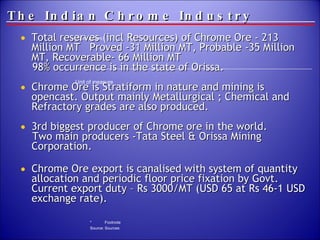

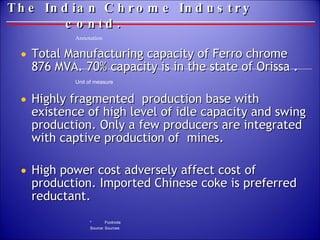

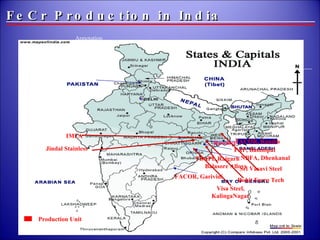

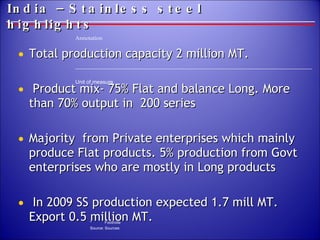

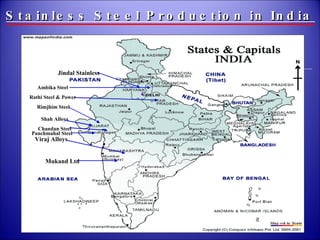

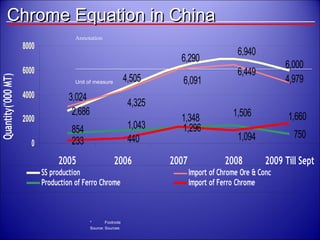

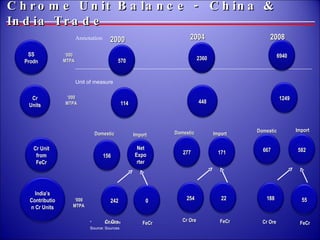

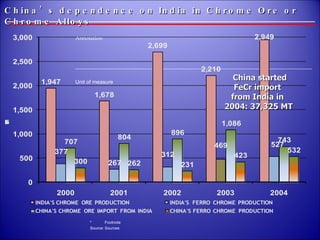

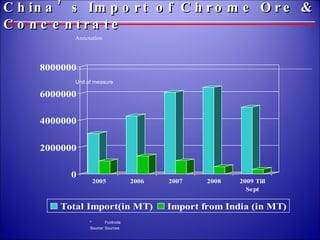

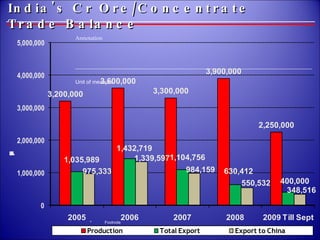

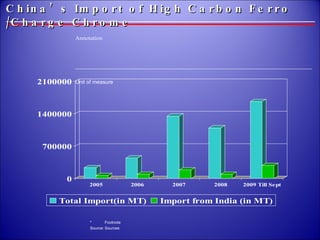

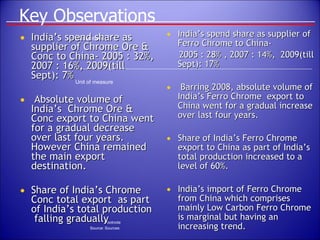

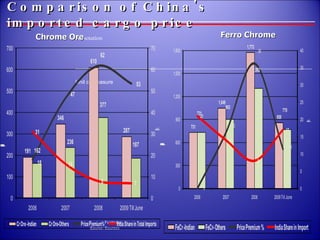

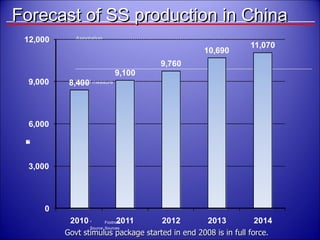

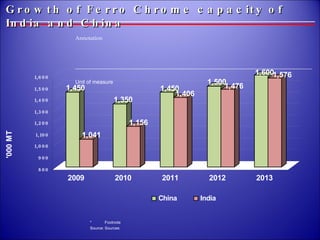

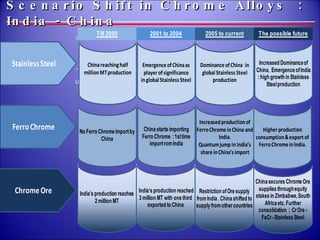

This document presents an overview of the chrome industry in India and China, highlighting trade evolution, market dynamics, and future scenarios. It discusses India's significant chrome reserves, production capabilities, and the fragmented production base in China, while detailing trade statistics and dependencies between the two countries. The forecast suggests that both nations will continue to collaborate in the chrome and ferro chrome market, with India's supply being critical to China's needs.