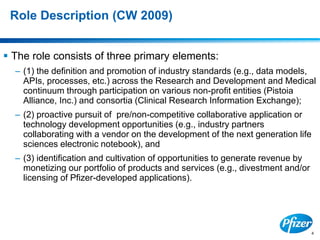

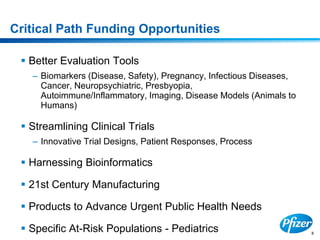

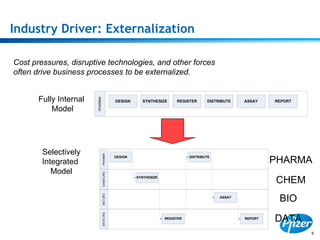

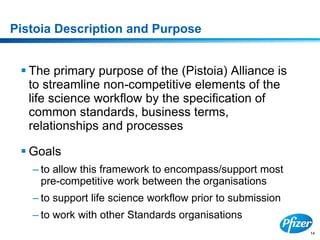

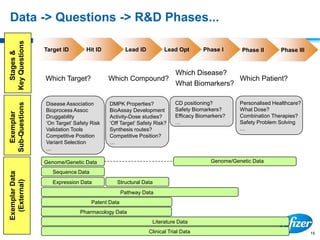

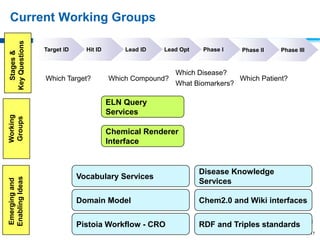

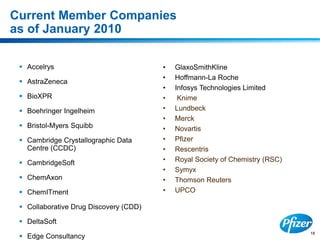

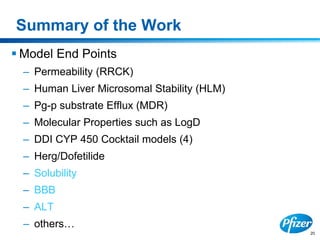

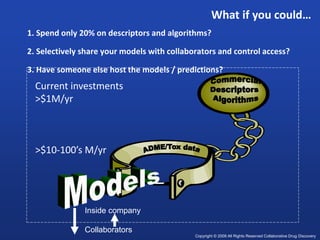

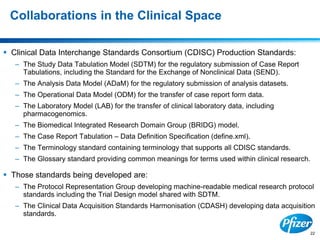

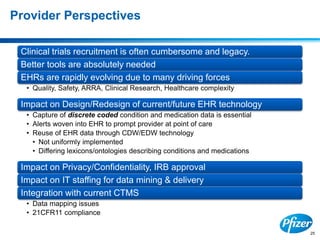

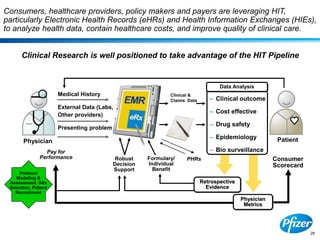

This document discusses precompetitive collaborations in the pharmaceutical industry. It defines precompetitive as referring to standards, data, or processes that are common across an industry and provide no competitive advantage. The document outlines a precompetitive mission statement to foster collaborations between organizations to develop standards, identify partnerships, and transfer technology. It also describes current working groups focused on areas like biomarkers, clinical trial design, and data standards.