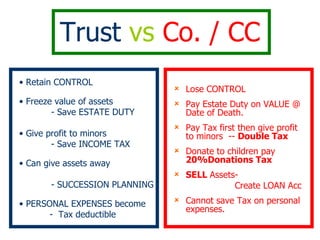

1. The document discusses the practical applications of trusts, from protecting personal assets like during divorce or insolvency, to succession planning and minimizing taxes in business.

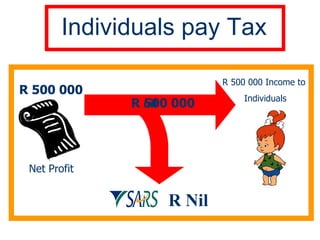

2. Trusts allow individuals to retain control over assets while benefiting family members. Income earned by the trust is taxed at lower rates than corporate structures and individuals.

3. Key benefits of trusts include asset protection, passing assets to heirs while avoiding estate duties, income tax savings when distributing to minors, and maintaining control over assets and how they are distributed.