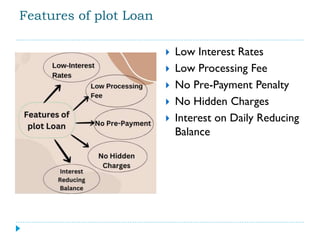

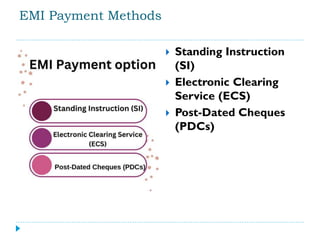

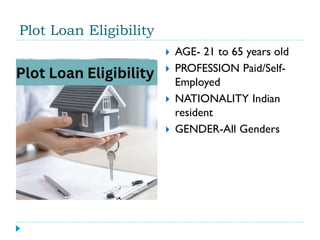

A plot loan is a loan provided by banks to purchase land, with EMIs paid back over time. It has benefits like online approval, low EMIs and interest rates. Plot loans can be used to directly purchase land from a housing society or through resale. They enable buyers to build their own home while land investment yields high returns. Borrower credit scores, age, income, nationality, gender and identification documents are considered for eligibility.