The auditor's report provides an unmodified opinion on the financial statements of Pmc Projects (India) Private Limited for the period 01/04/2013 to 31/03/2014. The auditor found that the company has maintained proper records of fixed assets, inventories and loans. Internal control procedures for purchase, sale and fixed assets were adequate. The company has not accepted any deposits from the public. Statutory dues have generally been regularly paid, with no material disputed amounts. No frauds were reported during the period.

![Pmc Projects (India) Private Limited

Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

[400100] Disclosure of general information about company

Unless otherwise specified, all monetary values are in INR

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

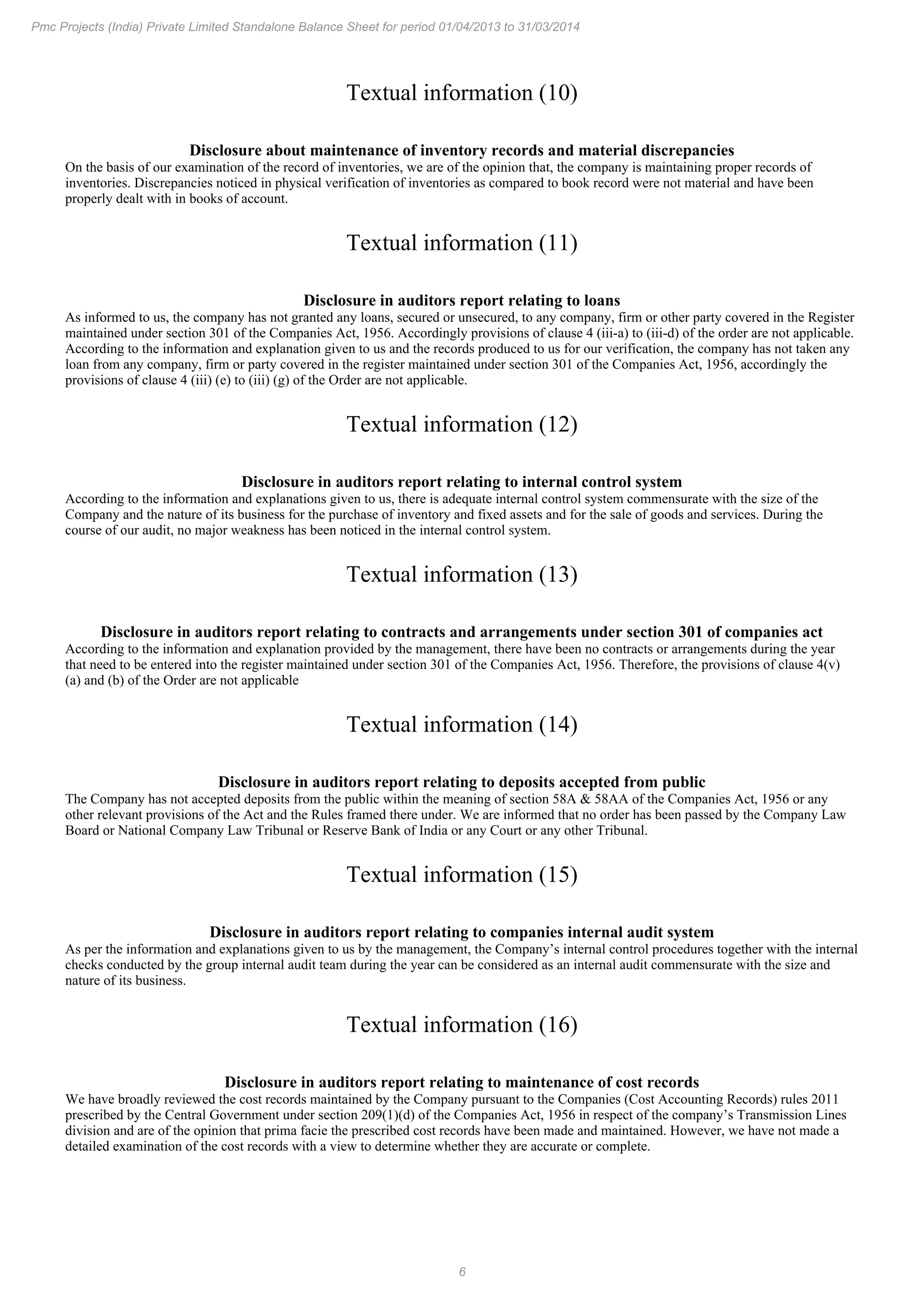

Name of company

Pmc Projects (India)

Private Limited

Corporate identity number U45202GJ2005PTC045974

Permanent account number of entity AADCP5841L

Address of registered office of company

Aiim Building, At

Shantigram , Near

Vaishnodevi Circle, S.G.

Highway, , Ahmedabad ,

GUJARAT , INDIA - 382421

Type of industry

C o m m e r c i a l a n d

Industrial

Date of board meeting when final accounts were approved 30/08/2014

Date of start of reporting period 01/04/2013 01/04/2012

Date of end of reporting period 31/03/2014 31/03/2013

Nature of report standalone consolidated Standalone

Content of report Balance Sheet

Description of presentation currency INR

Level of rounding used in financial statements Actual

Type of cash flow statement Indirect Method

SRN of form 66 Q36388304

[400400] Disclosures - Directors report

Details of directors signing board report [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Directors signing board report [Axis] 1

01/04/2013

to

31/03/2014

Details of signatories of board report [Abstract]

Details of directors signing board report [LineItems]

Name of director signing board report [Abstract]

First name of director Phani Kumar

Middle name of director Venkata

Last name of director Uppalapati

Designation of director Director

Director identification number of director 02492898

Date of signing board report 30/08/2014](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-1-2048.jpg)

![2

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Unless otherwise specified, all monetary values are in INR

01/04/2013

to

31/03/2014

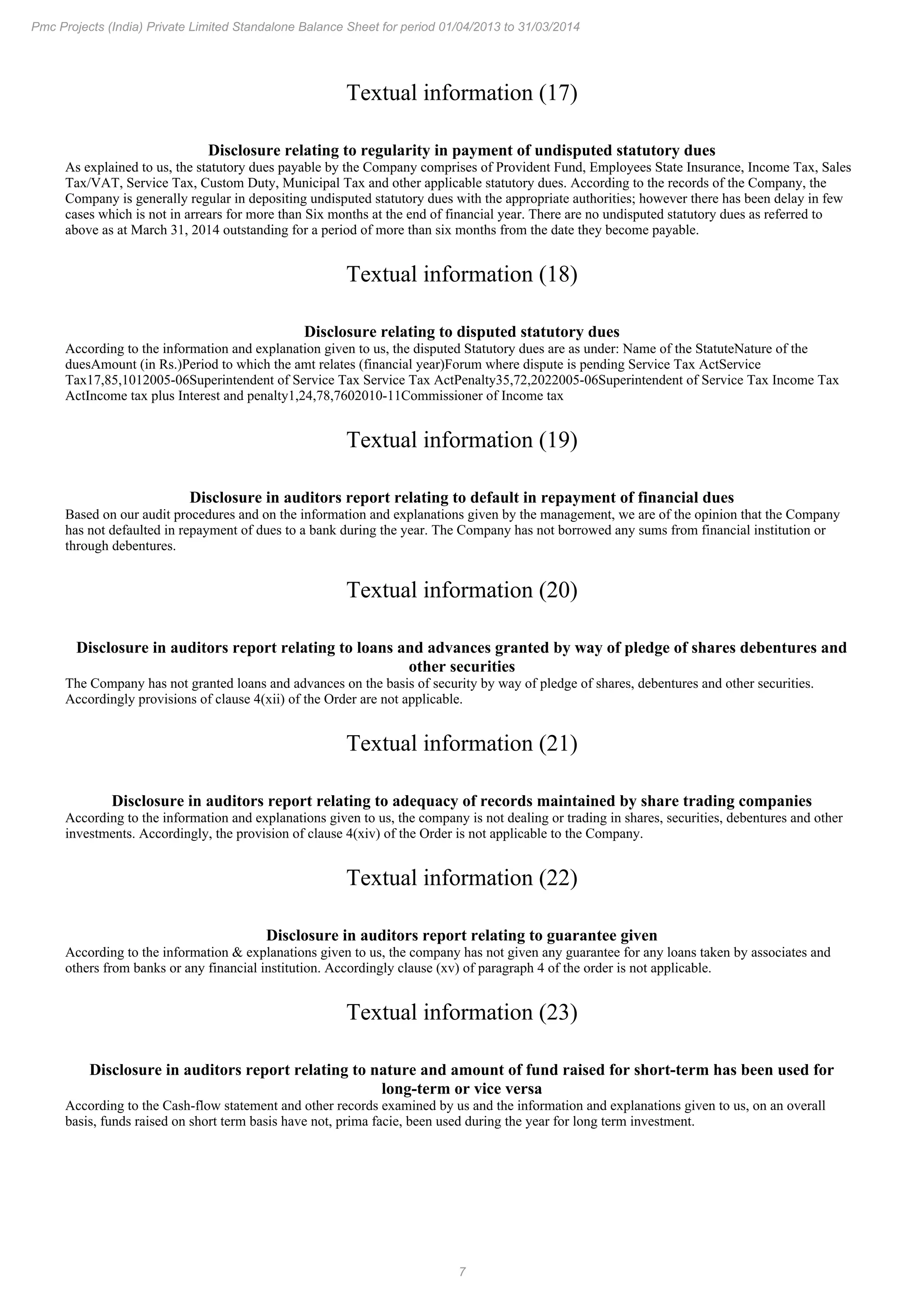

Disclosure in board of directors report explanatory [TextBlock]

Textual information (1)

[See below]

Description of state of companies affair

Textual information (2)

[See below]

Disclosures relating to dividends

Due to non-availably of

distributable profits,

your Directors express

their inability to

recommend any dividend

for the year ended March

31, 2014.

Details regarding energy conservation

Textual information (3)

[See below]

Details regarding foreign exchange earnings and outgo

The details of Foreign

Earnings and Outgo are set

out in Note 34 of Notes to

the financial Statements

for the year ended March

31, 2014.

Particulars of employees as per provisions of section 217

Textual information (4)

[See below]

Disclosures in director’s responsibility statement

Textual information (5)

[See below]

Director's comments on qualification(s), reservation(s) or adverse

remark(s) of auditors as per board's report

The Notes to Financial

Statements referred in

the Auditors Report are

self-explanatory and

therefore do not call for

any comments.

Other details mentioned board report

Textual information (6)

[See below]

Textual information (1)

Disclosure in board of directors report explanatory [Text Block]

Dear Shareholders,

Your Directors are pleased to present the Ninth Annual Report alongwith the audited accounts of your Company for the financial year ended

on March 31, 2014.

Textual information (2)

Description of state of companies affair

Your Directors are pleased to inform that total income earned during the year under review was Rs. 822.78 Crores against expenditure of Rs.

832.82 Crores including financial charges amounting to Rs. 227.75 Crores and depreciation amounting to Rs. 6.58 Crores. The net loss after

tax during the year under review was Rs. 10.03 Crores.

Textual information (3)

Details regarding energy conservation

In view of the nature of activities which are being carried on by the company, Rules 2A and 2B of the Companies (Disclosure of particulars

in the Report of Board of Directors) Rules, 1988, concerning conservation of energy and technology absorption respectively are not

applicable to the Company.

Textual information (4)

Particulars of employees as per provisions of section 217

The Statement of Employees who are in receipt of remuneration in excess of limits specified by Section 217(2A) of the Companies Act, 1956

and Companies (Particulars of Employees) Rules, 1975 as amended from time to time during the year under review is appended as an

Annexure I.](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-2-2048.jpg)

![3

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

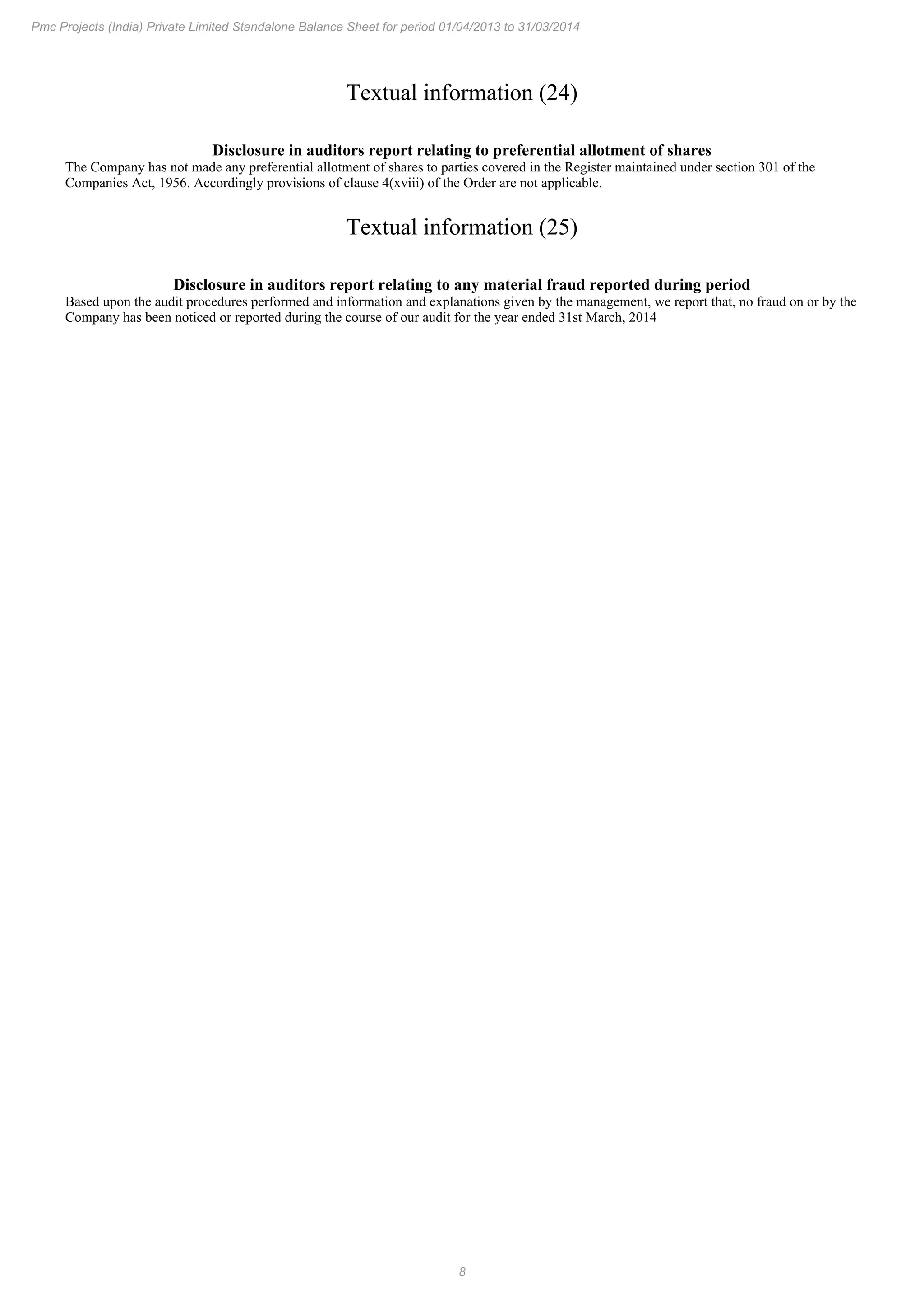

Textual information (5)

Disclosures in director’s responsibility statement

Directors’ Responsibility Statement: Pursuant to the requirements under 217(2AA) of the Companies Act, 1956, with respect to Directors’

Responsibility Statement, your Directors hereby confirm the following: 1. That in the preparation of the annual accounts, the applicable

accounting standards have been followed along with proper explanatory statement relating to material departures; 2. That the directors have

selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to

give a true and fair view of the state of affairs of the company at the end of the financial year; 3. That directors have taken proper and

sufficient care for the maintenance of adequate accounting records in accordance with the provisions of Companies Act, 1956 for

safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities; 4. That the directors have prepared

the annual accounts on a going concern basis.

Textual information (6)

Other details mentioned board report

Fixed Deposits: During the year under review, your Company has not accepted any fixed deposits within the meaning of Section 58A of the

Companies Act, 1956 and the rules made there under. Directors Mr. Sandip Adani and Mr. Pijush Bhattacharjee were appointed as

Additional Directors of the Company w.e.f August 22, 2014 to hold office upto the date of ensuing Annual General Meeting in terms of

Section 161 of the Companies Act, 2013. The Company has received a notice in writing in terms of Section 160 of the Companies Act, 2013.

Board welcomes them and looks forward to their valued contribution in meeting the long term objectives of your Company. Mr. Kumar

Vikram and Col. Vinod George have resigned as Directors of the Company w.e.f. August 22, 2014. The Board places on record its deep

appreciation of the valuable services and guidance provided by them during their tenure. Insurance: Assets of your Company are adequately

insured against various perils. Auditors & Auditors’ Report: The Statutory Auditors of the Company, M/s. Shah Dhandharia & Co.,

Chartered Accountants, Ahmedabad will retire on the conclusion of the ensuing Annual General Meeting. The said Statutory Auditors have

confirmed their eligibility and willingness to accept the office on re-appointment. The necessary resolution seeking your approval for

reappointment of Statutory Auditors has been incorporated in the Notice convening the Annual General Meeting. Compliance Certificate: In

accordance with section 383A of the Companies Act, 1956 and Companies (Compliance Certificate) Rules, 2001, the Company has obtained

a certificate from a Secretary in whole time practice confirming that the Company has complied with the provisions of the Companies Act,

1956 and copy of such certificate is annexed to and is part of this report. Appreciation and Acknowledgement: Your Directors have pleasure

in taking this opportunity to thank the Government Agencies, bankers and all other personnel of their continued support and co-operation to

the Company

[400200] Disclosures - Auditors report

Details regarding auditors [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Auditors [Axis] 1

01/04/2013

to

31/03/2014

Details regarding auditors [Abstract]

Details regarding auditors [LineItems]

Category of auditor Auditors firm

Name of audit firm

S H A H

DHANDHARIA &

Co.

Name of auditor signing report

Dhandharia Pravin

Rajendraprasad

Firms registration number of audit firm 118707W

Membership number of auditor 115490

Address of auditors

B/302, ANAND

VIEW SOC., NR

SHAHIBAUG

RLY. CROSS.,

Ahmedabad –

380004

Permanent account number of auditor or auditor's firm AAGFM7049H

SRN of form 23B S27866391

Date of signing audit report by auditors 30/08/2014

Date of signing of balance sheet by auditors 30/08/2014](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-3-2048.jpg)

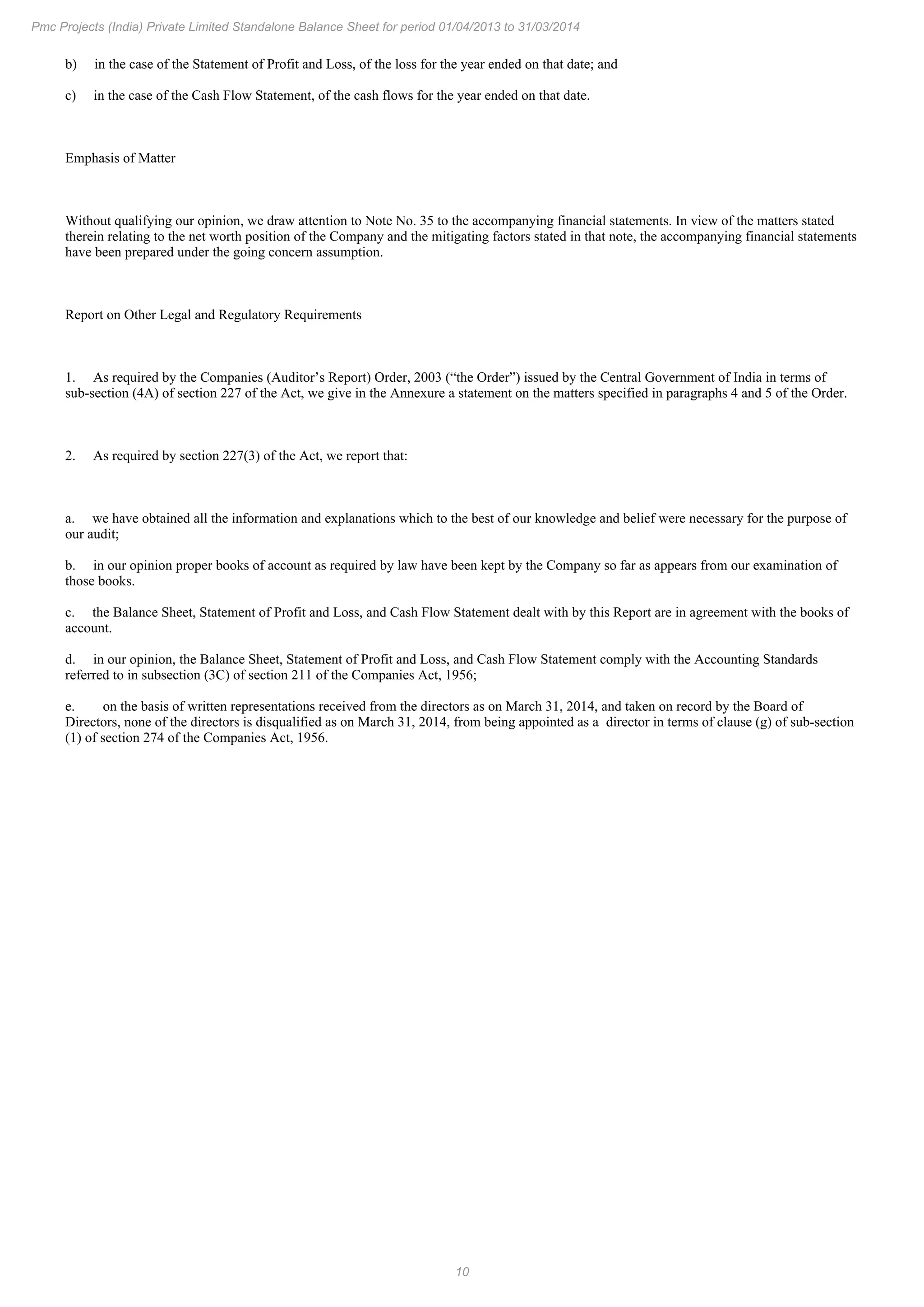

![4

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of auditor's qualification(s), reservation(s) or adverse remark(s) in auditors' report [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Auditor's qualification(s), reservation(s) or adverse remark(s) in auditors' report [Axis]

Auditor's

favourable remark

[Member]

Clause not

applicable

[Member]

01/04/2013

to

31/03/2014

01/04/2013

to

31/03/2014

Disclosure of auditor's qualification(s), reservation(s) or adverse remark(s) in

auditors' report [Abstract]

Disclosure of auditor's qualification(s), reservation(s) or adverse remark(s) in

auditors' report [LineItems]

Disclosure in auditors report relating to fixed assets As given below

Disclosure relating to quantitative details of fixed assets

The Company has

maintained proper

records showing full

particulars,

including

quantitative details

and situation of

fixed assets.

Disclosure relating to physical verification and material discrepancies of fixed

assets

Textual information

(7) [See below]

Disclosure relating to fixed assets disposed off

As the Company

has disposed off, an

insignificant part of

the fixed assets

during the year,

provisions of clause

4 (i) (c) of the Order

are not applicable.

Disclosure in auditors report relating to inventories As given below

Disclosure of physical verification of inventories at fixed intervals

Textual information

(8) [See below]

Disclosure of procedure followed for physical verification of inventories

Textual information

(9) [See below]

Disclosure about maintenance of inventory records and material discrepancies

Textual information

(10) [See below]

Disclosure in auditors report relating to loans

Textual information

(11) [See below]

Disclosure in auditors report relating to internal control system

Textual information

(12) [See below]

Disclosure in auditors report relating to contracts and arrangements under

section 301 of companies act

Textual information

(13) [See below]

Disclosure relating to presence of register for necessary transactions Not Applicable

Disclosure relating to reasonability of transactions Not Applicable

Disclosure in auditors report relating to deposits accepted from public

Textual information

(14) [See below]

Disclosure in auditors report relating to companies internal audit system

Textual information

(15) [See below]

Disclosure in auditors report relating to maintenance of cost records

Textual information

(16) [See below]

Disclosure in auditors report relating to statutory dues As given below

Disclosure relating to regularity in payment of undisputed statutory dues

Textual information

(17) [See below]

Disclosure relating to disputed statutory dues

Textual information

(18) [See below]

Disclosure in auditors report relating to accumulated losses

The Net worth of

the Company as on

31.03.2014 is

completely eroded.

Further the

Company has

incurred cash losses

during current and

incurred cash losses

during immediately

preceding financial

year.

Disclosure in auditors report relating to default in repayment of financial dues

Textual information

(19) [See below]

Disclosure in auditors report relating to loans and advances granted by way

of pledge of shares debentures and other securities

Textual information

(20) [See below]](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-4-2048.jpg)

![5

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure in auditors report relating to provisions under special statute

In our opinion, the

Company is not a

chit fund or a

nidhi/mutual benefit

fund/society.

Therefore, the

provisions of clause

4(xiii) of the Order

are not applicable to

the Company.

Disclosure in auditors report relating to adequacy of records maintained by share

trading companies

Textual information

(21) [See below]

Disclosure in auditors report relating to guarantee given

Textual information

(22) [See below]

Disclosure in auditors report relating to term loans used for purpose other than

for purpose they were raised

According to the

information &

explanations given

to us, the Company

has not borrowed

any fund by way of

term loan.

Accordingly clause

(xvi) of paragraph 4

of the order is not

applicable.

Disclosure in auditors report relating to nature and amount of fund raised

for short-term has been used for long-term or vice versa

Textual information

(23) [See below]

Disclosure in auditors report relating to preferential allotment of shares

Textual information

(24) [See below]

Disclosure in auditors report relating to securities created against debentures

issued

As the Company

has not issued any

debentures,

provisions of clause

4(xix) of the Order

are not applicable.

Disclosure in auditors report relating to purpose and end use of money raised

through public issues

During the year,

since the Company

has not raised

money by way of

public issue,

provisions of clause

4(xx) of the Order

are not applicable.

Disclosure in auditors report relating to any material fraud reported during period

Textual information

(25) [See below]

Unless otherwise specified, all monetary values are in INR

01/04/2013

to

31/03/2014

Disclosure in auditor’s report explanatory [TextBlock]

Textual information (26)

[See below]

Whether companies auditors report order is applicable on company Yes

Whether auditors' report has been qualified or has any reservations or

contains adverse remarks

No

Textual information (7)

Disclosure relating to physical verification and material discrepancies of fixed assets

The fixed assets are physically verified by the management at reasonable intervals, in a phased verification-programme, which, in our

opinion, is reasonable, looking to the size of the Company and the nature of its business.

Textual information (8)

Disclosure of physical verification of inventories at fixed intervals

During the year, the inventories have been physically verified by the management, except for stocks lying with outside parties, which have,

however, been confirmed by them. In our opinion, the frequency of verification is reasonable.

Textual information (9)

Disclosure of procedure followed for physical verification of inventories

In our opinion and according to the information and explanation given to us, the procedures of physical verification of inventories followed

by the management are reasonable and adequate in relation to the size of the Company and the nature of its business.](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-5-2048.jpg)

![9

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Textual information (26)

Disclosure in auditor’s report explanatory [Text Block]

Independent Auditors’ Report

To the Members of PMC PROJECTS (INDIA) PRIVATE LIMITED

Report on the Financial Statements

We have audited the accompanying financial statements of PMC PROJECTS (INDIA) PRIVATE LIMITED (“the Company”), which

comprise the Balance Sheet as at March 31, 2014, and the Statement of Profit and Loss and Cash Flow Statement for the year then ended,

and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation of these financial statements that give a true and fair view of the financial position, financial

performance and cash flows of the Company in accordance with the Accounting Standards referred to in sub-section (3C) of section 211 of

the Companies Act, 1956 (“the Act”). This responsibility includes the design, implementation and maintenance of internal control relevant to

the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether

due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the

Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require that we comply with ethical

requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material

misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The

procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial

statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s

preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances. An

audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of the accounting estimates made by

management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion and to the best of our information and according to the explanations given to us, the financial statements give the information

required by the Act in the manner so required and give a true and fair view in conformity with the accounting principles generally accepted in

India:

a) in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 2014;](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-9-2048.jpg)

![11

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

[100100] Balance sheet

Unless otherwise specified, all monetary values are in INR

31/03/2014 31/03/2013

Balance sheet [Abstract]

Equity and liabilities [Abstract]

Shareholders' funds [Abstract]

Share capital 3,15,38,610 3,15,38,610

Reserves and surplus -102,93,93,317 -92,90,44,767

Total shareholders' funds -99,78,54,707 -89,75,06,157

Share application money pending allotment 0 0

Non-current liabilities [Abstract]

Long-term borrowings 0 0

Other long-term liabilities 0 27,38,85,423

Long-term provisions 83,72,322 3,14,38,114

Total non-current liabilities 83,72,322 30,53,23,537

Current liabilities [Abstract]

Short-term borrowings 775,43,24,014 150,00,00,000

Trade payables (A) 1,111,58,29,973 (B) 1,593,49,77,966

Other current liabilities 1,768,44,79,390 1,671,12,94,890

Short-term provisions 4,17,68,653 66,83,480

Total current liabilities 3,659,64,02,030 3,415,29,56,336

Total equity and liabilities 3,560,69,19,645 3,356,07,73,716

Assets [Abstract]

Non-current assets [Abstract]

Fixed assets [Abstract]

Tangible assets 18,60,81,454 22,64,19,475

Intangible assets 2,46,81,823 3,19,70,939

Total fixed assets 21,07,63,277 25,83,90,414

Non-current investments 0 0

Long-term loans and advances 27,27,94,869 93,64,11,870

Other non-current assets 0 95,62,65,930

Total non-current assets 48,35,58,146 215,10,68,214

Current assets [Abstract]

Current investments 0 13,50,09,373

Inventories 0 0

Trade receivables 2,870,79,22,540

(C) 2,740,31,93,763

Cash and bank balances 89,21,44,599 1,69,38,964

Short-term loans and advances 499,72,46,203 372,12,78,542

Other current assets 52,60,48,157 13,32,84,860

Total current assets 3,512,33,61,499 3,140,97,05,502

Total assets 3,560,69,19,645 3,356,07,73,716

Footnotes

(A) It includes Acceptances ( Short Term ) 9144048288 Trade payables - Others 1971781685 Discloser required under section 22 of

the Micro Small and Medium Enterprises Development Act 2006 Principal amount remaining unpaid to any supplier as at end of the

accounting year: Nil Interest due there on remaining unpaid to any supplier as at end of the accounting year : Nil The amount of

Interest paid along with amounts of the payment made to the supplier beyond the appointed day: Nil The amount of Interest due and

payable for the year: Nil The amount of Interest accrued and remaining unpaid at the end of the accounting year: Nil The amount of

further Interest due and payable even in the succeeding year, until such date when the interest dues as above are actually paid : Nil

(B) It includes Acceptances ( Short Term ) 10954467986 Trade payables - Others 4980509980 Discloser required under section 22

of the Micro Small and Medium Enterprises Development Act 2006 Principal amount remaining unpaid to any supplier as at end of

the accounting year: Nil Interest due there on remaining unpaid to any supplier as at end of the accounting year : Nil The amount of

Interest paid along with amounts of the payment made to the supplier beyond the appointed day: Nil The amount of Interest due and

payable for the year: Nil The amount of Interest accrued and remaining unpaid at the end of the accounting year: Nil The amount of

further Interest due and payable even in the succeeding year, until such date when the interest dues as above are actually paid : Nil

(C) Diffrence due to rounding off](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-11-2048.jpg)

![12

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

[400300] Disclosures - Signatories of balance sheet

Details of directors signing balance sheet [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Directors signing balance sheet [Axis] 1 2

01/04/2013

to

31/03/2014

01/04/2013

to

31/03/2014

Details of signatories of balance sheet [Abstract]

Details of directors signing balance sheet [Abstract]

Details of directors signing balance sheet [LineItems]

Name of director signing balance sheet [Abstract]

First name of director Pijush Phani Kumar

Middle name of director Venkata

Last name of director Bhattacharjee Uppalapati

Designation of director Director Director

Director identification number of director 06954903 02492898

Date of signing of balance sheet by director 30/08/2014 30/08/2014](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-12-2048.jpg)

![13

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

[100400] Cash flow statement, indirect

Unless otherwise specified, all monetary values are in INR

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

31/03/2012

Statement of cash flows [Abstract]

Cash flows from used in operating activities [Abstract]

Profit before extraordinary items and tax -10,03,48,551 -35,21,47,735

Adjustments for reconcile profit (loss) [Abstract]

Adjustments to profit (loss) [Abstract]

Adjustments for depreciation and amortisation expense 6,57,83,587 5,77,12,962

Adjustments for unrealised foreign exchange losses gains 44,43,82,870 96,64,344

Other adjustments for non-cash items (A) -61,47,482 (B) -1,26,30,130

Total adjustments to profit (loss) 50,40,18,975 5,47,47,176

Adjustments for working capital [Abstract]

Adjustments for decrease (increase) in inventories 0 3,99,12,107

Adjustments for decrease (increase) in trade receivables -130,55,77,648 -1,018,44,19,035

Adjustments for decrease (increase) in other current and

non-current assets (C) 68,01,91,417 (D) 40,09,48,550

Adjustments for increase (decrease) in trade payables -455,11,33,363 1,228,21,69,701

Total adjustments for working capital -517,65,19,594 253,86,11,323

Total adjustments for reconcile profit (loss) -467,25,00,619 259,33,58,499

Net cash flows from (used in) operations -477,28,49,170 224,12,10,764

Dividends received 0 -1,26,33,778

Interest paid 59,82,01,027 21,93,32,435

Interest received 70,10,05,314 1,60,63,166

Income taxes (paid) refund -88,40,88,326 85,68,92,958

Net cash flows from (used in) operating activities before extraordinary

items

-378,59,56,557 116,84,14,759

Net cash flows from (used in) operating activities -378,59,56,557 116,84,14,759

Cash flows from used in investing activities [Abstract]

Other cash receipts from sales of equity or debt instruments of other

entities (E) 247,72,92,895 (F) 2,040,15,74,352

Other cash payments to acquire equity or debt instruments of other

entities (G) 234,22,83,522 (H) 2,052,58,06,462

Proceeds from sales of tangible assets 3,19,914 1,98,000

Purchase of tangible assets 1,87,20,012 6,45,25,142

Dividends received 0 1,26,33,778

Interest received 60,43,61,987 23,09,99,025

Other inflows (outflows) of cash (I) -161,31,27,769 (J) -271,68,00,000

Net cash flows from (used in) investing activities before extraordinary

items

-89,21,56,507 -266,17,26,449

Net cash flows from (used in) investing activities -89,21,56,507 -266,17,26,449

Cash flows from used in financing activities [Abstract]

Proceeds from borrowings (K) 625,43,24,014 (L) 150,00,00,000

Interest paid (M) 70,10,05,315 (N) 1,60,63,166

Net cash flows from (used in) financing activities before extraordinary

items

555,33,18,699 148,39,36,834

Net cash flows from (used in) financing activities 555,33,18,699 148,39,36,834

Net increase (decrease) in cash and cash equivalents before effect of

exchange rate changes

87,52,05,635 -93,74,856

Net increase (decrease) in cash and cash equivalents 87,52,05,635 -93,74,856

Cash and cash equivalents cash flow statement at end of period 89,21,44,599 1,69,38,964 2,63,13,822](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-13-2048.jpg)

![14

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Footnotes

(A) It includes Profit sale of Investment (6160960) Liabilities no longer required w/back (230171) Profit & Loss on Sale of Fixed

Assets ( Net ) 243648 Difference due to rounding off (Rs. 1)

(B) It includes Profit sale of Investment (11666591) Liabilities no longer required w/back (908091) Profit & Loss on Sale of Fixed

Assets ( Net ) (55451) Difference due to rounding off (Rs. 3)

(C) Loans & Advances

(D) Loans & Advances

(E) Sale of Investment

(F) Sale of Investment

(G) Purchase of Investment

(H) Purchase of Investment

(I) Loans to Inter Corporate Deposit ( Net )

(J) Loans to Inter Corporate Deposit ( Net )

(K) From Short Term Borrowings

(L) From Short Term Borrowings

(M) Interest & Other Financial Expenses Paid

(N) Interest & Other Financial Expenses Paid

[200100] Notes - Share capital

Disclosure of shareholding more than five per cent in company [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Classes of share capital [Axis] Equity shares [Member] Equity shares 1 [Member]

Name of shareholder [Axis] Shareholder 1 [Member] Shareholder 1 [Member]

31/03/2014 31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of shareholding more than five per cent in

company [Abstract]

Disclosure of shareholding more than five per cent

in company [LineItems]

Type of share Equity Equity

Name of shareholder

PMC Infra

Ltd(Formerly

known as Gudami

International (

Mauritius ) Ltd.

PMC Infra

Ltd(Formerly known

as Gudami

International (

Mauritius ) Ltd.

Country of incorporation or residence of

shareholder

MAURITIUS MAURITIUS

Number of shares held in company [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Percentage of shareholding in company 100.00% 100.00%](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-14-2048.jpg)

![15

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of classes of share capital [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Classes of share capital [Axis] Share capital [Member] Equity shares [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of classes of share capital [Abstract]

Disclosure of classes of share capital [LineItems]

Number of shares authorised [shares] 35,00,000 [shares] 35,00,000 [shares] 35,00,000 [shares] 35,00,000

Value of shares authorised 3,50,00,000 3,50,00,000 3,50,00,000 3,50,00,000

Number of shares issued [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Value of shares issued 3,15,38,610 3,15,38,610 3,15,38,610 3,15,38,610

Number of shares subscribed and fully paid [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Value of shares subscribed and fully paid 3,15,38,610 3,15,38,610 3,15,38,610 3,15,38,610

Number of shares subscribed but not fully paid [shares] 0 [shares] 0 [shares] 0 [shares] 0

Value of shares subscribed but not fully paid 0 0 0 0

Total number of shares subscribed [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Total value of shares subscribed 3,15,38,610 3,15,38,610 3,15,38,610 3,15,38,610

Value of shares paid-up [Abstract]

Number of shares paid-up [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Value of shares called 3,15,38,610 3,15,38,610 3,15,38,610 3,15,38,610

Calls unpaid [Abstract]

Calls unpaid by directors and officers

[Abstract]

Calls unpaid by directors 0 0 0 0

Calls unpaid by officers 0 0 0 0

Total calls unpaid by directors and

officers

0 0 0 0

Calls unpaid by others 0 0 0 0

Total calls unpaid 0 0 0 0

Forfeited shares 0 0 0 0

Forfeited shares reissued 0 0 0 0

Value of shares paid-up 3,15,38,610 3,15,38,610 3,15,38,610 3,15,38,610

Reconciliation of number of shares outstanding

[Abstract]

Changes in number of shares outstanding

[Abstract]

Increase in number of shares outstanding

[Abstract]

Number of shares issued in public offering [shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares issued as bonus shares [shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares issued as rights [shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares issued in private

placement

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares issued as preferential

allotment

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares allotted for

contracts without payment received

in cash

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares issued under scheme of

amalgamation

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of other issues of shares [shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares arising out of

conversion of securities

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Total aggregate number of shares issued

during period

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Decrease in number of shares during period

[Abstract]

Number of shares bought back [shares] 0 [shares] 0 [shares] 0 [shares] 0

Other decrease in number of shares [shares] 0 [shares] 0 [shares] 0 [shares] 0

Total decrease in number of shares during

period

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Total increase (decrease) in number of

shares outstanding

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Number of shares outstanding at end of period [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Reconciliation of value of shares outstanding

[Abstract]

Changes in share capital [Abstract]

Increase in share capital during period

[Abstract]

Amount of public issue during period 0 0 0 0](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-15-2048.jpg)

![16

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Amount of bonus issue during period 0 0 0 0

Amount of rights issue during period 0 0 0 0

Amount of private placement issue during

period

0 0 0 0

Amount of preferential allotment issue

during period

0 0 0 0

Amount of issue allotted for

contracts without payment

received in cash during period

0 0 0 0

Amount of issue under scheme of

amalgamation during period

0 0 0 0

Amount of other issues during period 0 0 0 0

Amount of issue arising out of

conversion of securities during

period

0 0 0 0

Total aggregate amount of increase in

share capital during period

0 0 0 0

Decrease in share capital during period

[Abstract]

Decrease in amount of shares bought back 0 0 0 0

Other decrease in amount of shares 0 0 0 0

Total decrease in share capital during

period

0 0 0 0

Total increase (decrease) in share capital 0 0 0 0

Share capital at end of period 3,15,38,610 3,15,38,610 3,15,38,610 3,15,38,610

Rights preferences and restrictions attaching

to class of share capital

Textual information

(27) [See below]

Textual information

(28) [See below]

Textual information

(29) [See below]

Textual information

(30) [See below]

Shares in company held by holding company or

ultimate holding company or by its subsidiaries

or associates [Abstract]

Shares in company held by holding company [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Shares in company held by ultimate holding

company

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Shares in company held by subsidiaries of its

holding company

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Shares in company held by subsidiaries of its

ultimate holding company

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Shares in company held by associates of its

holding company

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Shares in company held by associates of its

ultimate holding company

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Total shares in company held by holding company

or ultimate holding company or by its

subsidiaries or associates

[shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861 [shares] 31,53,861

Shares reserved for issue under options

and contracts or commitments for sale of

shares or disinvestment

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Amount of shares reserved for issue under options

and contracts or commitments for sale of shares or

disinvestment

0 0 0 0

Aggregate number of fully paid-up shares

issued pursuant to contracts without

payment being received in cash

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Aggregate number of fully paid-up shares

issued by way of bonus shares

[shares] 0 [shares] 0 [shares] 0 [shares] 0

Aggregate number of shares bought back [shares] 0 [shares] 0 [shares] 0 [shares] 0

Original paid-up value of forfeited shares 0 0 0 0

Details of application money received for

allotment of securities and due for refund and

interest accrued thereon [Abstract]

Application money received for allotment of

securities and due for refund and interest

accrued thereon [Abstract]

Application money received for

allotment of securities and due for

refund, principal

0 0 0 0

Application money received for

allotment of securities and due for

refund, interest accrued

0 0 0 0

Total application money received for

allotment of securities and due for refund

and interest accrued thereon

0 0 0 0

Number of shares proposed to be issued [shares] 0 [shares] 0 [shares] 0 [shares] 0

Share premium for shares to be allotted 0 0 0 0](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-16-2048.jpg)

![17

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of classes of share capital [Table] ..(2)

Unless otherwise specified, all monetary values are in INR

Classes of share capital [Axis] Equity shares 1 [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of classes of share capital [Abstract]

Disclosure of classes of share capital [LineItems]

Type of share Equity Equity

Number of shares authorised [shares] 35,00,000 [shares] 35,00,000

Value of shares authorised 3,50,00,000 3,50,00,000

Number of shares issued [shares] 31,53,861 [shares] 31,53,861

Value of shares issued 3,15,38,610 3,15,38,610

Number of shares subscribed and fully paid [shares] 31,53,861 [shares] 31,53,861

Value of shares subscribed and fully paid 3,15,38,610 3,15,38,610

Number of shares subscribed but not fully paid [shares] 0 [shares] 0

Value of shares subscribed but not fully paid 0 0

Total number of shares subscribed [shares] 31,53,861 [shares] 31,53,861

Total value of shares subscribed 3,15,38,610 3,15,38,610

Value of shares paid-up [Abstract]

Number of shares paid-up [shares] 31,53,861 [shares] 31,53,861

Value of shares called 3,15,38,610 3,15,38,610

Calls unpaid [Abstract]

Calls unpaid by directors and officers [Abstract]

Calls unpaid by directors 0 0

Calls unpaid by officers 0 0

Total calls unpaid by directors and officers 0 0

Calls unpaid by others 0 0

Total calls unpaid 0 0

Forfeited shares 0 0

Forfeited shares reissued 0 0

Value of shares paid-up 3,15,38,610 3,15,38,610

Par value per share [INR/shares] 10 [INR/shares] 10

Details of shares not fully called [Abstract]

Amount per share called [INR/shares] 0 [INR/shares] 0

Reconciliation of number of shares outstanding [Abstract]

Changes in number of shares outstanding [Abstract]

Increase in number of shares outstanding [Abstract]

Number of shares issued in public offering [shares] 0 [shares] 0

Number of shares issued as bonus shares [shares] 0 [shares] 0

Number of shares issued as rights [shares] 0 [shares] 0

Number of shares issued in private placement [shares] 0 [shares] 0

Number of shares issued as preferential allotment [shares] 0 [shares] 0

Number of shares allotted for contracts without payment received in cash [shares] 0 [shares] 0

Number of shares issued under scheme of amalgamation [shares] 0 [shares] 0

Number of other issues of shares [shares] 0 [shares] 0

Number of shares arising out of conversion of securities [shares] 0 [shares] 0

Total aggregate number of shares issued during period [shares] 0 [shares] 0

Decrease in number of shares during period [Abstract]

Number of shares bought back [shares] 0 [shares] 0

Other decrease in number of shares [shares] 0 [shares] 0

Total decrease in number of shares during period [shares] 0 [shares] 0

Total increase (decrease) in number of shares outstanding [shares] 0 [shares] 0

Number of shares outstanding at end of period [shares] 31,53,861 [shares] 31,53,861

Reconciliation of value of shares outstanding [Abstract]

Changes in share capital [Abstract]

Increase in share capital during period [Abstract]

Amount of public issue during period 0 0

Amount of bonus issue during period 0 0

Amount of rights issue during period 0 0

Amount of private placement issue during period 0 0

Amount of preferential allotment issue during period 0 0

Amount of issue allotted for contracts without payment received in cash

during period

0 0

Amount of issue under scheme of amalgamation during period 0 0

Amount of other issues during period 0 0

Amount of issue arising out of conversion of securities during period 0 0

Total aggregate amount of increase in share capital during period 0 0](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-17-2048.jpg)

![18

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Decrease in share capital during period [Abstract]

Decrease in amount of shares bought back 0 0

Other decrease in amount of shares 0 0

Total decrease in share capital during period 0 0

Total increase (decrease) in share capital 0 0

Share capital at end of period 3,15,38,610 3,15,38,610

Rights preferences and restrictions attaching to class of share capital

Textual information

(31) [See below]

Textual information

(32) [See below]

Shares in company held by holding company or ultimate holding company or by its

subsidiaries or associates [Abstract]

Shares in company held by holding company [shares] 31,53,861 [shares] 31,53,861

Shares in company held by ultimate holding company [shares] 0 [shares] 0

Shares in company held by subsidiaries of its holding company [shares] 0 [shares] 0

Shares in company held by subsidiaries of its ultimate holding company [shares] 0 [shares] 0

Shares in company held by associates of its holding company [shares] 0 [shares] 0

Shares in company held by associates of its ultimate holding company [shares] 0 [shares] 0

Total shares in company held by holding company or ultimate holding company

or by its subsidiaries or associates

[shares] 31,53,861 [shares] 31,53,861

Shares reserved for issue under options and contracts or commitments for sale of

shares or disinvestment

[shares] 0 [shares] 0

Amount of shares reserved for issue under options and contracts or commitments

for sale of shares or disinvestment

0 0

Aggregate number of fully paid-up shares issued pursuant to contracts without

payment being received in cash

[shares] 0 [shares] 0

Aggregate number of fully paid-up shares issued by way of bonus shares [shares] 0 [shares] 0

Aggregate number of shares bought back [shares] 0 [shares] 0

Original paid-up value of forfeited shares 0 0

Details of application money received for allotment of securities and due for

refund and interest accrued thereon [Abstract]

Application money received for allotment of securities and due for refund and

interest accrued thereon [Abstract]

Application money received for allotment of securities and due for refund,

principal

0 0

Application money received for allotment of securities and due for refund,

interest accrued

0 0

Total application money received for allotment of securities and due for

refund and interest accrued thereon

0 0

Number of shares proposed to be issued [shares] 0 [shares] 0

Share premium for shares to be allotted 0 0

Unless otherwise specified, all monetary values are in INR

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of notes on share capital explanatory [TextBlock]

Whether there are any shareholders holding more than five per cent

shares in company

Yes Yes

Whether money raised from public offering during year No No

Textual information (27)

Rights preferences and restrictions attaching to class of share capital

The Company has only one class of equity shares having par value of Rs. 10 per share. Each holder of equity shares is entitled to one vote per

share. The Company declares and pays dividends in Indian rupees. The dividend if proposed by the Board of Directors is subject to the

approval of the shareholders in the ensuing Annual General Meeting. In the event of liquidation of the Company, the holders of equity shares

will be entitled to receive remaining assets of the Company, after distribution of all preferential amounts.

Textual information (28)

Rights preferences and restrictions attaching to class of share capital

The Company has only one class of equity shares having par value of Rs. 10 per share. Each holder of equity shares is entitled to one vote per

share. The Company declares and pays dividends in Indian rupees. The dividend if proposed by the Board of Directors is subject to the

approval of the shareholders in the ensuing Annual General Meeting. In the event of liquidation of the Company, the holders of equity shares

will be entitled to receive remaining assets of the Company, after distribution of all preferential amounts.](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-18-2048.jpg)

![19

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Textual information (29)

Rights preferences and restrictions attaching to class of share capital

The Company has only one class of equity shares having par value of Rs. 10 per share. Each holder of equity shares is entitled to one vote per

share. The Company declares and pays dividends in Indian rupees. The dividend if proposed by the Board of Directors is subject to the

approval of the shareholders in the ensuing Annual General Meeting. In the event of liquidation of the Company, the holders of equity shares

will be entitled to receive remaining assets of the Company, after distribution of all preferential amounts.

Textual information (30)

Rights preferences and restrictions attaching to class of share capital

The Company has only one class of equity shares having par value of Rs. 10 per share. Each holder of equity shares is entitled to one vote per

share. The Company declares and pays dividends in Indian rupees. The dividend if proposed by the Board of Directors is subject to the

approval of the shareholders in the ensuing Annual General Meeting. In the event of liquidation of the Company, the holders of equity shares

will be entitled to receive remaining assets of the Company, after distribution of all preferential amounts.

Textual information (31)

Rights preferences and restrictions attaching to class of share capital

The Company has only one class of equity shares having par value of Rs. 10 per share. Each holder of equity shares is entitled to one vote per

share. The Company declares and pays dividends in Indian rupees. The dividend if proposed by the Board of Directors is subject to the

approval of the shareholders in the ensuing Annual General Meeting. In the event of liquidation of the Company, the holders of equity shares

will be entitled to receive remaining assets of the Company, after distribution of all preferential amounts.

Textual information (32)

Rights preferences and restrictions attaching to class of share capital

The Company has only one class of equity shares having par value of Rs. 10 per share. Each holder of equity shares is entitled to one vote per

share. The Company declares and pays dividends in Indian rupees. The dividend if proposed by the Board of Directors is subject to the

approval of the shareholders in the ensuing Annual General Meeting. In the event of liquidation of the Company, the holders of equity shares

will be entitled to receive remaining assets of the Company, after distribution of all preferential amounts.

[200200] Notes - Reserves and surplus

Statement of changes in reserves [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Components of reserves [Axis] Reserves [Member] Surplus [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Statement of changes in reserves [Abstract]

Statement of changes in reserves [LineItems]

Changes in reserves [Abstract]

Additions to reserves [Abstract]

Profit (loss) for period -10,03,48,550 -35,21,47,735 -10,03,48,550 -35,21,47,735

Total additions to reserves -10,03,48,550 -35,21,47,735 -10,03,48,550 -35,21,47,735

Total changes in reserves -10,03,48,550 -35,21,47,735 -10,03,48,550 -35,21,47,735

Reserves at end of period -102,93,93,317 -92,90,44,767 -102,93,93,317 -92,90,44,767

Statement of changes in reserves [Table] ..(2)

Unless otherwise specified, all monetary values are in INR

Components of reserves [Axis] Surplus [Member]

31/03/2012

Statement of changes in reserves [Abstract]

Statement of changes in reserves [LineItems]

Reserves at end of period -57,68,97,032](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-19-2048.jpg)

![20

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

[200300] Notes - Borrowings

Classification of borrowings [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Classification based on time period [Axis] Short-term [Member]

Classification of borrowings [Axis] Borrowings [Member]

Subclassification of borrowings [Axis] Secured borrowings [Member] Unsecured borrowings [Member]

31/03/2014 31/03/2013 31/03/2014 31/03/2013

Borrowings notes [Abstract]

Details of borrowings [Abstract]

Details of borrowings [LineItems]

Borrowings 71,90,97,538 0 703,52,26,476 150,00,00,000

Classification of borrowings [Table] ..(2)

Unless otherwise specified, all monetary values are in INR

Classification based on time period [Axis] Short-term [Member]

Classification of borrowings [Axis]

Working capital loans from banks

[Member]

Deposits [Member]

Subclassification of borrowings [Axis] Secured borrowings [Member] Unsecured borrowings [Member]

31/03/2014 31/03/2013 31/03/2014 31/03/2013

Borrowings notes [Abstract]

Details of borrowings [Abstract]

Details of borrowings [LineItems]

Borrowings (A) 71,90,97,538 0 703,52,26,476 150,00,00,000

Footnotes

(A) Secured by pledge of Fixed Deposit

Classification of borrowings [Table] ..(3)

Unless otherwise specified, all monetary values are in INR

Classification based on time period [Axis] Short-term [Member]

Classification of borrowings [Axis] Intercorporate deposits [Member]

Subclassification of borrowings [Axis] Unsecured borrowings [Member]

31/03/2014 31/03/2013

Borrowings notes [Abstract]

Details of borrowings [Abstract]

Details of borrowings [LineItems]

Borrowings 703,52,26,476 150,00,00,000](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-20-2048.jpg)

![21

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

[201000] Notes - Tangible assets

Disclosure of tangible assets [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Company total tangible assets [Member]

Sub classes of tangible assets [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

1,10,45,999 3,59,22,959 1,10,45,999 3,59,22,959

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -5,14,07,776 -5,20,97,997 5,14,07,776 5,20,97,997

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

5,63,563 1,42,549 30,16,228 5,24,573 24,52,665 3,82,024

Total disposals tangible

assets

5,63,563 1,42,549 30,16,228 5,24,573 24,52,665 3,82,024

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

5,87,319 0 1,02,55,271 0 96,67,952 0

Total other adjustments

tangible assets

5,87,319 0 1,02,55,271 0 96,67,952 0

Total changes in tangible

assets

-4,03,38,021 -1,63,17,587 1,82,85,042 3,53,98,386 5,86,23,063 5,17,15,973

Tangible assets at end of period 18,60,81,454 22,64,19,475 54,05,51,821 52,22,66,779 35,44,70,367 29,58,47,304](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-21-2048.jpg)

![22

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(2)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Company total tangible assets [Member]

Sub classes of tangible assets [Axis] Owned assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

1,10,45,999 3,59,22,959 1,10,45,999 3,59,22,959

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -5,14,07,776 -5,20,97,997 5,14,07,776 5,20,97,997

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

5,63,563 1,42,549 30,16,228 5,24,573 24,52,665 3,82,024

Total disposals tangible

assets

5,63,563 1,42,549 30,16,228 5,24,573 24,52,665 3,82,024

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

5,87,319 0 1,02,55,271 0 96,67,952 0

Total other adjustments

tangible assets

5,87,319 0 1,02,55,271 0 96,67,952 0

Total changes in tangible

assets

-4,03,38,021 -1,63,17,587 1,82,85,042 3,53,98,386 5,86,23,063 5,17,15,973

Tangible assets at end of period 18,60,81,454 22,64,19,475 54,05,51,821 52,22,66,779 35,44,70,367 29,58,47,304](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-22-2048.jpg)

![23

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(3)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Buildings [Member]

Sub classes of tangible assets [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

5,63,750 0 5,63,750 0

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -7,16,767 -1,19,291 7,16,767 1,19,291

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

0 0 0 0 0 0

Total disposals tangible

assets

0 0 0 0 0 0

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

0 0 0 0 0 0

Total other adjustments

tangible assets

0 0 0 0 0 0

Total changes in tangible

assets

-1,53,017 -1,19,291 5,63,750 0 7,16,767 1,19,291

Tangible assets at end of period 21,13,514 22,66,531 49,15,455 43,51,705 28,01,941 20,85,174](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-23-2048.jpg)

![24

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(4)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Buildings [Member]

Sub classes of tangible assets [Axis] Owned assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

5,63,750 0 5,63,750 0

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -7,16,767 -1,19,291 7,16,767 1,19,291

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

0 0 0 0 0 0

Total disposals tangible

assets

0 0 0 0 0 0

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

0 0 0 0 0 0

Total other adjustments

tangible assets

0 0 0 0 0 0

Total changes in tangible

assets

-1,53,017 -1,19,291 5,63,750 0 7,16,767 1,19,291

Tangible assets at end of period 21,13,514 22,66,531 49,15,455 43,51,705 28,01,941 20,85,174](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-24-2048.jpg)

![25

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(5)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Office building [Member]

Sub classes of tangible assets [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

5,63,750 0 5,63,750 0

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -7,16,767 -1,19,291 7,16,767 1,19,291

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

0 0 0 0 0 0

Total disposals tangible

assets

0 0 0 0 0 0

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

0 0 0 0 0 0

Total other adjustments

tangible assets

0 0 0 0 0 0

Total changes in tangible

assets

-1,53,017 -1,19,291 5,63,750 0 7,16,767 1,19,291

Tangible assets at end of period 21,13,514 22,66,531 49,15,455 43,51,705 28,01,941 20,85,174](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-25-2048.jpg)

![26

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(6)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Office building [Member]

Sub classes of tangible assets [Axis] Owned assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

5,63,750 0 5,63,750 0

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -7,16,767 -1,19,291 7,16,767 1,19,291

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

0 0 0 0 0 0

Total disposals tangible

assets

0 0 0 0 0 0

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

0 0 0 0 0 0

Total other adjustments

tangible assets

0 0 0 0 0 0

Total changes in tangible

assets

-1,53,017 -1,19,291 5,63,750 0 7,16,767 1,19,291

Tangible assets at end of period 21,13,514 22,66,531 49,15,455 43,51,705 28,01,941 20,85,174](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-26-2048.jpg)

![27

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(7)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Plant and equipment [Member]

Sub classes of tangible assets [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

0 0 0 0

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -45,20,689 -52,65,435 45,20,689 52,65,435

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

1,41,214 0 3,84,095 0 2,42,881 0

Total disposals tangible

assets

1,41,214 0 3,84,095 0 2,42,881 0

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

0 0 0 0 0 0

Total other adjustments

tangible assets

0 0 0 0 0 0

Total changes in tangible

assets

-46,61,903 -52,65,435 -3,84,095 0 42,77,808 52,65,435

Tangible assets at end of period 2,79,26,260 3,25,88,163 8,29,63,400 8,33,47,495 5,50,37,140 5,07,59,332](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-27-2048.jpg)

![28

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(8)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Plant and equipment [Member]

Sub classes of tangible assets [Axis] Owned assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

0 0 0 0

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -45,20,689 -52,65,435 45,20,689 52,65,435

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

1,41,214 0 3,84,095 0 2,42,881 0

Total disposals tangible

assets

1,41,214 0 3,84,095 0 2,42,881 0

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

0 0 0 0 0 0

Total other adjustments

tangible assets

0 0 0 0 0 0

Total changes in tangible

assets

-46,61,903 -52,65,435 -3,84,095 0 42,77,808 52,65,435

Tangible assets at end of period 2,79,26,260 3,25,88,163 8,29,63,400 8,33,47,495 5,50,37,140 5,07,59,332](https://image.slidesharecdn.com/pmcprojects2014annualreport1-230124000441-cc38b1a8/75/PMC-Projects-2014-Annual-Report-pdf-28-2048.jpg)

![29

Pmc Projects (India) Private Limited Standalone Balance Sheet for period 01/04/2013 to 31/03/2014

Disclosure of tangible assets [Table] ..(9)

Unless otherwise specified, all monetary values are in INR

Classes of tangible assets [Axis] Furniture and fixtures [Member]

Sub classes of tangible assets [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and

gross carrying amount [Axis]

Carrying amount [Member]

Gross carrying amount

[Member]

Accumulated depreciation and

impairment [Member]

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

01/04/2013

to

31/03/2014

01/04/2012

to

31/03/2013

Disclosure of tangible assets [Abstract]

Disclosure of tangible assets

[LineItems]

Reconciliation of changes in

tangible assets [Abstract]

Changes in tangible assets

[Abstract]

Additions other than through

business combinations tangible

assets

7,15,674 4,50,598 7,15,674 4,50,598

Acquisitions through

business combinations

tangible assets

0 0 0 0

Depreciation tangible assets -21,32,881 -19,88,831 21,32,881 19,88,831

Impairment loss

recognised in profit or

loss tangible assets

0 0 0 0

Reversal of impairment loss

recognised in profit or loss

tangible assets

0 0 0 0

Revaluation increase

(decrease) tangible assets

0 0 0 0

Disposals tangible assets

[Abstract]

Disposals tangible assets

through demergers

0 0 0 0 0 0

Disposals tangible assets,

others

0 0 0 0 0 0

Total disposals tangible

assets

0 0 0 0 0 0

Other adjustments tangible

assets [Abstract]

Increase (decrease) through

net exchange differences

tangible assets

0 0 0 0

Other adjustments tangible

assets, others

-1,36,113 0 -4,32,137 0 -2,96,024 0

Total other adjustments

tangible assets

-1,36,113 0 -4,32,137 0 -2,96,024 0

Total changes in tangible

assets