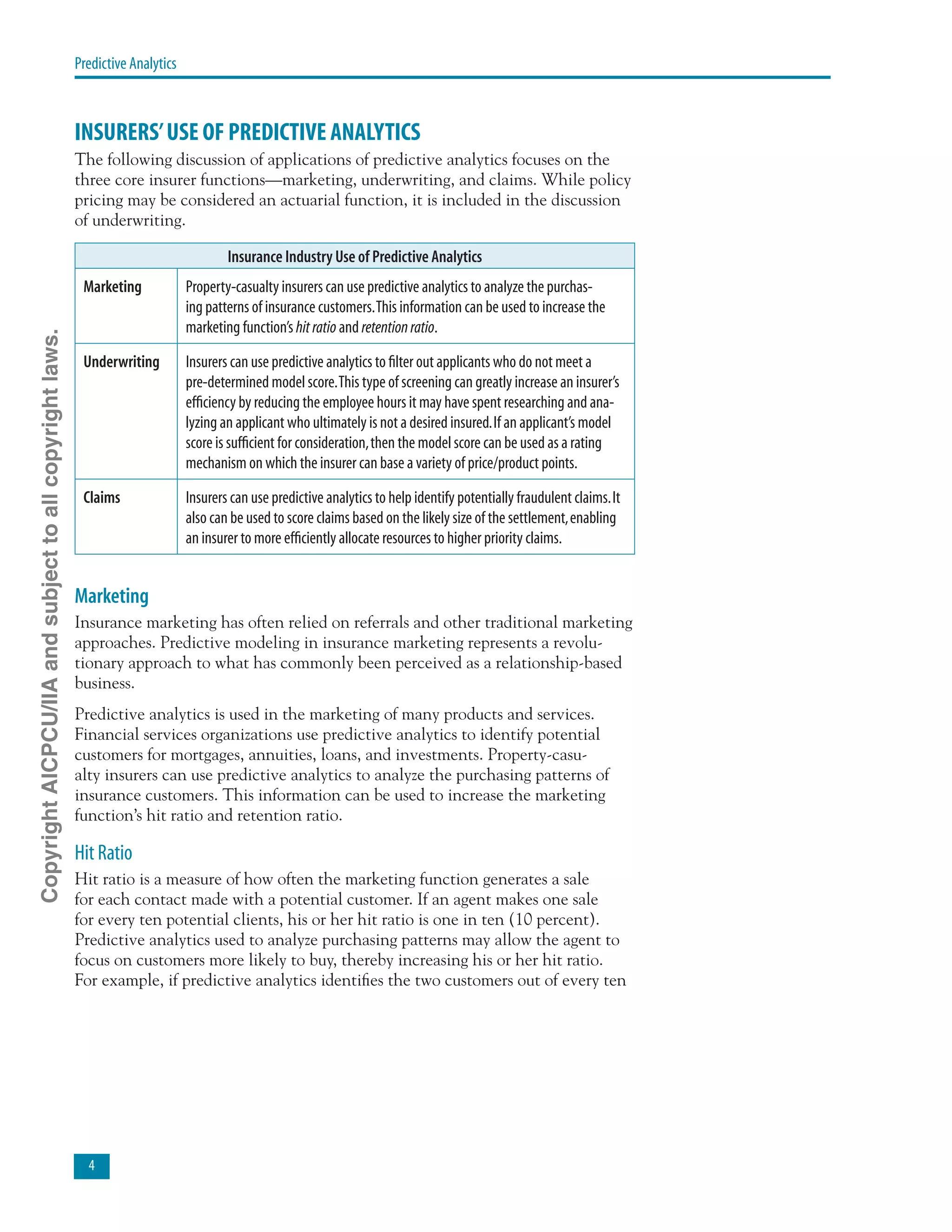

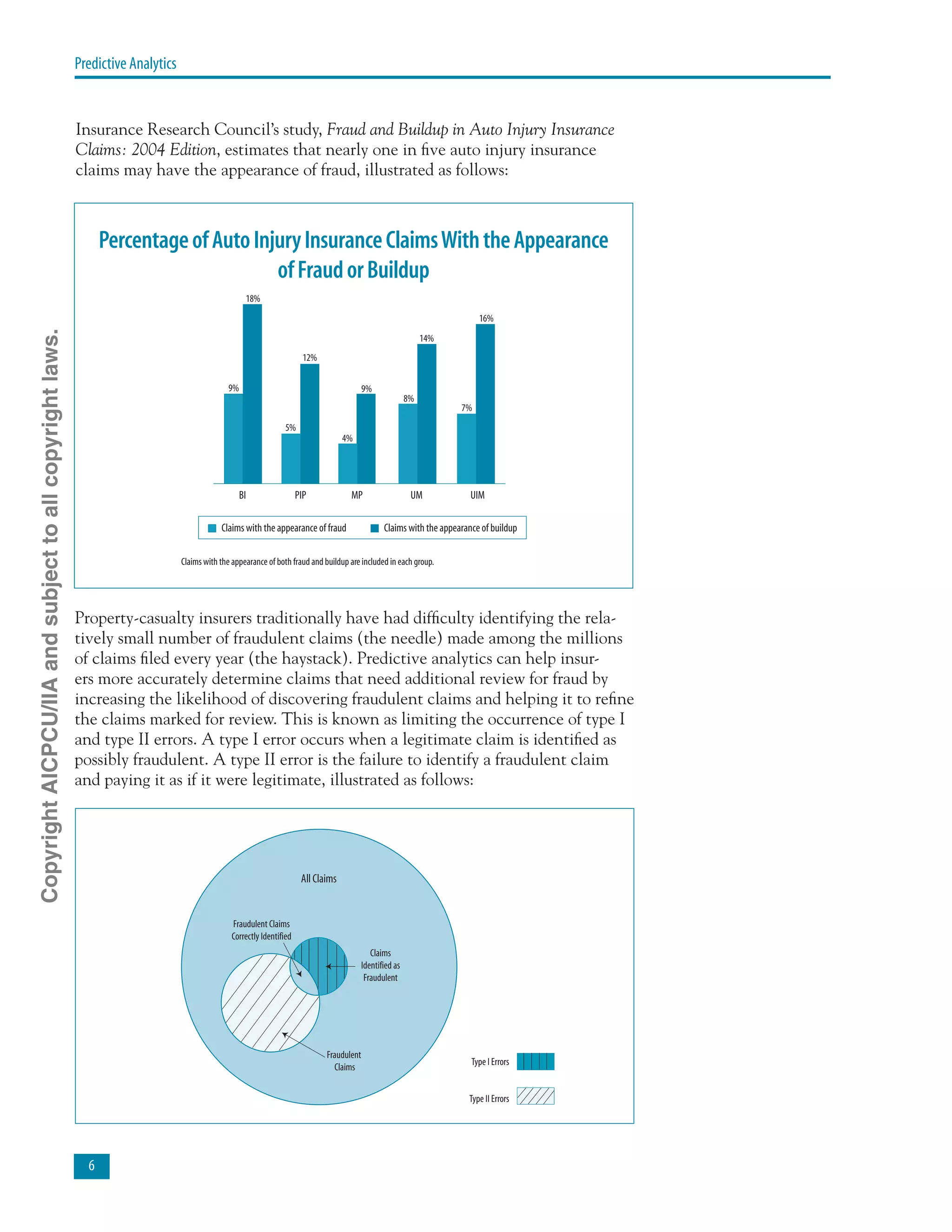

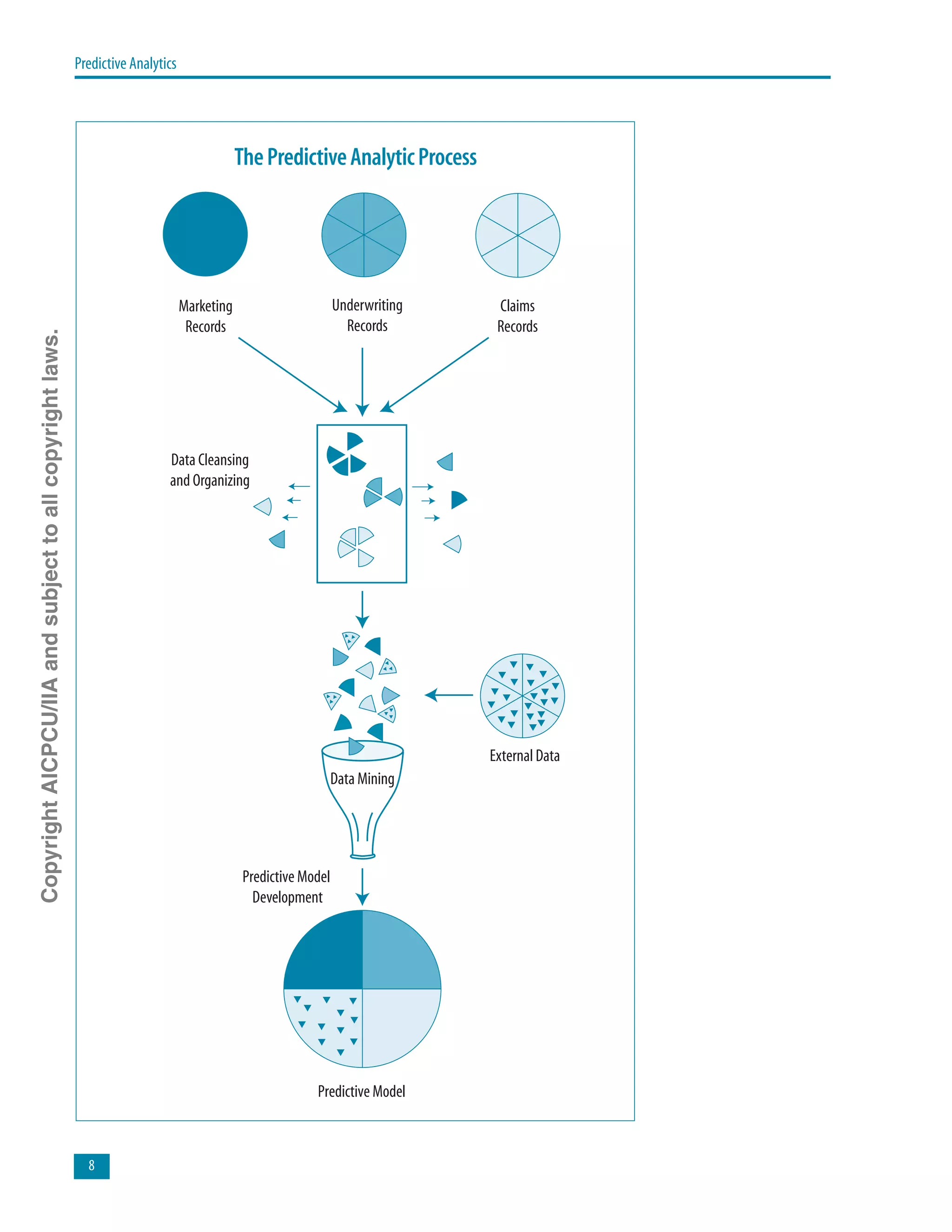

This document provides an overview of predictive analytics and its growing use in the insurance industry. It discusses key drivers for insurers' adoption of predictive analytics, including technological advances, data availability, seeking growth in slow-growth markets, and gaining competitive advantage. The document outlines how insurers use predictive analytics in marketing, underwriting, and claims to improve hit ratios, retention ratios, identify fraudulent claims, and prioritize claims processing. It provides details on the predictive analytic process of data mining, model development using regression and advanced models, and model validation. The advantages and disadvantages of predictive analytics for insurers are also discussed.