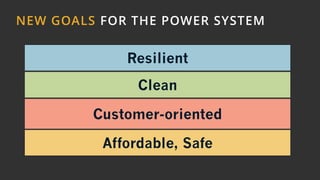

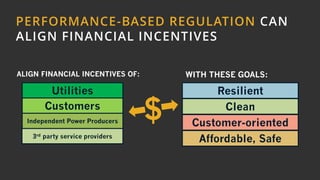

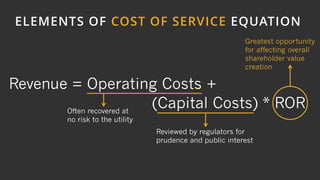

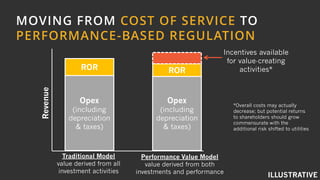

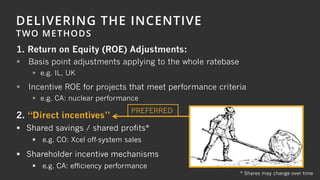

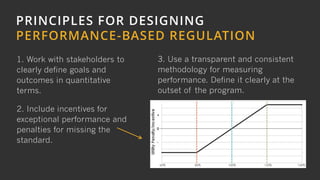

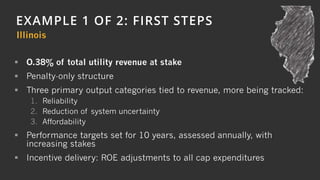

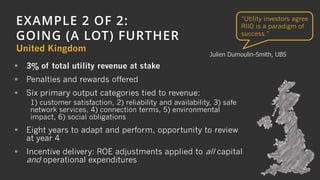

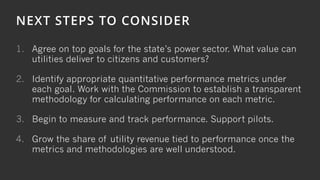

The document discusses the evolution of performance-based regulation in the power sector, shifting from traditional cost of service methods to models that align financial incentives of utilities, customers, and third-party providers with new goals such as resilience, customer satisfaction, and clean energy. It outlines principles for designing effective performance-based regulation and provides examples of implementations in Illinois and the UK. The next steps suggested include agreeing on top goals, identifying performance metrics, measuring performance, and increasing utility revenue tied to these metrics.