This document discusses several economic theories related to exchange rates between Pakistan and the US:

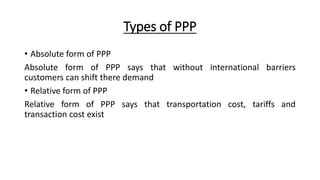

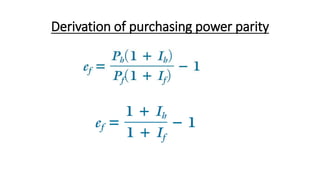

1) Purchasing power parity (PPP) suggests exchange rates adjust for inflation, but it does not hold for Pakistan-US rates due to imperfect substitutes between goods and other factors influencing exchange rates.

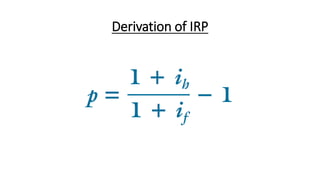

2) Interest rate parity (IRP) equalizes interest rate differentials and forward/spot exchange rates, but increasing interest rates in one country increase forward contracts for its currency.

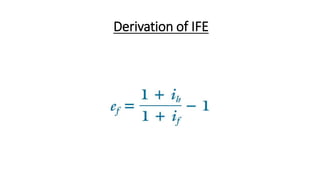

3) Interest rate expectation theory (IFE) describes how interest rate changes, rather than just inflation, impact nominal and real interest rates and exchange rates. Currencies with higher interest rates are expected to depreciate.