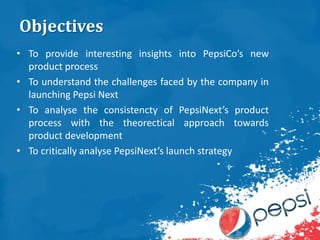

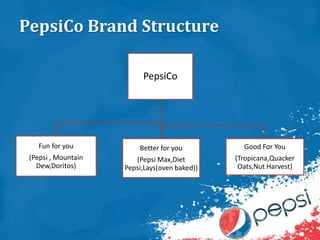

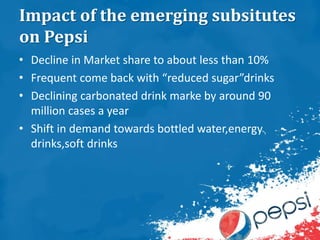

The case study analyzes PepsiCo's launch of Pepsi Next, a mid-calorie cola drink aimed at health-conscious consumers, highlighting the challenges faced due to a declining soft drink market and increased competition. It critiques the consistency of PepsiCo's product development strategy and explores the implications of launching a product similar to previous offerings, questioning whether Pepsi Next could affect the brand's overall equity. Recommendations for future launches include a focus on generating consumer trials and enhancing promotional strategies.