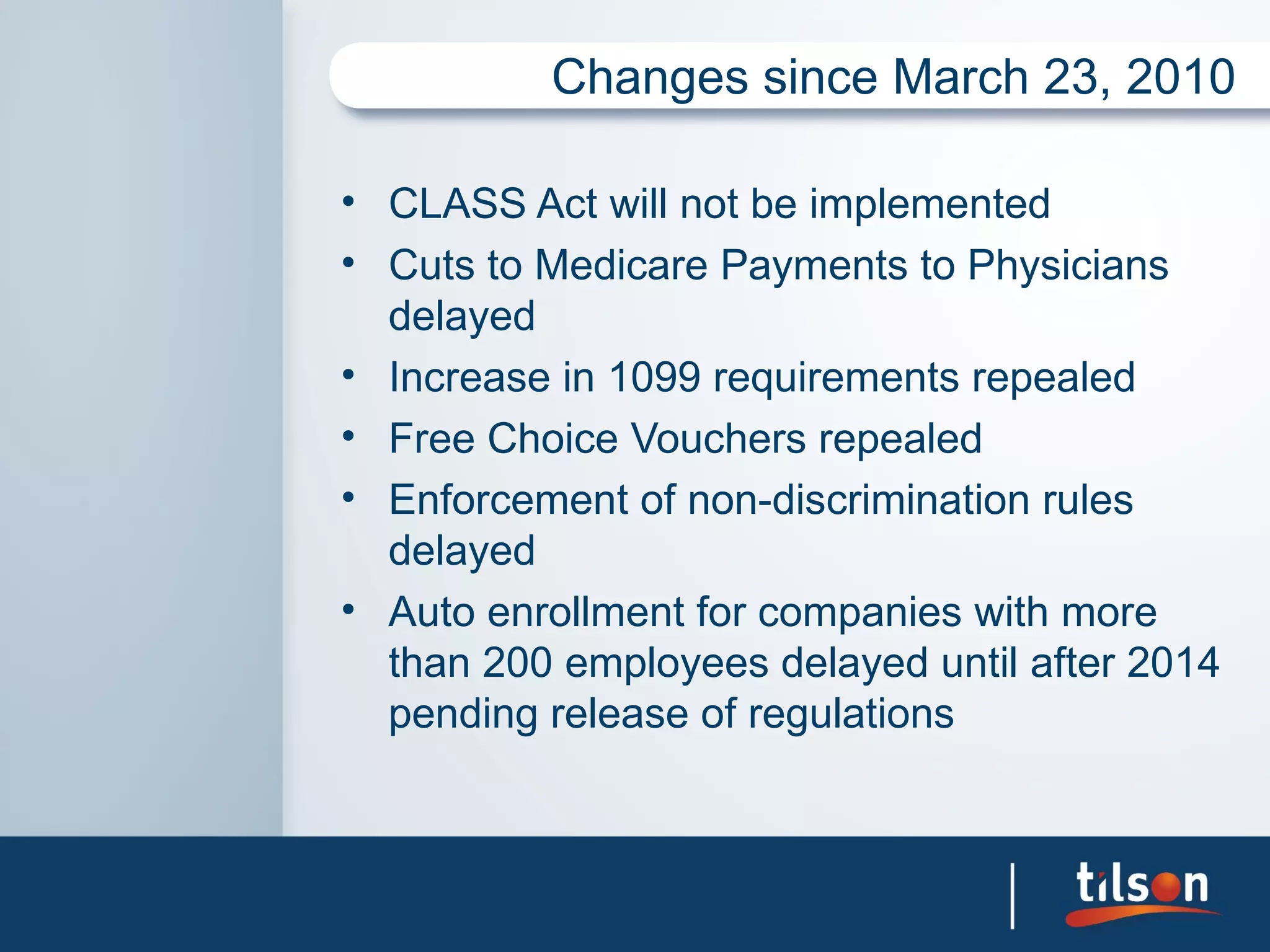

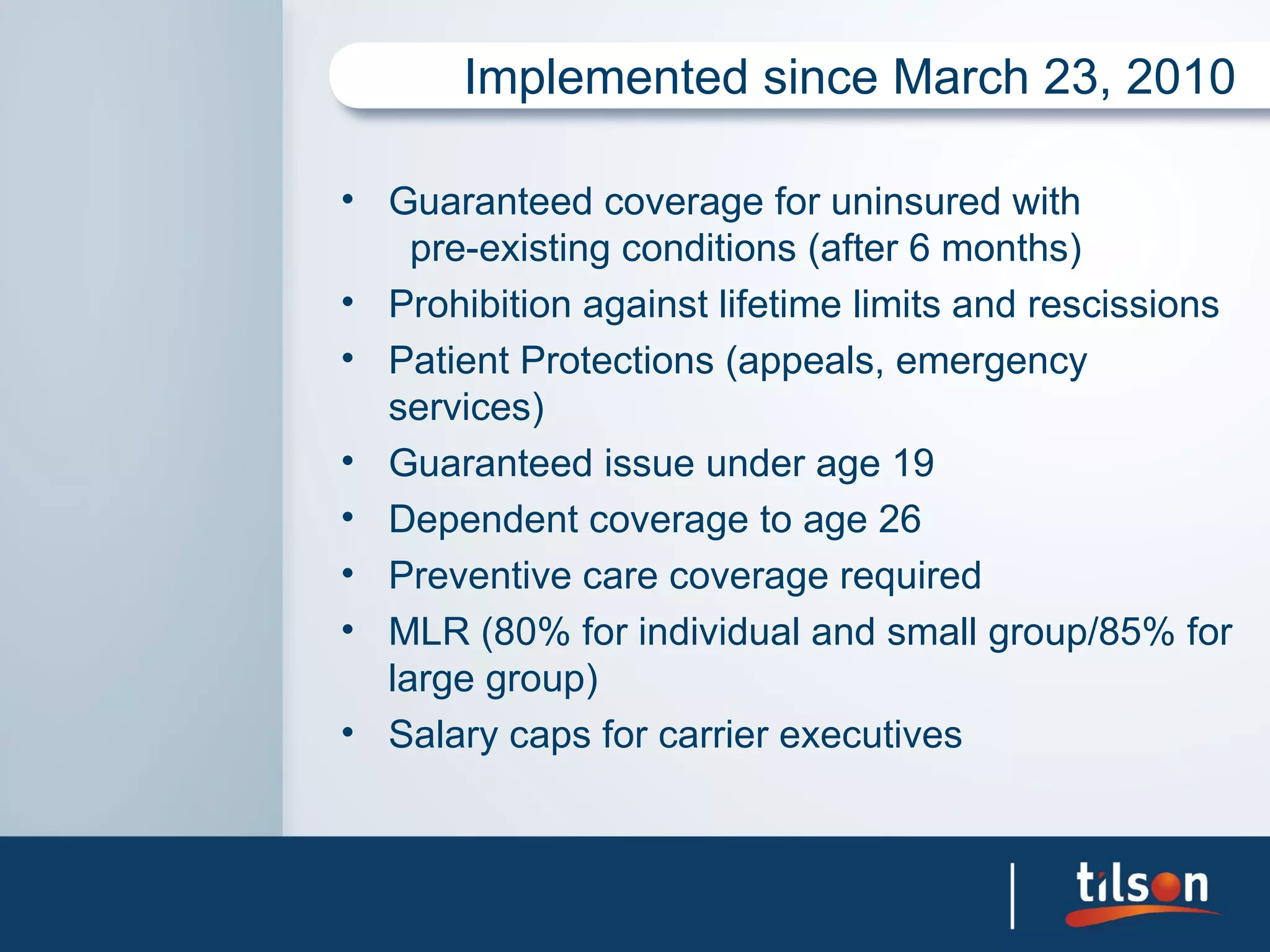

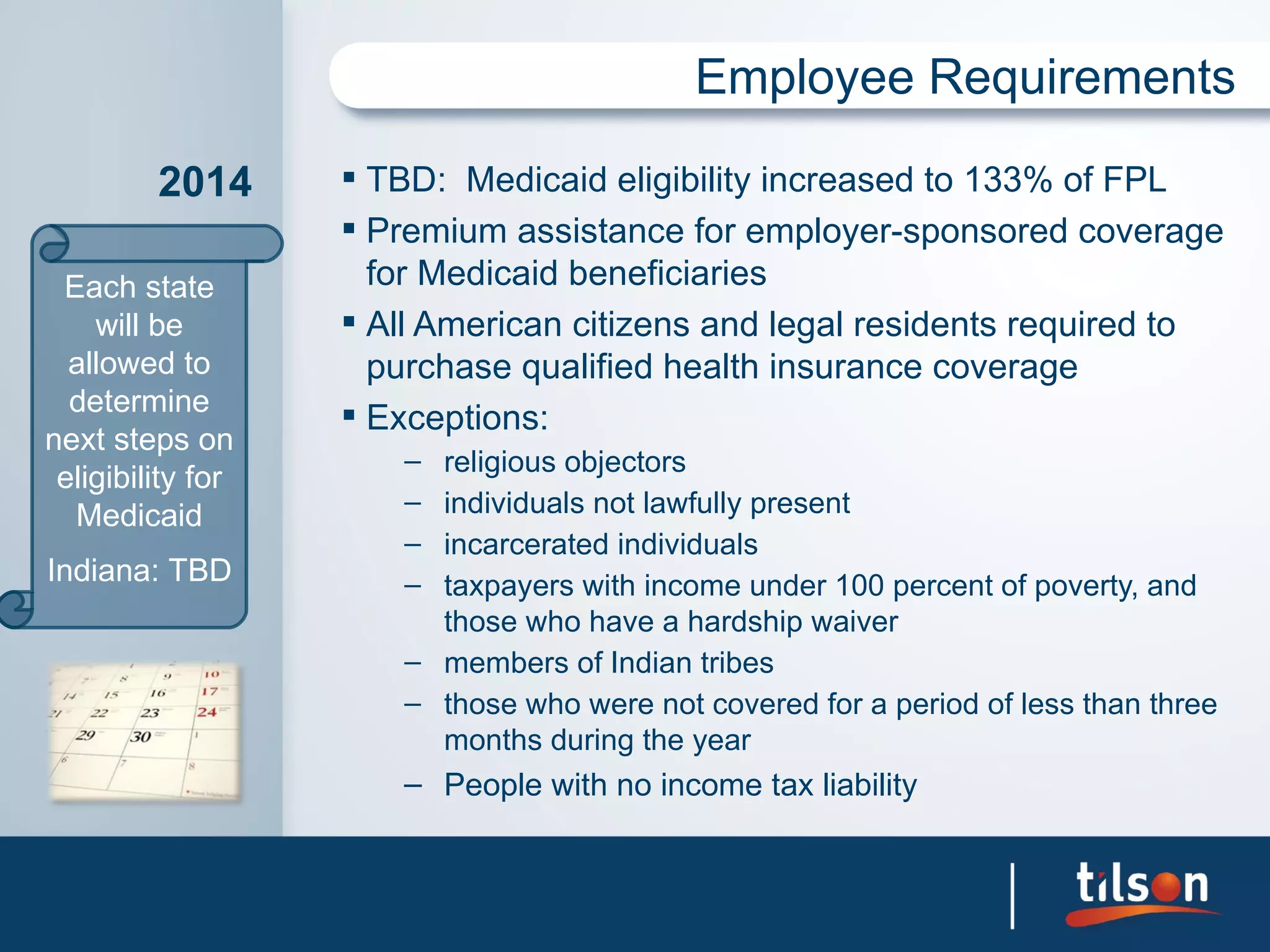

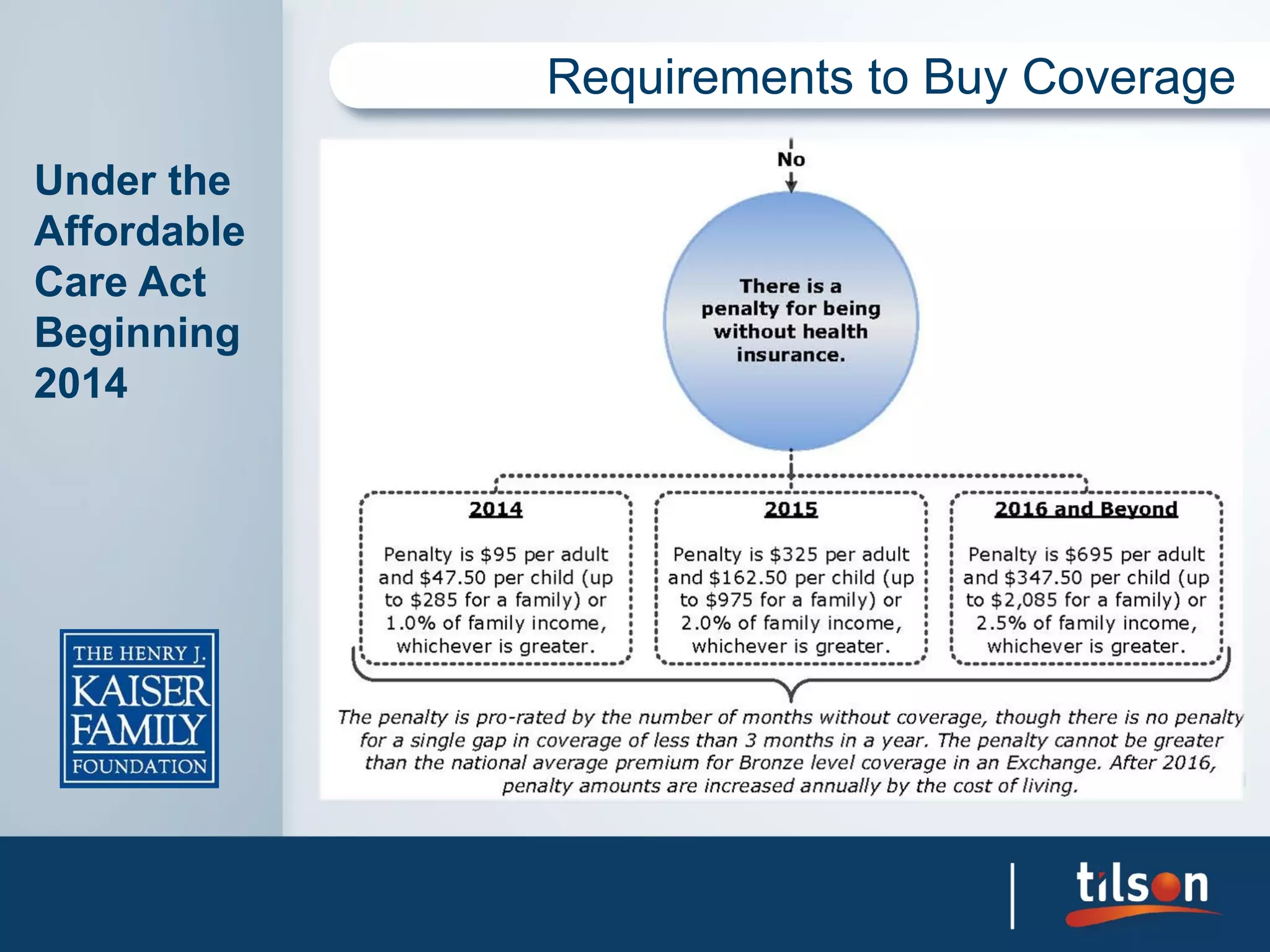

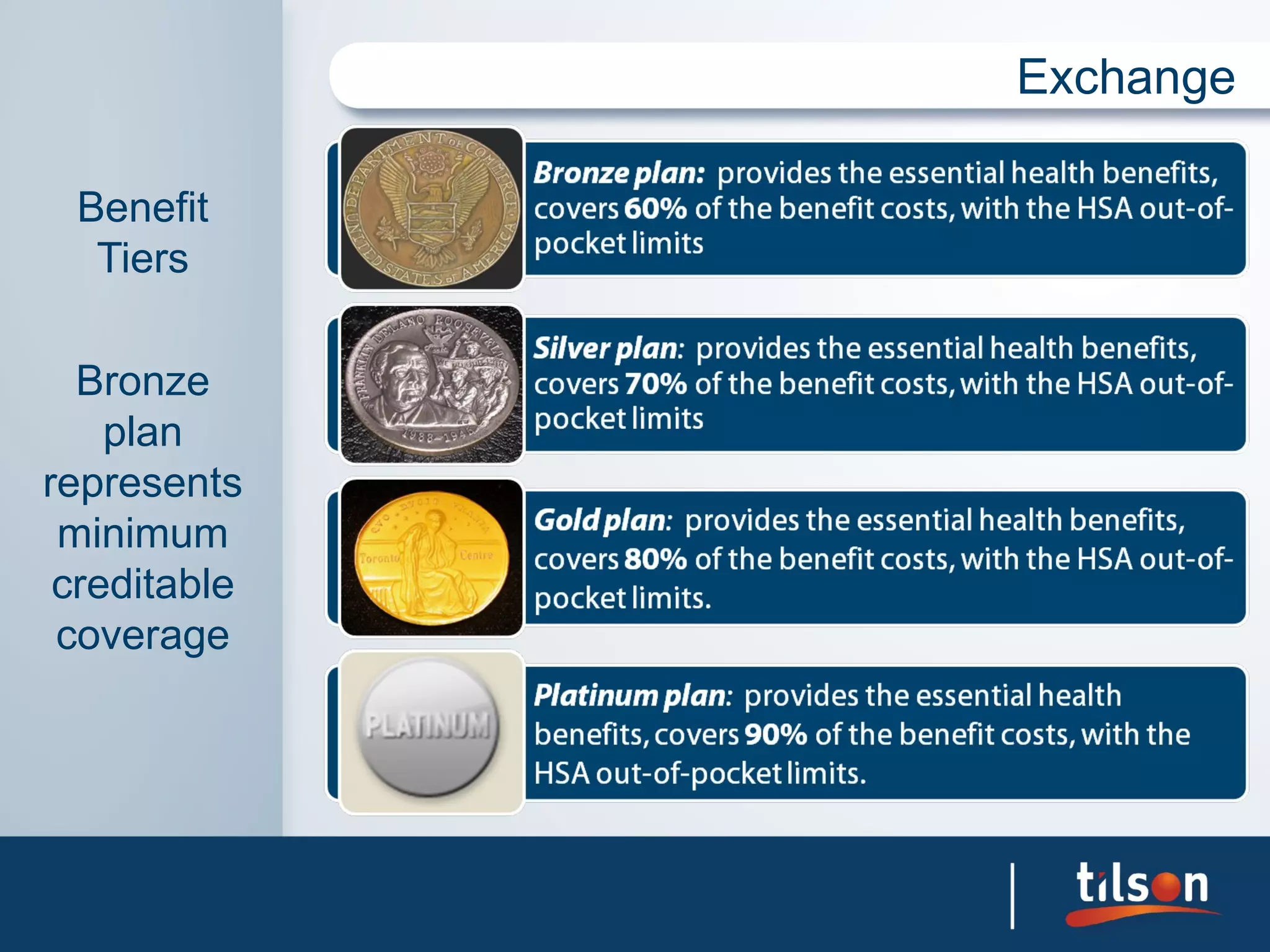

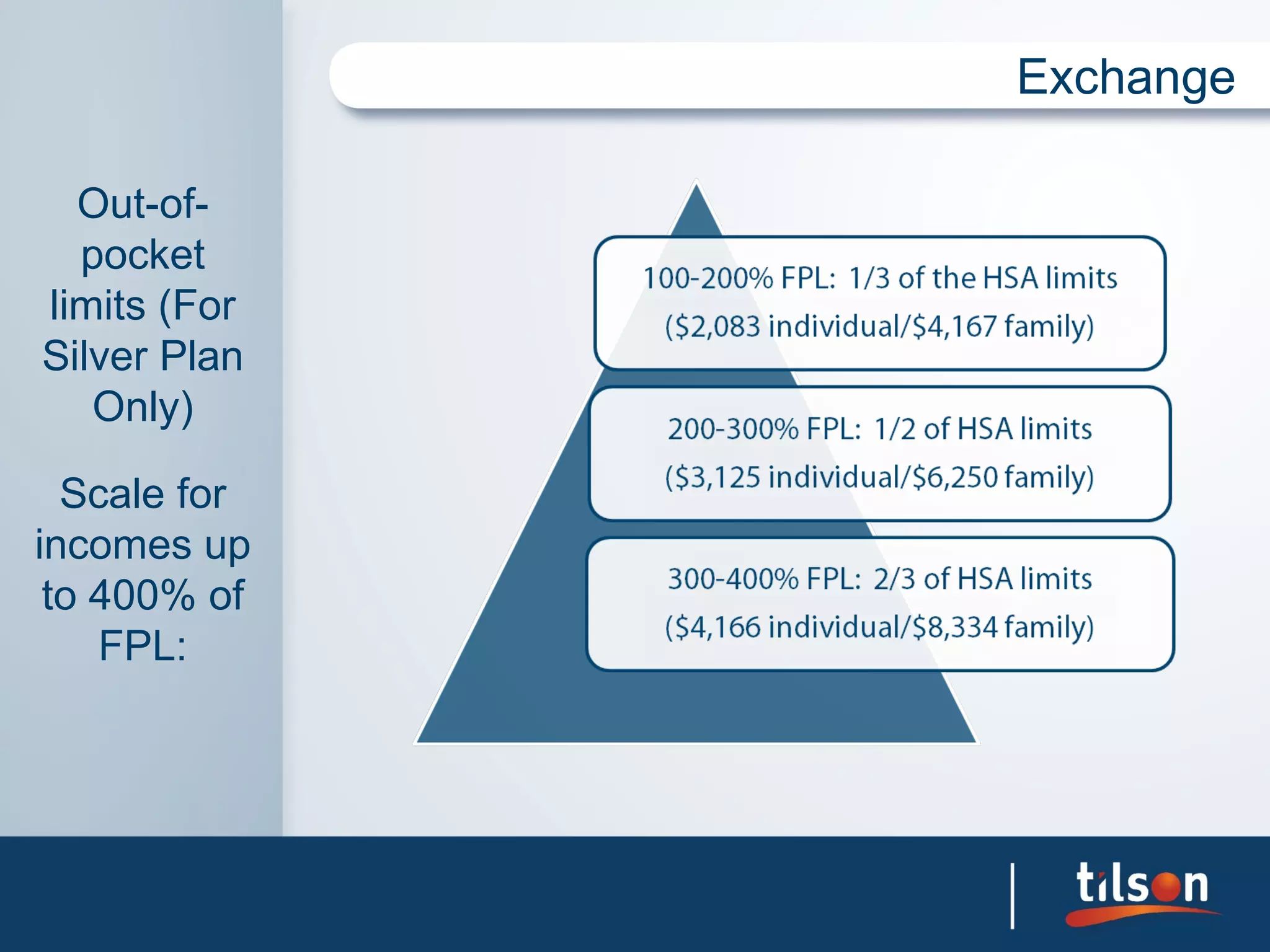

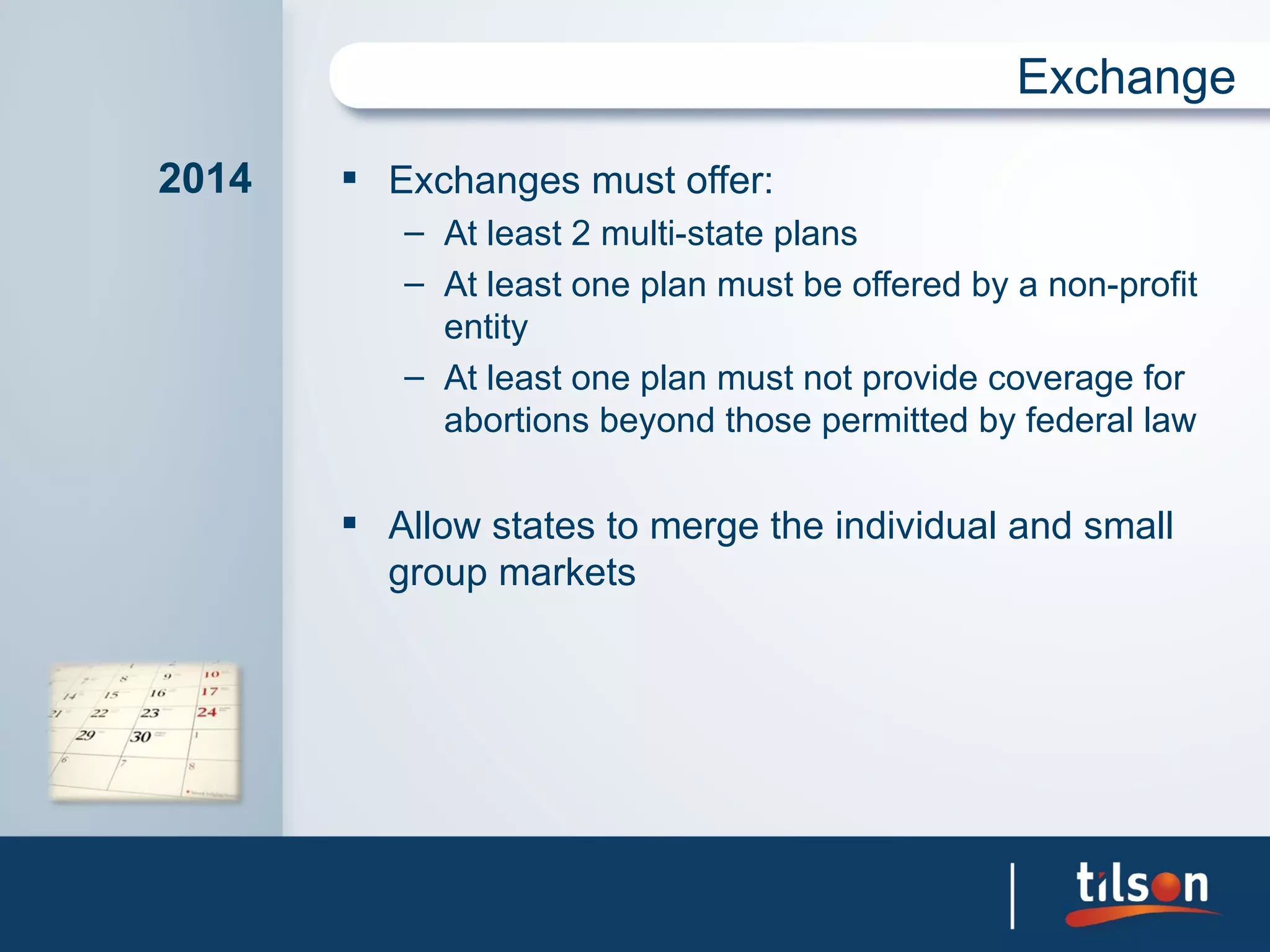

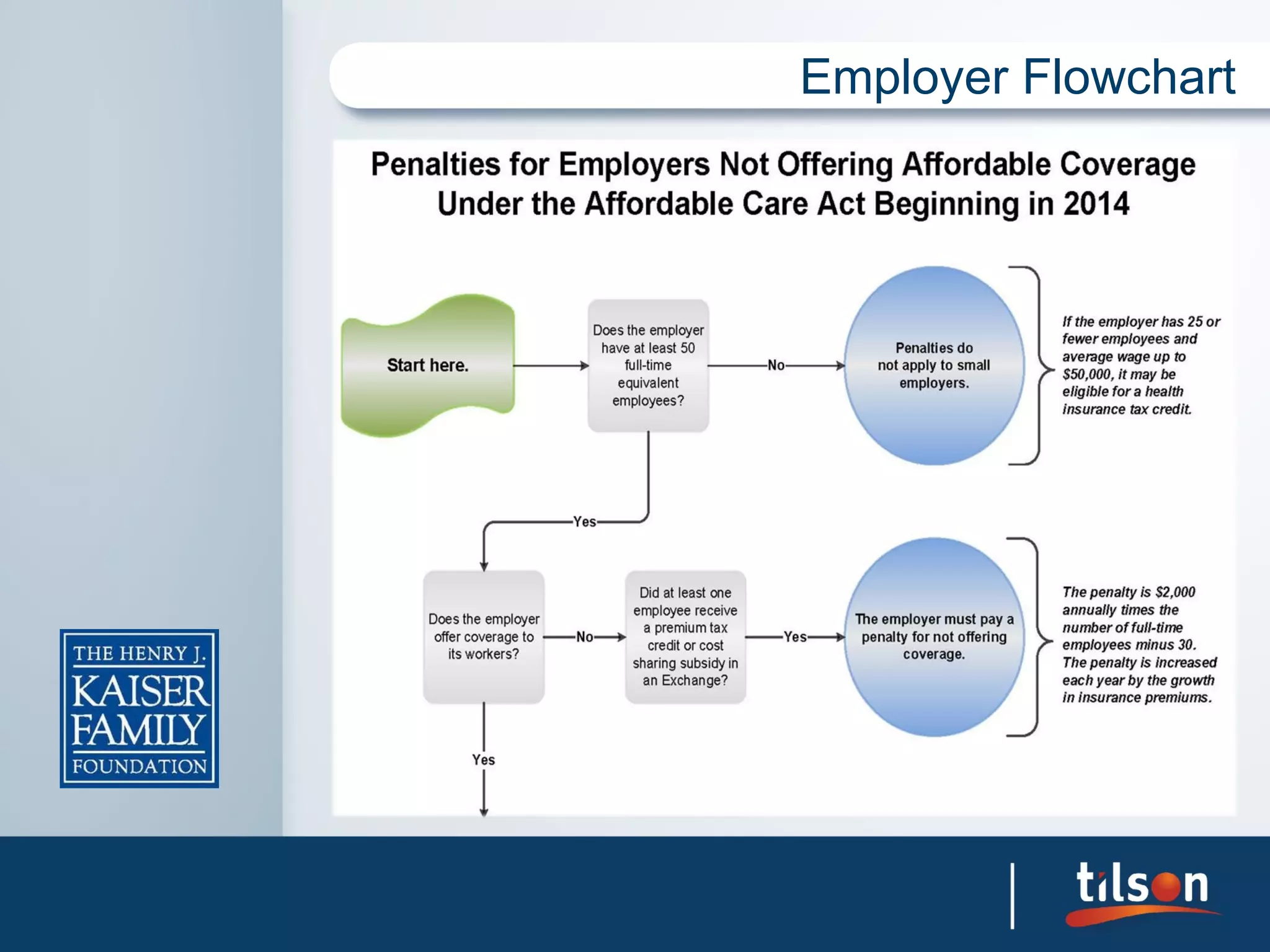

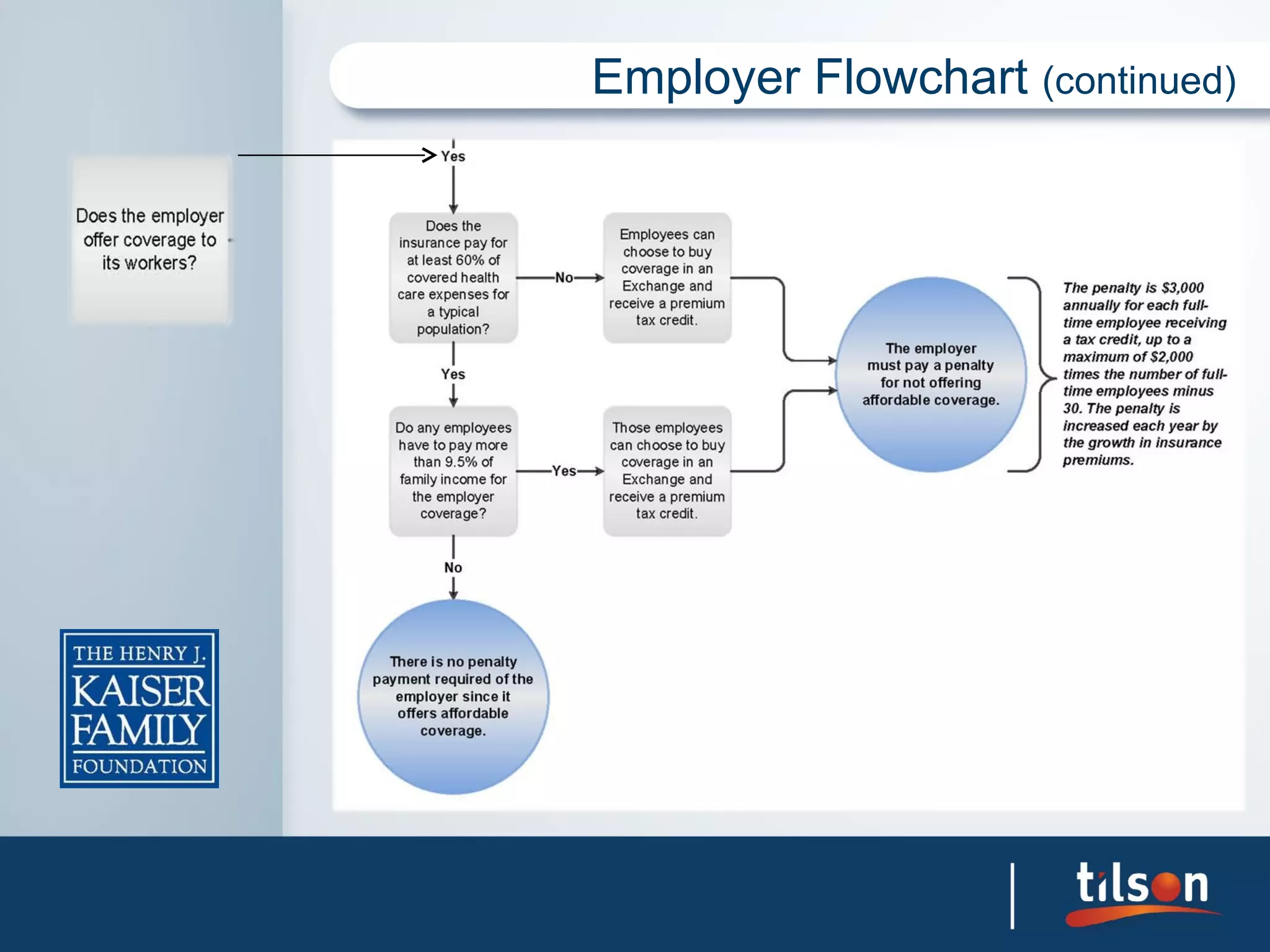

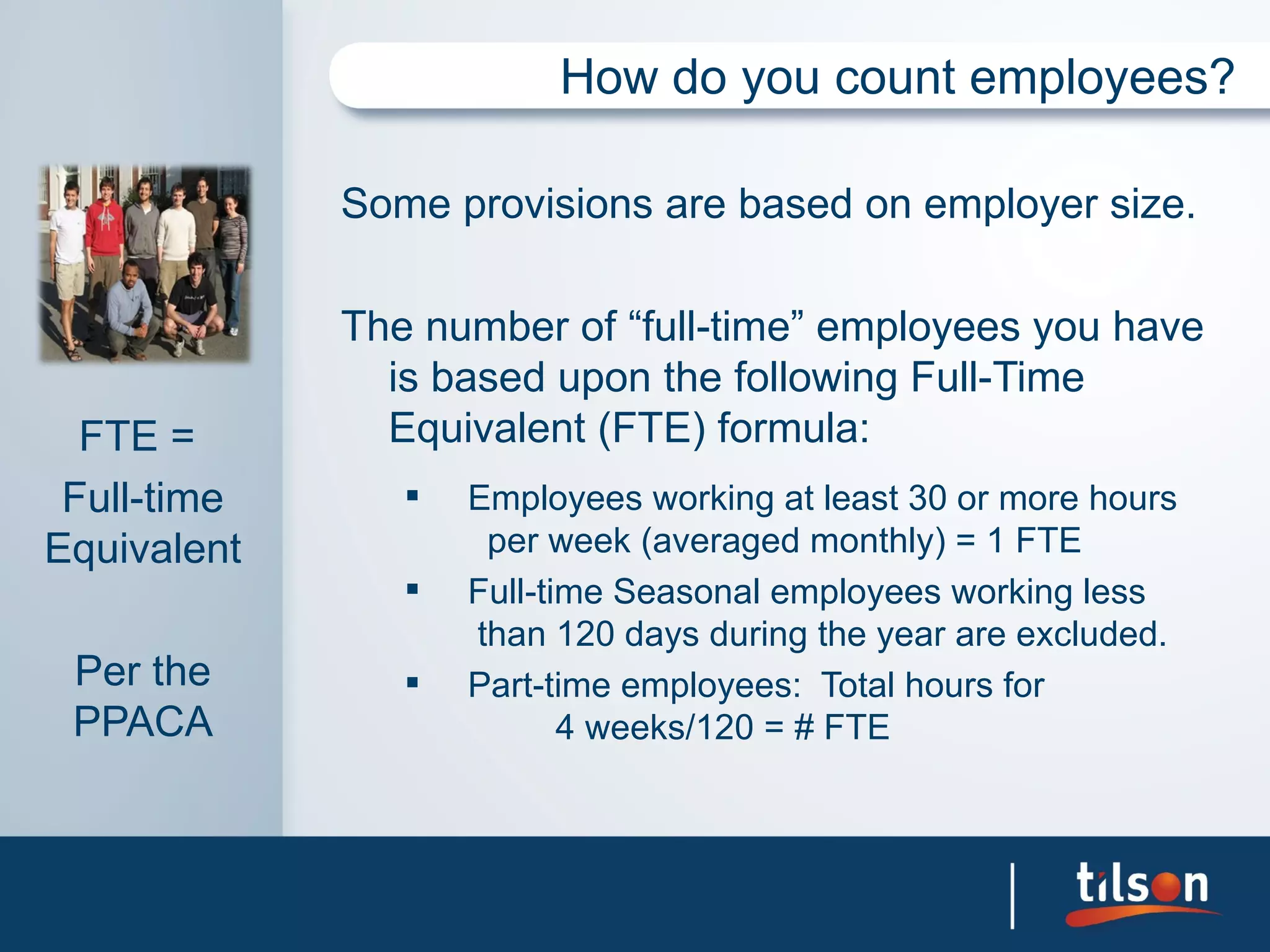

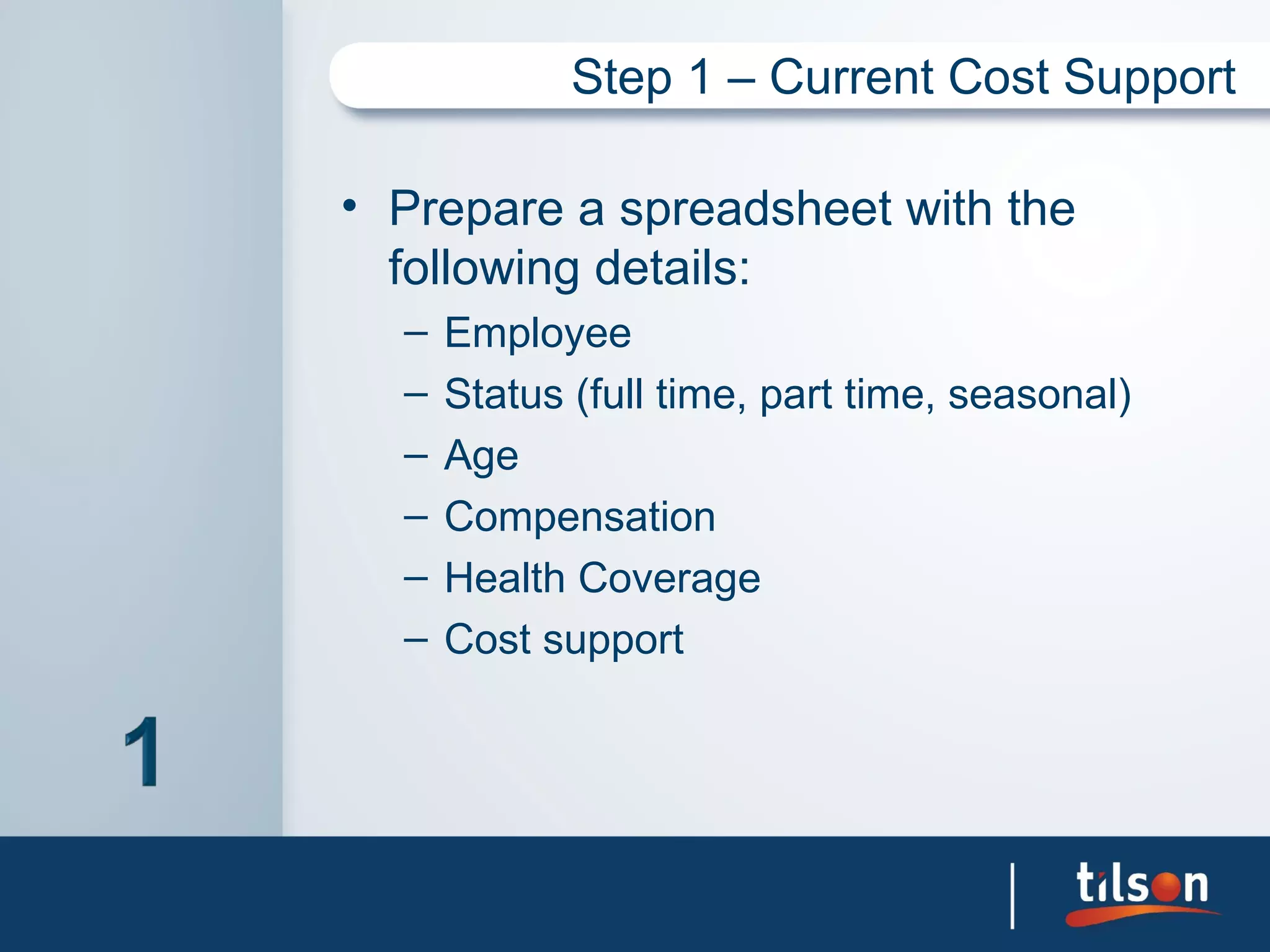

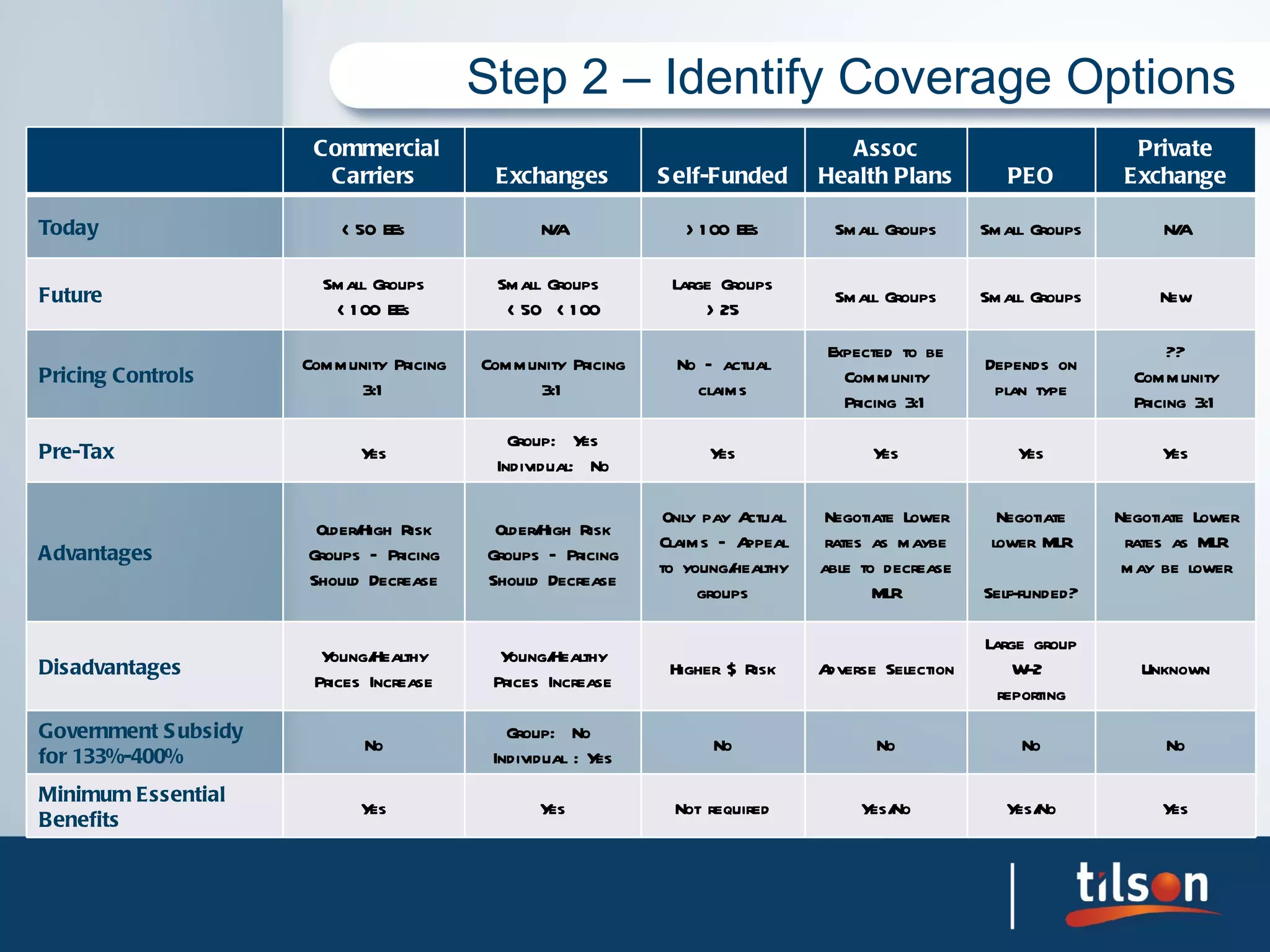

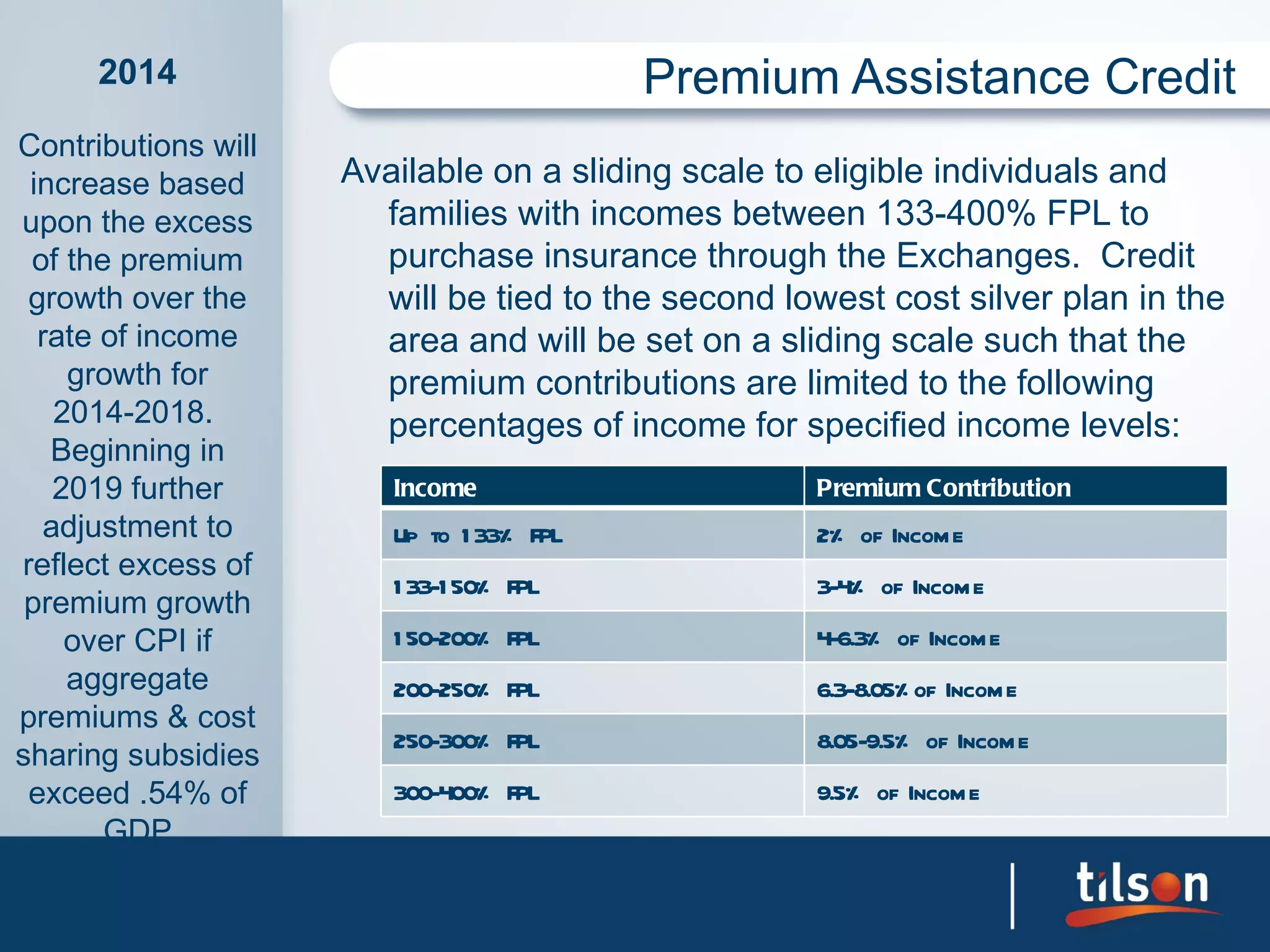

The document outlines the impact of the Affordable Care Act (Obamacare) on employer-provided healthcare and business planning, detailing compliance requirements and changes occurring from 2010 to 2014. It emphasizes the necessity for employers to evaluate their health coverage options and the financial implications of both offering and not offering health insurance. The document also discusses the requirements for reporting, coverage documentation, and the long-term considerations of healthcare costs and employee demographics.