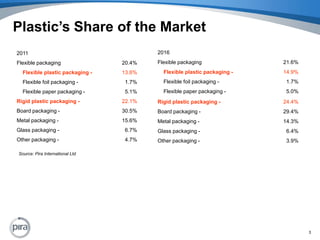

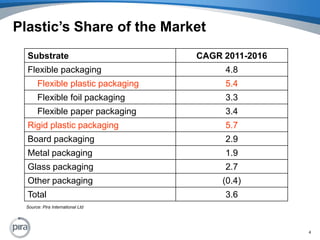

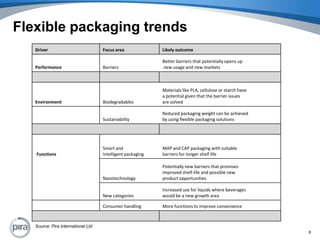

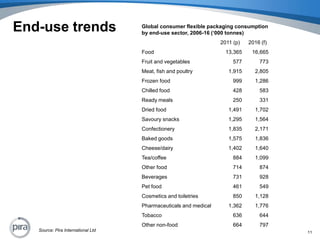

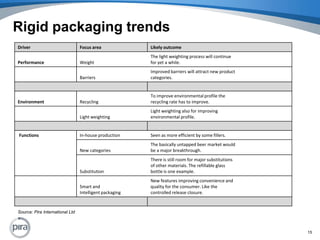

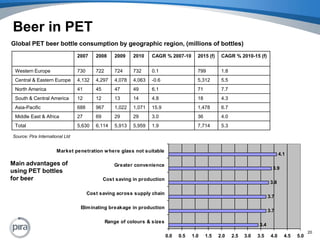

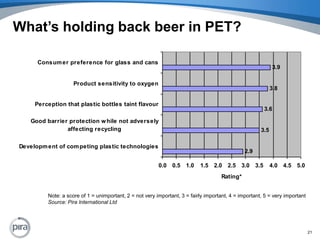

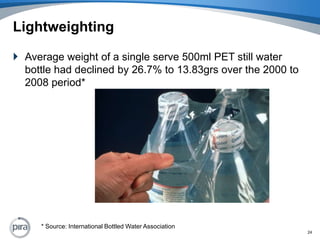

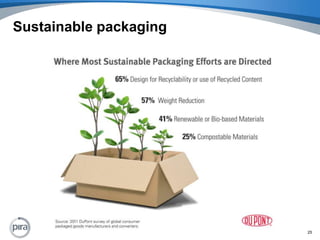

Pira International forecasts growth in plastic packaging, especially flexible plastic packaging and bioplastics. Flexible plastic packaging is replacing materials like metal, glass, and rigid plastics in applications like meat and produce due to properties like low cost and weight. Bioplastics are increasing for food service items and film. Beer companies are interested in PET bottles but consumer acceptance remains uncertain. Overall plastic packaging growth is predicted to outpace other materials due to properties, new markets, and developing economies, though recycling and sustainability issues persist.