This document discusses various estate and gift planning opportunities available in 2013 and beyond, including:

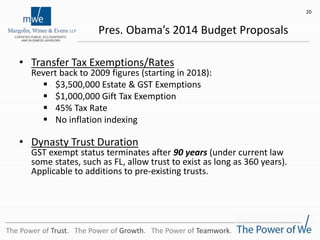

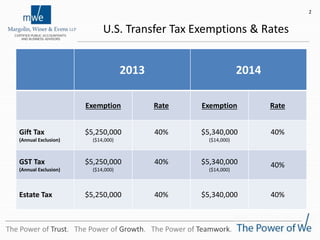

1) The gift, estate, and GST tax exemptions and rates for 2013-2014 which allow for large tax-free transfers of up to $5.25 million individually or $10.5 million for a married couple.

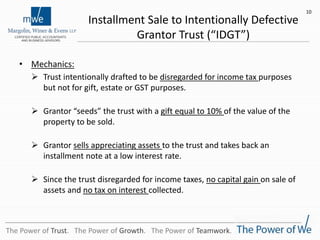

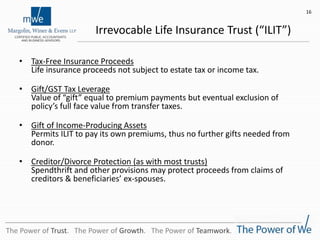

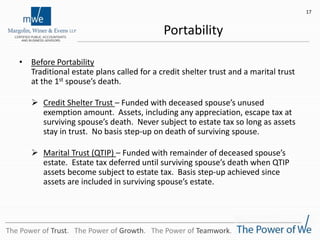

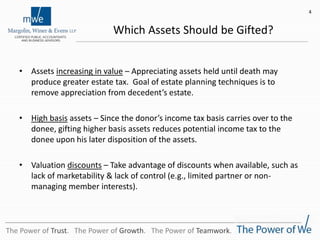

2) Techniques for leveraging exemptions such as annual exclusion gifts, installment sales to intentionally defective grantor trusts, and irrevocable life insurance trusts.

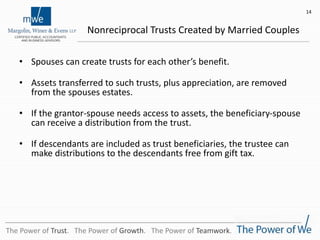

3) The benefits of using trusts including removing future appreciation from one's estate, providing for heirs, and maintaining some control over transferred assets.

![Grantor Trusts – Advantages

• Grantor Trust = Income Tax “Nothing”

Transactions between grantor and trust are disregarded (e.g., sales,

interest payments).

• More Rapid Appreciation

Assets appreciate more rapidly in grantor trust since not depleted

by income taxes.

• Tax-Free Gifts from Grantor

Payment of income tax by grantor is not deemed an indirect gift to

trust beneficiaries [LTR 9543049].

9

The Power of Trust. The Power of Growth. The Power of Teamwork.](https://image.slidesharecdn.com/48a0eba4-bcb6-4cdb-943d-803e64224e64-150708182229-lva1-app6892/85/2013-Gift-Estate-Planning-Opportunities-9-320.jpg)