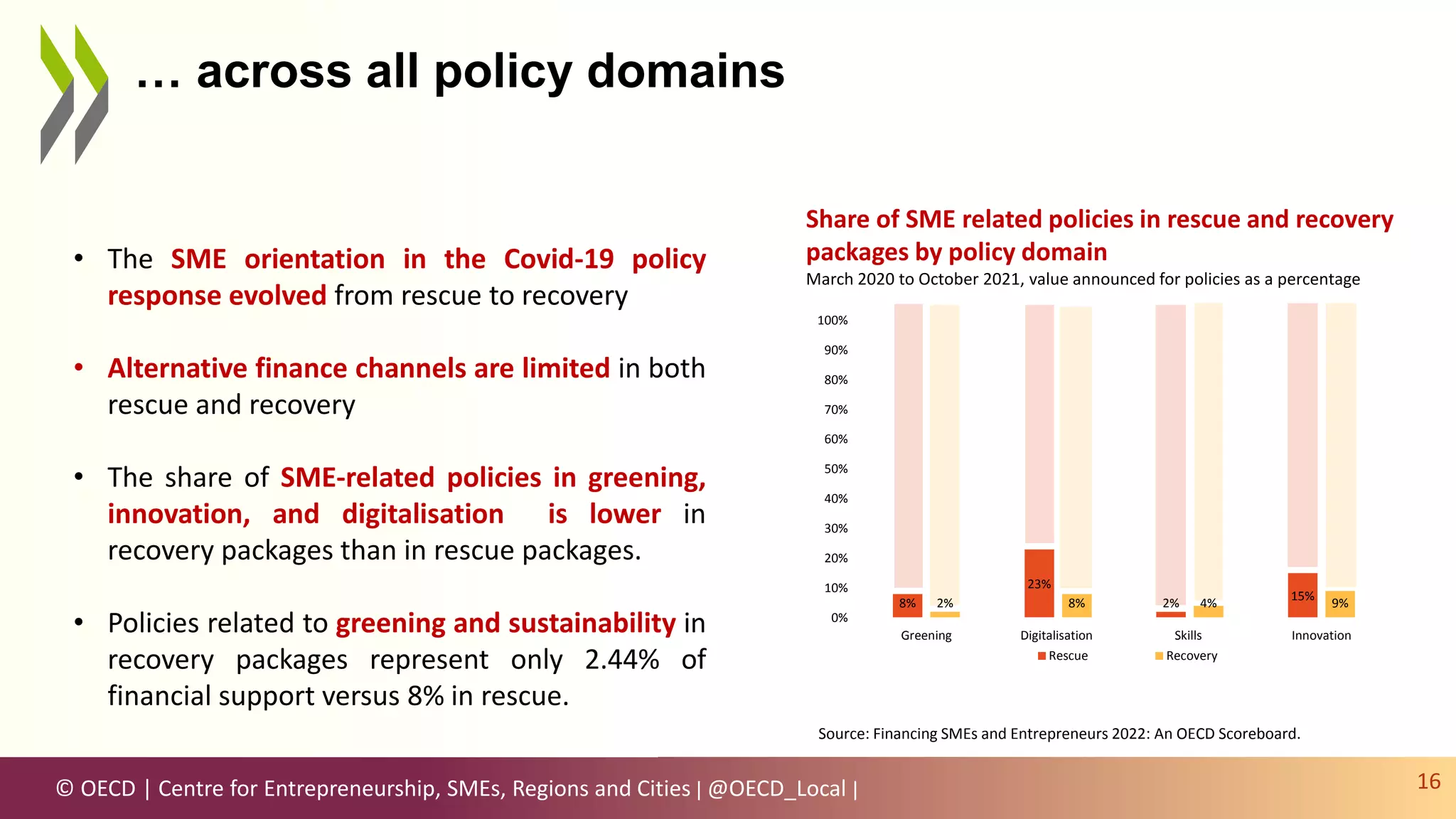

SMEs are a less explicit focus in recovery packages…

15

Source: Global Recovery Observatory (O’Callaghan, 2020[47])

Share of SME related policies in the total value

announced in rescue and recovery packages

March 2020 to October 2021, value announced for policies in USD

billions and as a percentage

• The SME orientation in COVID-19 policy

responses declined from the rescue to recovery

phases.

• Only around 2% of total funding in recovery

packages targets SMEs, compared to more than

25% in crisis rescue packages.

• In absolute terms, spending on SME-related

policies dropped from USD 3 862.02 billion in

the rescue packages to USD 78.15 billion in

recovery packages.

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

[CELLRANGE]

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Rescue Recovery Total

Share of SME related policies Share of other policies

Value tags in USD billion](https://image.slidesharecdn.com/presentationscoreboardlaunch29march2022-220331120843/75/Presentation-Scoreboard-Launch_29-March-2022-pptx-15-2048.jpg)