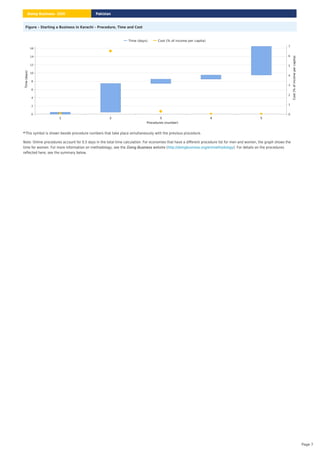

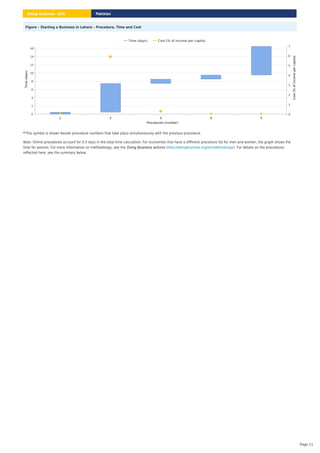

The document provides information on starting a business in Pakistan according to the World Bank's Doing Business study. It finds that starting a business in Pakistan requires 5 procedures, takes 16.5 days and costs 6.7% of income per capita. Specifically in Karachi, starting a business requires 5 procedures, takes 16.5 days and costs 6.9% of income per capita. The document also compares starting a business in Pakistan and Karachi to other economies and cities in the region based on procedures, time and cost.