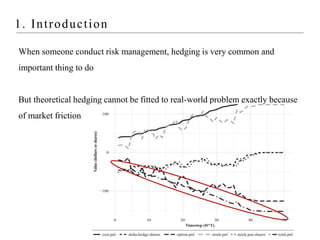

The document describes using reinforcement learning to implement hedging of derivatives. It discusses:

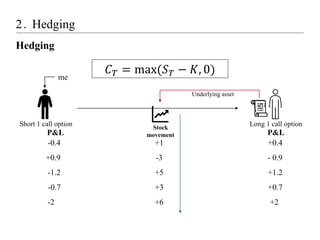

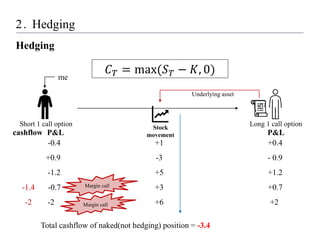

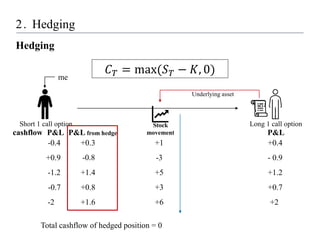

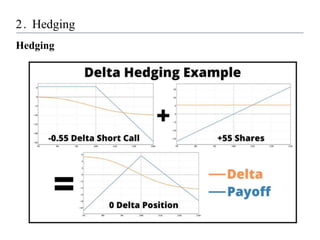

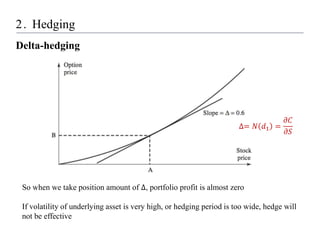

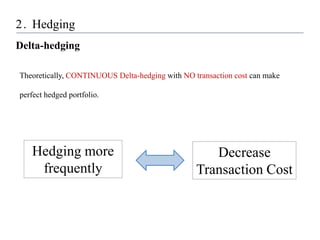

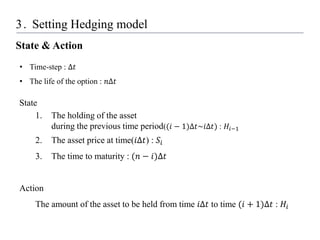

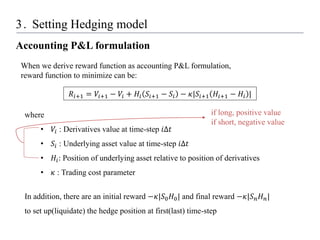

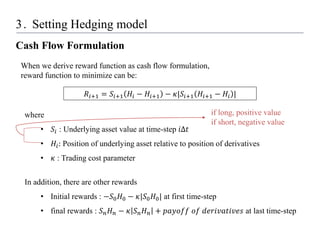

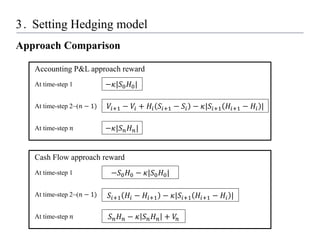

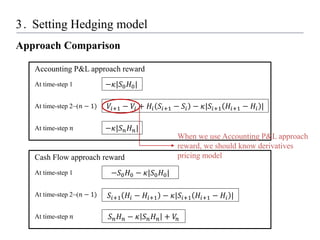

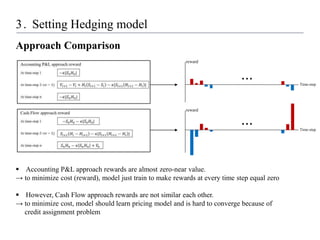

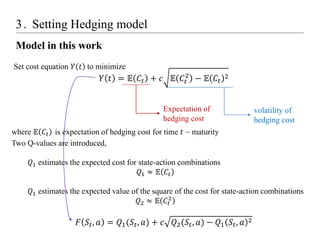

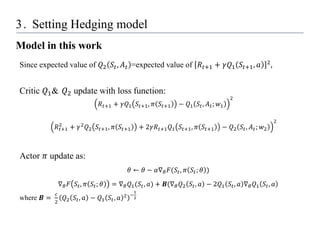

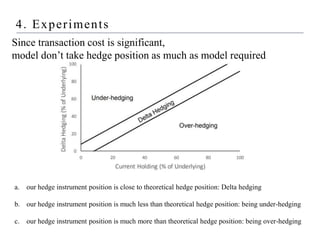

1) Setting up a hedging model using reinforcement learning, where the state includes the asset price and time to maturity, the action is the hedge position, and the reward minimizes hedging costs.

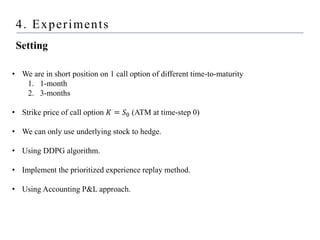

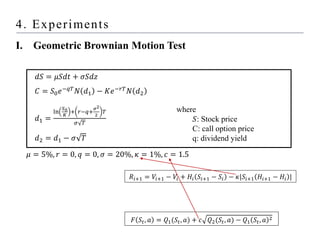

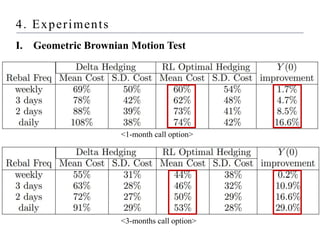

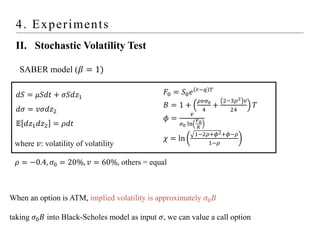

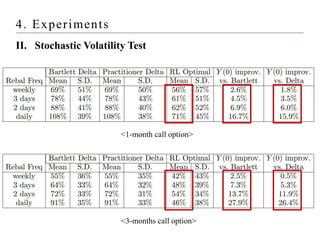

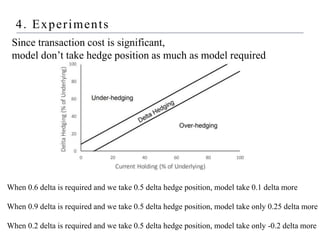

2) Conducting experiments hedging a short call option using the model, comparing performance under geometric Brownian motion and stochastic volatility.

3) Finding that the reinforcement learning model outperforms delta hedging strategies and achieves lower hedging costs, demonstrating the effectiveness of using reinforcement learning for hedging derivatives.