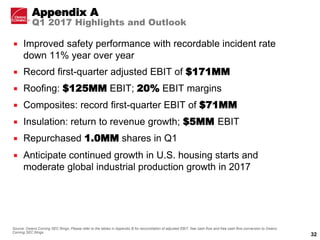

Owens Corning presented information on its Q2 2017 performance focused on shareholder value. It operates three strong businesses: Insulation, Roofing, and Composites. The presentation discussed OC's investment thesis of having market leading businesses, improved portfolio performance and earnings, and attractive macroeconomic drivers. It also provided an overview of each business segment and their financial profiles.