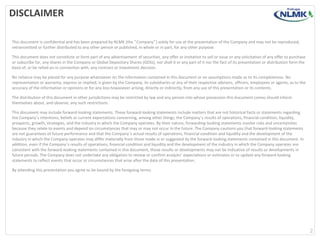

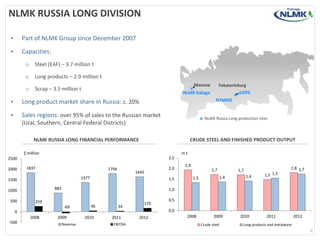

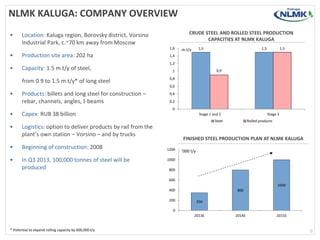

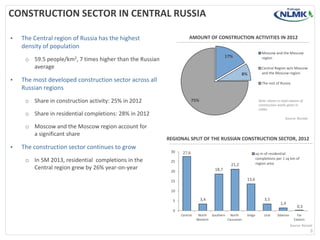

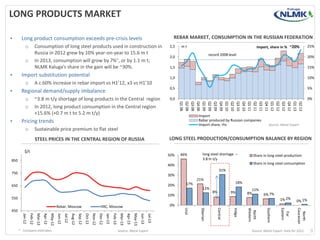

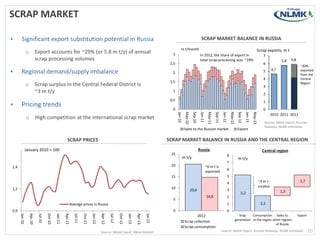

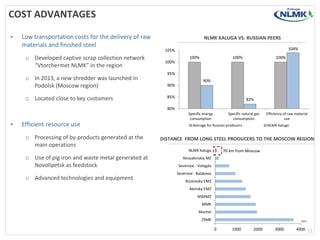

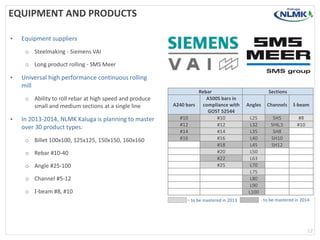

NLMK Kaluga is a steel production facility located near Moscow that began construction in 2008. It has a planned annual steel production capacity of 1.5 million tons and will produce long steel products for the construction industry. The plant utilizes efficient production technologies and will help meet growing demand for construction steel in the central region of Russia, while also having competitive advantages from its location near scrap sources and customers. It is expected to begin full production in 2013.