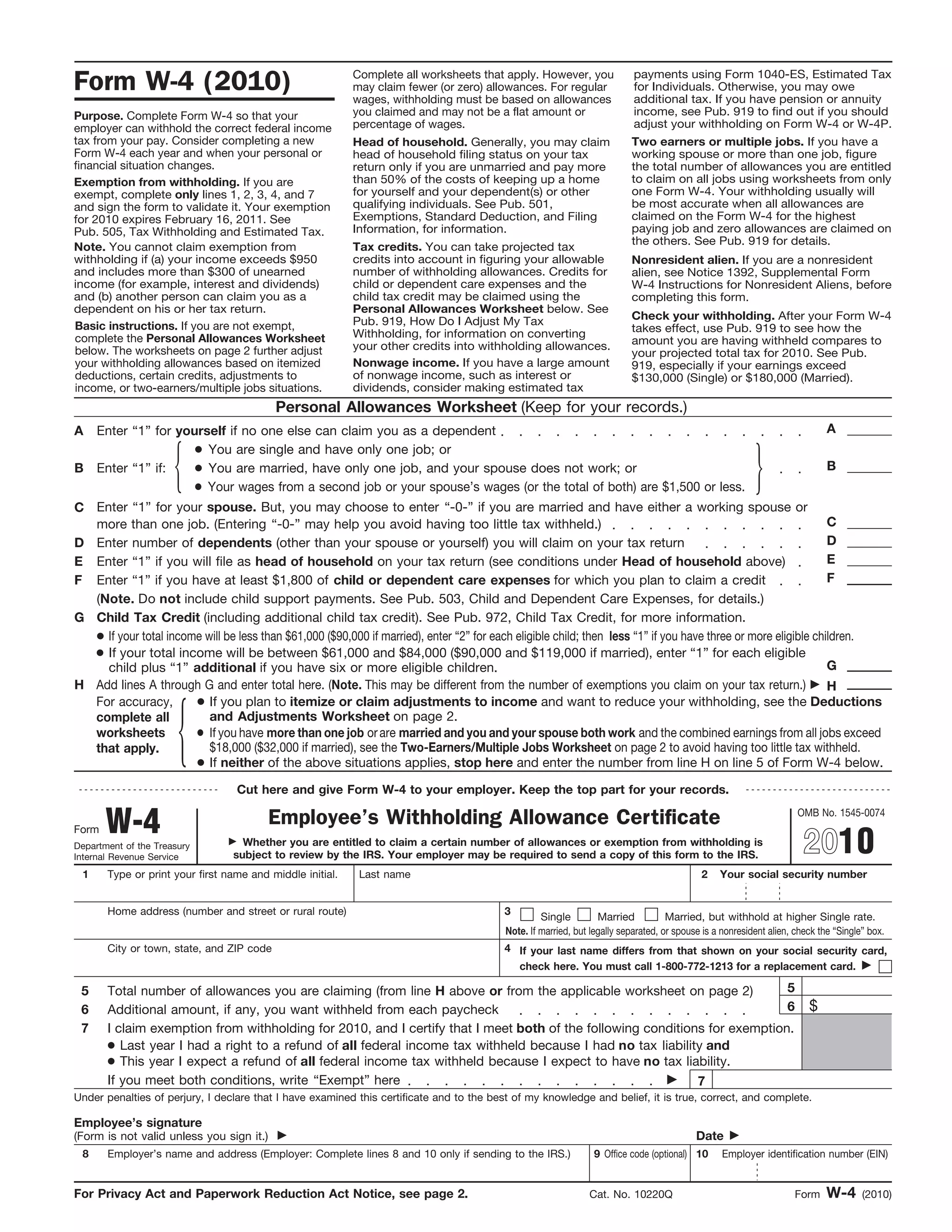

1) Complete all applicable worksheets to determine your withholding allowances. Consider your filing status, dependents, credits, deductions, and income from multiple sources.

2) Enter the number of allowances from line H of the Personal Allowances Worksheet on line 5 of Form W-4. Adjust as needed if you have more than one job or high income.

3) Sign and date Form W-4 and provide to your employer so the correct amount of federal income tax can be withheld from your pay.