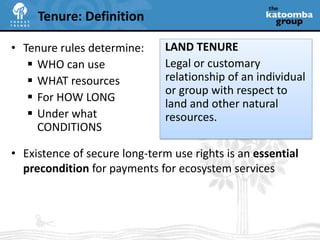

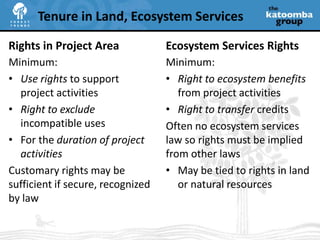

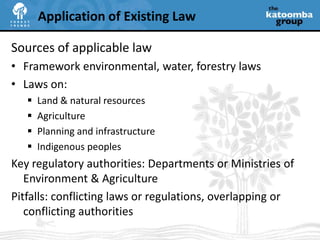

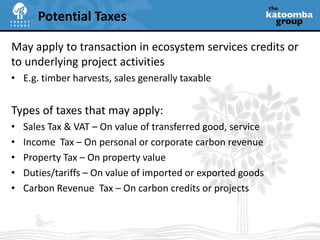

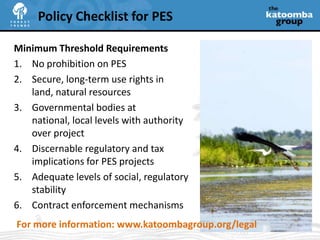

The document summarizes key policy issues regarding Payments for Ecosystem Services (PES) and Reducing Emissions from Deforestation and Degradation (REDD+). It discusses whether PES is permitted by existing law, land tenure and rights over land and natural resources, potential taxes on carbon revenue, and minimum policy requirements to enable PES projects. These include no legal prohibition on PES, secure long-term use rights, governmental authority over projects, and mechanisms for contract enforcement. The document also notes additional favorable policies that could attract buyers, such as regulatory clarity, investment stability, and low taxes.