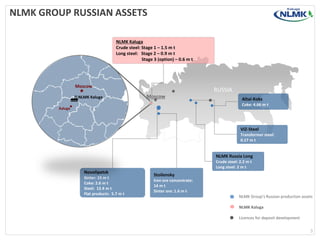

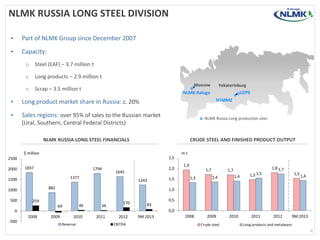

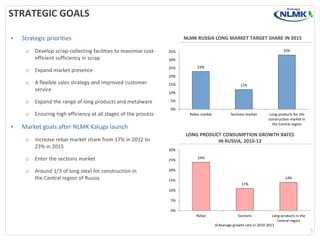

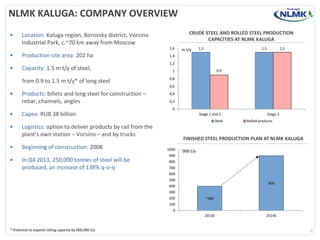

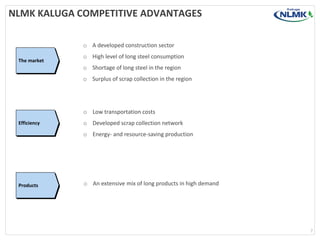

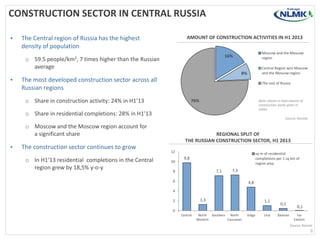

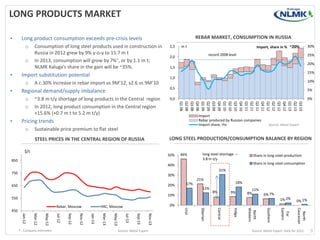

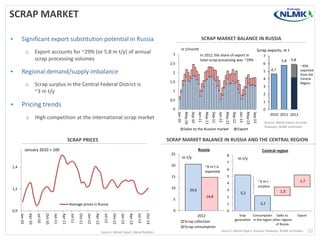

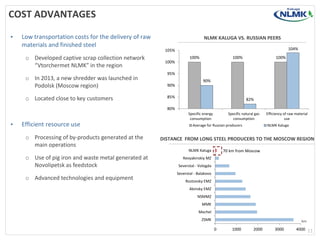

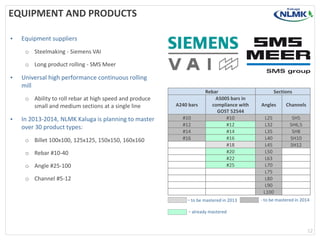

NLMK Kaluga is a steel mill located near Moscow that began production in 2013. It has a production capacity of 1.5 million tons per year of steel and 0.9-1.5 million tons per year of long steel products. The mill uses efficient production technologies and a developed scrap collection network, giving it cost advantages over competitors. It aims to help meet the significant shortage of long steel products in the Central region of Russia, where construction activity and demand are high. Initial production has begun, and the mill plans to expand its product portfolio to include rebar, channels, angles and other items for the construction sector.