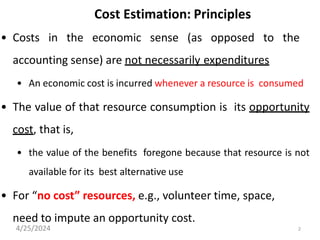

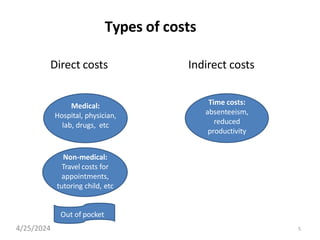

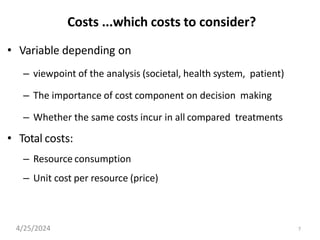

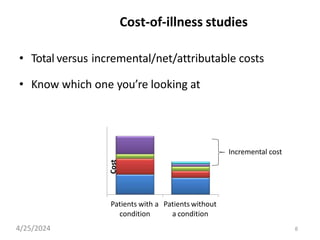

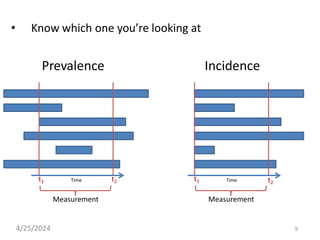

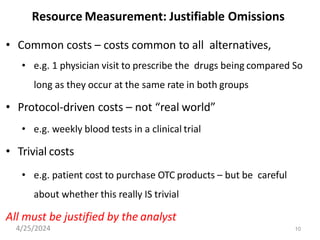

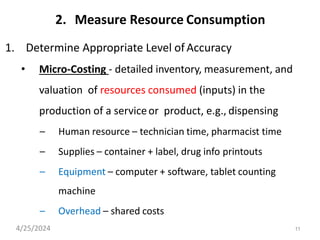

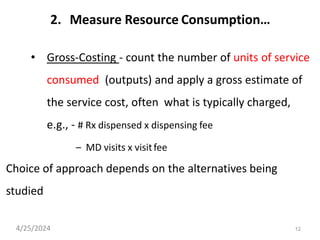

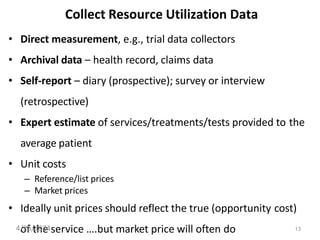

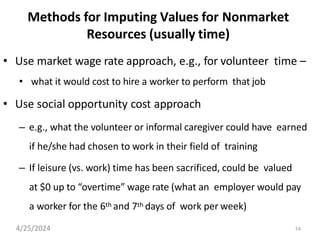

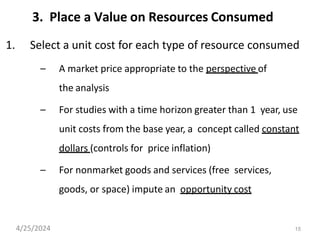

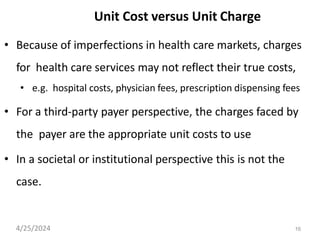

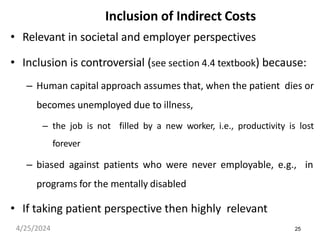

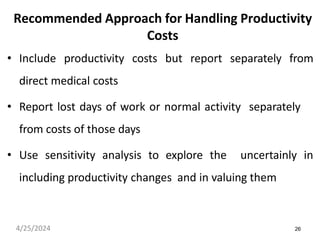

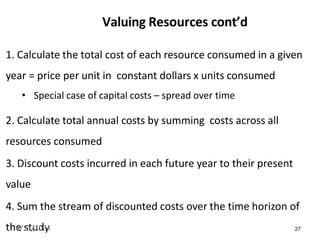

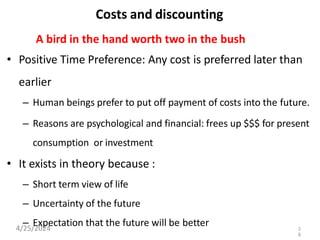

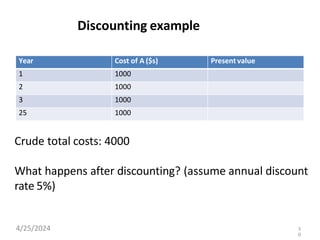

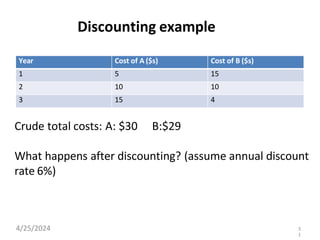

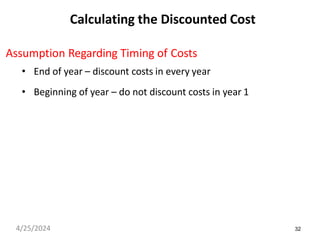

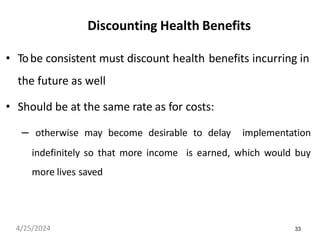

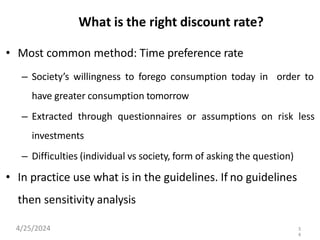

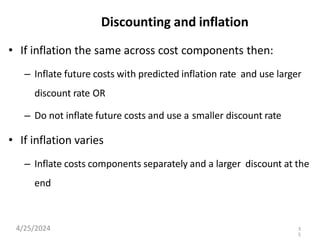

The document outlines principles and methodologies for cost estimation in the context of healthcare, emphasizing the importance of opportunity costs and resource consumption. It discusses various types of costs, perspectives for analysis, and methods for accurately measuring and valuating resources, including considerations for capital and indirect costs. Additionally, it addresses discounting costs and benefits over time, providing frameworks for making cost analyses relevant and actionable.