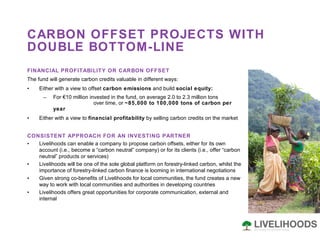

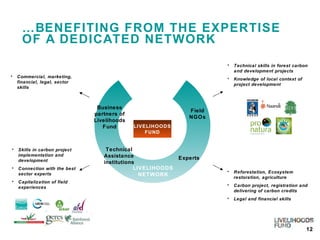

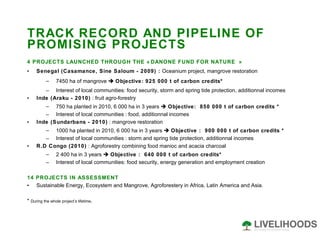

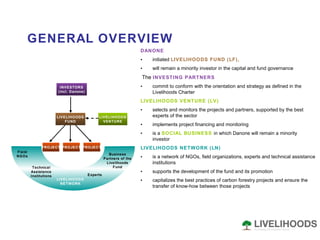

The document describes the Livelihoods Fund, an initiative by Danone to support carbon offsetting projects that also benefit local communities. The Fund will invest in ecosystem restoration, agroforestry, and rural energy projects managed by local communities across Africa, Asia, and Latin America. It will generate carbon credits for offsetting while enhancing food security and incomes. Danone invites other partners to pool resources and support innovative, exemplary projects through the Livelihoods Fund.

![WE CAN COMBINE OUR RESOURCES, OUR EXPERTISE AND OUR TALENTS WE CAN DEVELOP NEW APPROACHES TO CARBON OFFSETTING AND DEVELOPMENT WE CAN DEVISE NEW MODELS FOR THE FUTURE. Livelihoods contacts : Bernard Giraud President of Livelihoods Venture bgiraud@ livelihoods-venture.com - +33 1 44 35 23 00 Jean-Pierre Rennaud General Delegate of Livelihoods Venture jprennaud@ livelihoods-venture.com - +33 1 44 35 20 84 Guillaume Bouculat Finance and Carbon Finance Director of Livelihoods Venture [email_address] - +33 6 61 10 99 98](https://image.slidesharecdn.com/presentationlh-110704030424-phpapp01/85/Presentation-lh-17-320.jpg)