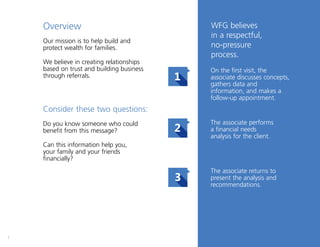

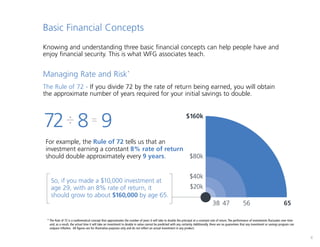

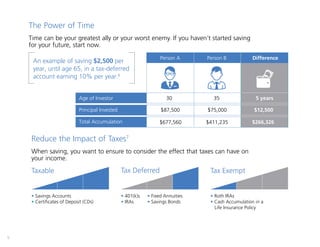

This document provides an overview of World Financial Group and their services. They aim to help clients build and protect wealth through a respectful financial needs analysis process. Their services include term life insurance, annuities, retirement plans, and college savings vehicles. They emphasize basic financial concepts like managing rates of return, the power of starting early, and reducing taxes. The financial needs analysis evaluates a client's goals, protection needs, debts, cash flow, and wealth preservation.