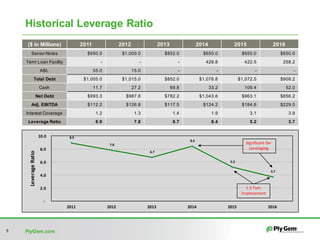

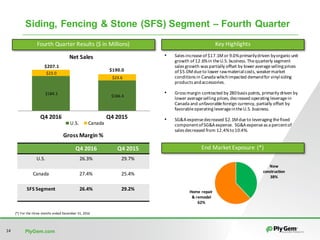

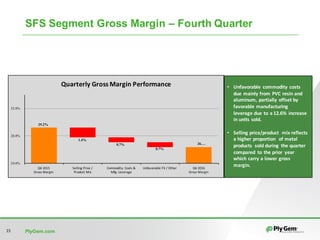

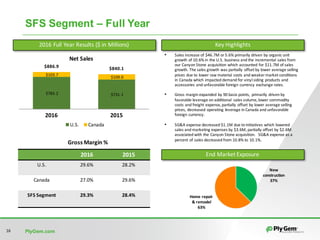

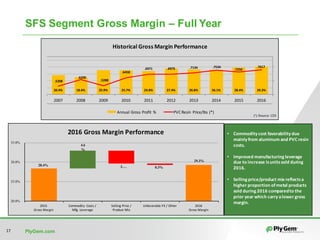

- The document provides an overview of Ply Gem's fourth quarter and full year 2016 financial results.

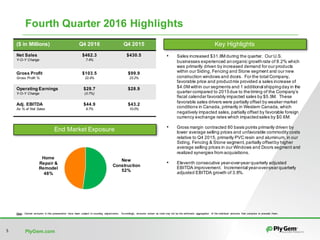

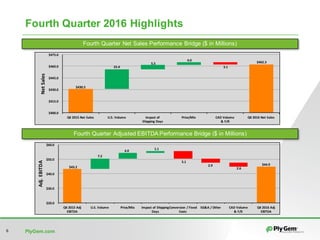

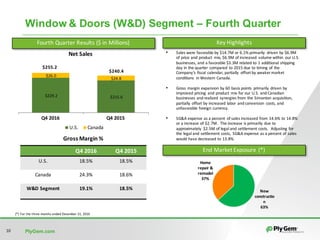

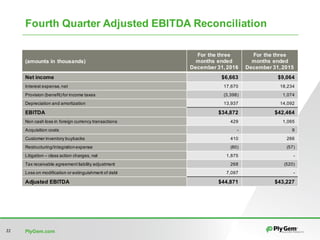

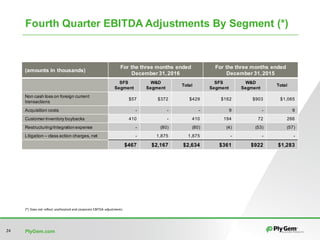

- In Q4 2016, net sales increased 7.4% to $462.3 million driven by organic growth in the US. Adjusted EBITDA increased 3.8% to $44.9 million.

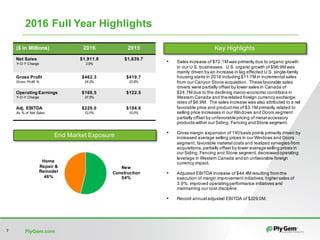

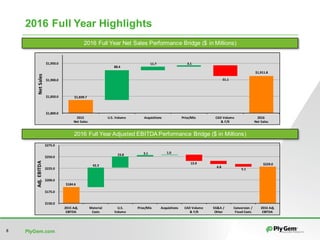

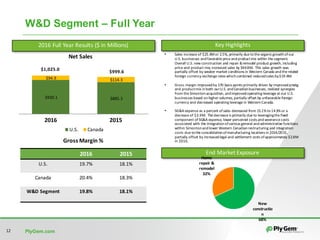

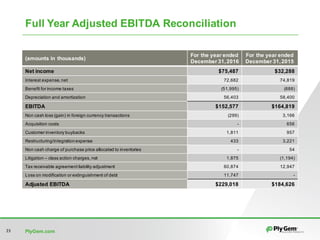

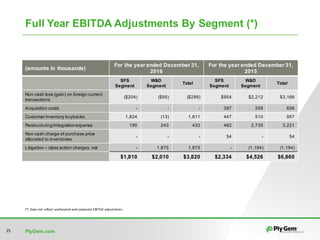

- For the full year 2016, net sales increased 3.9% to $1.91 billion and adjusted EBITDA increased 24.4% to a record $229 million due to execution of margin initiatives and cost discipline.