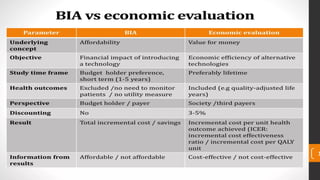

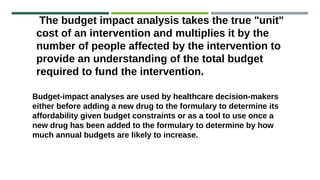

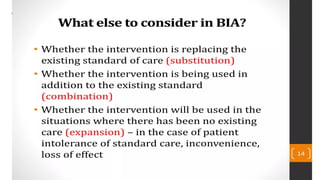

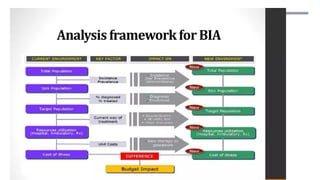

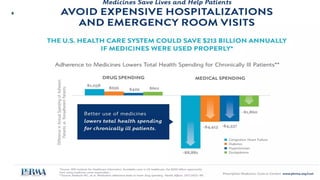

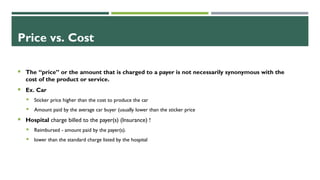

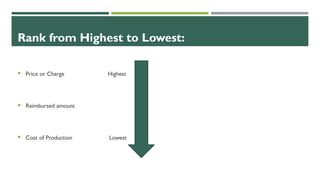

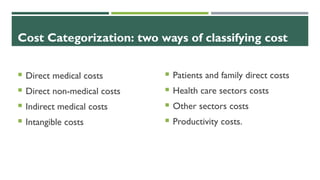

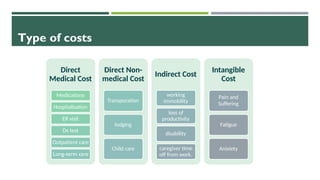

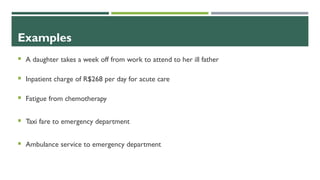

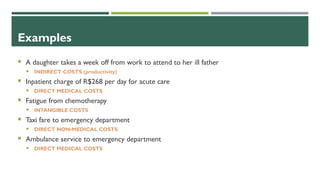

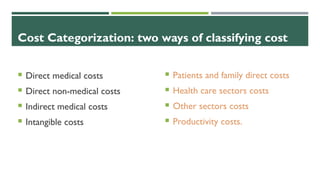

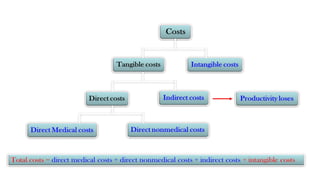

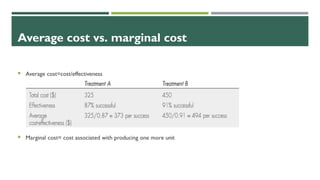

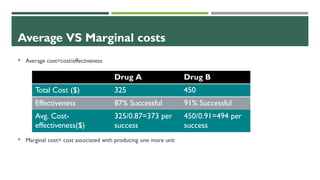

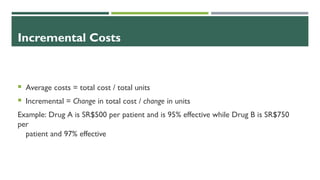

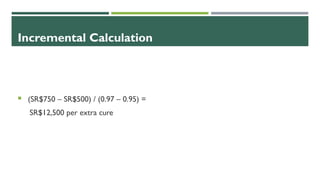

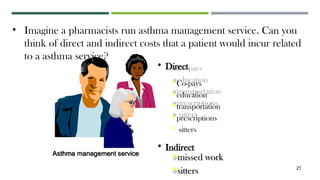

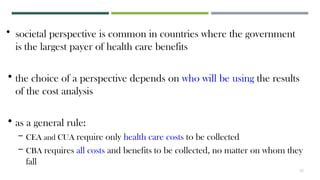

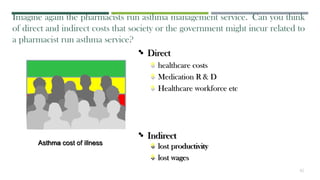

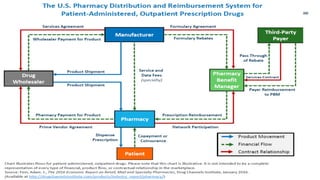

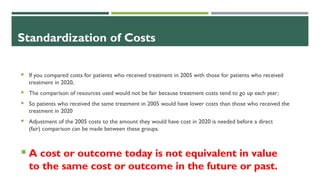

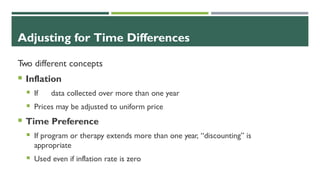

The document discusses the increasing global health spending due to demographic changes and costly health technologies, emphasizing the need for efficient resource allocation to control costs. It categorizes different types of health-related costs, including direct medical, non-medical, indirect, and intangible costs, and highlights the importance of measuring costs from various perspectives (patient, provider, payer, and society). Also addressed are methodologies for cost analysis, timing adjustments for costs, and the role of budget impact analyses in understanding the financial implications of new health technologies.

![Scarcity is the fundamental economic

problem that forces consumers and

producers to use resources wisely.

Unlimited Wants

NIPH & PNIPH – Budget Impact Analysis 57

Limit resources

Scarcity

Choices

For whom

to make it

What to

make

How to

make it

How does the concept of scarcity

apply to healthcare?

The fundamental economic problem

Recap

Sl ide from: Chola L, Heupink LF, Peacocke E, Sæterdal I (2020). Economic evaluation of public health interventions [PowerPoint

s l ides]. Norwegian Institute of Public Health, Oslo.](https://image.slidesharecdn.com/6costestimationpharm615-241003174648-d55dfc81/85/6-Cost-estimation-pharmcy-madtr-615-pptx-57-320.jpg)

![The ‘Health Economic’ problem

Recap

Unlimited healthcare “wants” with rapid growth in

health expenditure.

Insufficient health sector resources.

Choosing between ‘wants’ we can ‘afford’ given our

resource ‘budget’.

4

NIPH & PNIPH – Budget Impact Analysis

Sl ide from: Chola L, Heupink LF, Peacocke E, Sæterdal I (2020). Economic evaluation of public health interventions [PowerPoint

s l ides]. Norwegian Institute of Public Health, Os lo.

Sl ide from: Chola L, Heupink LF, Peacocke E, Sæterdal I (2020). Economic evaluation of public health interventions [PowerPoint

s l ides]. Norwegian Institute of Public Health, Oslo.](https://image.slidesharecdn.com/6costestimationpharm615-241003174648-d55dfc81/85/6-Cost-estimation-pharmcy-madtr-615-pptx-58-320.jpg)

![How HTA can inform policy and priorities

BIA can be a part of an HTA to inform on the financial impact of a ‘new’ intervention

Financial and non-financial

levers for quality improvement

Quality

standards

Clinical

guidelines

and

pathways

HTA

Health technology assessment

(HTA) to compare clinical and cost-

effectiveness of different

interventions

Clinical guidelines and

pathways distilled from HTA and

other evidence

Quality standards and indicators

from evidence-based guidelines

Health benefits plans (HBPs), pay-for-

performance, other levers (regulation,

accreditation, education…)

Evidence

NIPH 2020 - Lithuania Workshop 6

Source: International Decision Support Initiative (iDSI)

Sl ide from: Chola L, Heupink LF, Peacocke E, Sæterdal I (2020). Economic evaluation of public health interventions [PowerPoint

s l ides]. Norwegian Institute of Public Health, Oslo.](https://image.slidesharecdn.com/6costestimationpharm615-241003174648-d55dfc81/85/6-Cost-estimation-pharmcy-madtr-615-pptx-59-320.jpg)