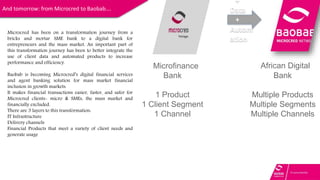

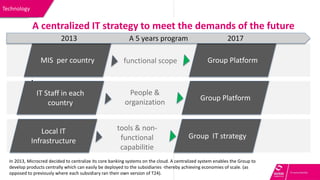

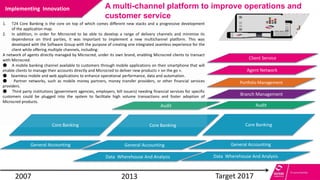

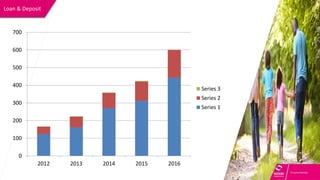

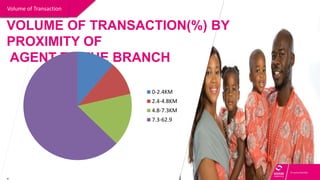

Baobab is an evolution of Microcred, focusing on becoming a digital bank providing financial services through technology. It aims to reach over 1 million previously unbanked customers through an agent network and automated products accessible via mobile apps. Baobab has seen success in Senegal and Madagascar, with over 800 agents and 100,000 active clients using the SMS-based platform for deposits, withdrawals, payments and loans. Microcred is transforming its infrastructure and products to better integrate customer data and automation, launching mobile apps and remote account opening to improve access, experience and financial inclusion across Africa.