Embed presentation

Download to read offline

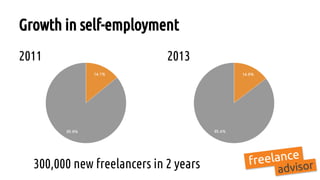

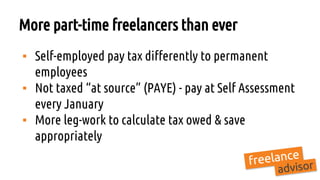

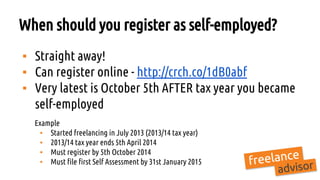

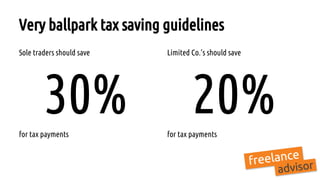

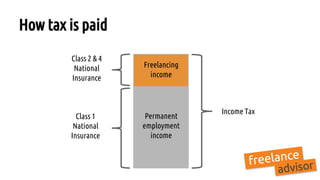

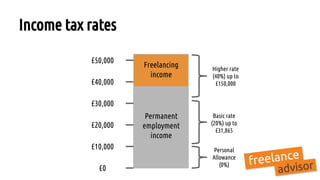

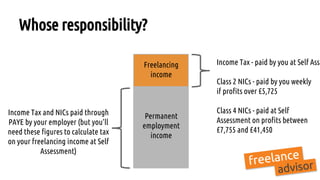

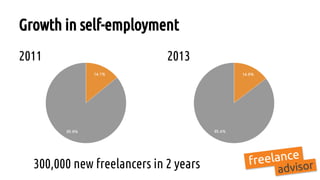

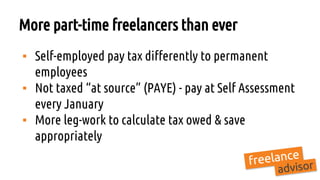

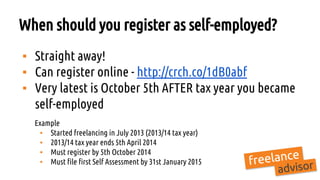

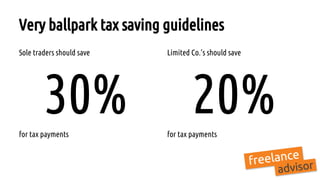

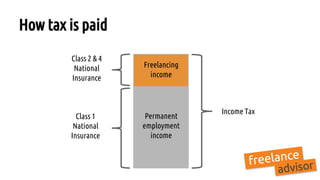

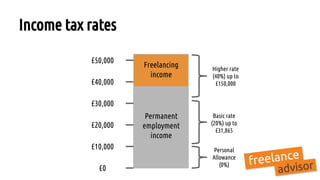

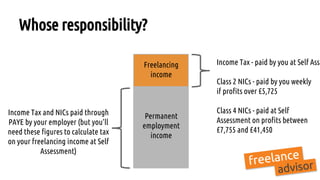

The document provides guidance for part-time freelancers on tax responsibilities, highlighting the rise in self-employment with 300,000 new freelancers from 2011 to 2013. It outlines the necessity of registering as self-employed immediately and the deadlines for self-assessment tax filing. The document also includes general tax saving recommendations and a comparison of tax payments between permanent employment and freelancing.