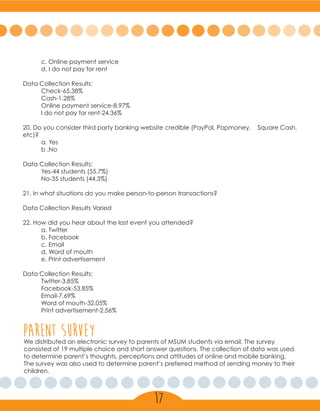

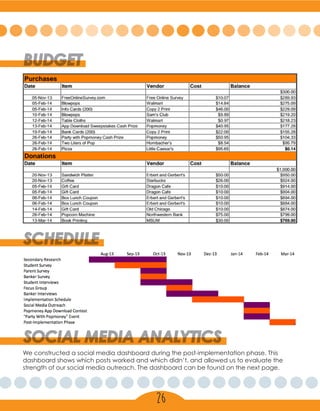

The document outlines a campaign by Minnesota State University Moorhead's Bateman team to promote the use of the Popmoney app among college students for person-to-person payment transactions. The campaign aimed to increase awareness and adoption of Popmoney through innovative strategies, including social media engagement and promotional events, ultimately resulting in significant increases in app downloads and user registrations. Despite facing challenges such as brand confusion and apprehensive attitudes towards third-party payments, the campaign exceeded its objectives and garnered attention for the service.