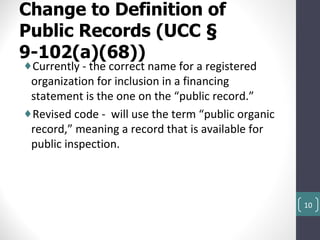

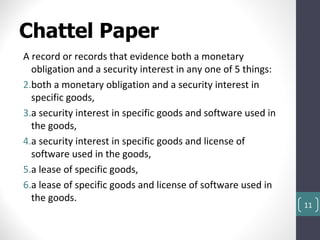

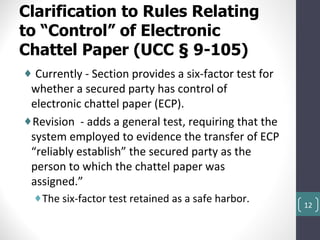

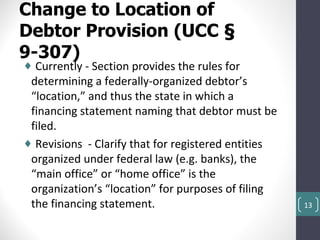

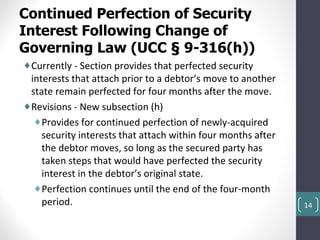

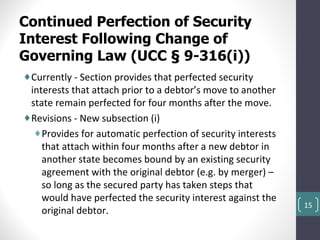

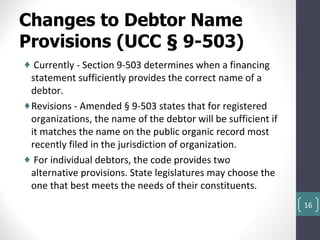

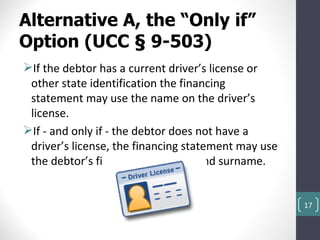

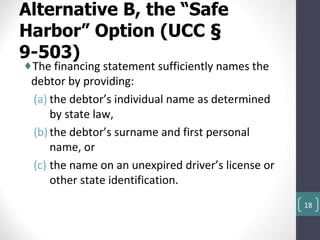

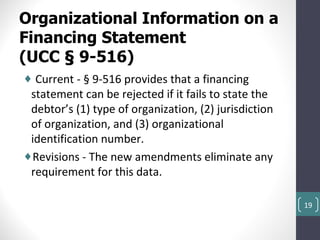

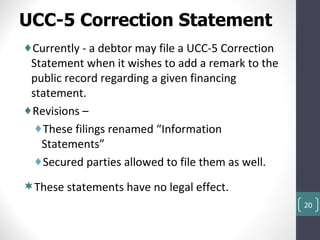

The document discusses upcoming changes to UCC Article 9 including clarifying rules around control of electronic chattel paper, location of debtor provisions, and continued perfection following a change in governing law. It also covers creating a security interest, such as how attachment works for future advances and automatic attachment for certain collateral types. The presentation provides an overview of the revisions and important concepts in secured transactions.