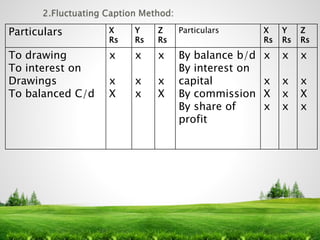

The document provides a definition of partnership according to the Indian Partnership Act of 1932, which describes it as the relationship between individuals who share profits from a jointly conducted business. Key features include the necessity of an agreement for profit-sharing, lawful business conduct, and limitations on the number of partners. Additionally, it discusses partner compensation and necessary adjustments in financial dealings, including interest on capital and profit distribution.