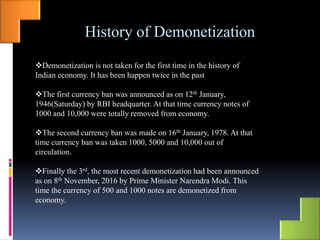

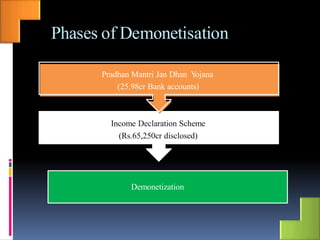

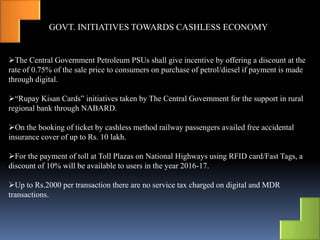

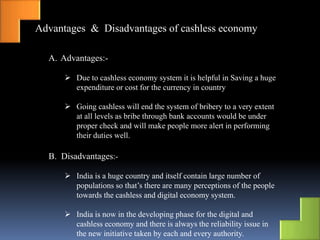

Demonetization triggered India's transition to a cashless economy. The document discusses the history of demonetization in India, the phases of the 2016 demonetization, and government initiatives to promote digital payments like incentives for cashless transactions. While going cashless offers advantages like reducing black money, changing cultural payment habits will take time given India's large population and some reliability issues with new digital systems. Overall, demonetization accelerated India's shift to a cashless economy, though a complete transition will be gradual.