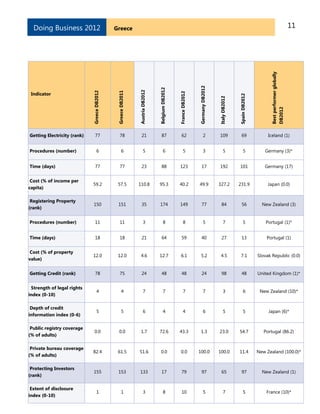

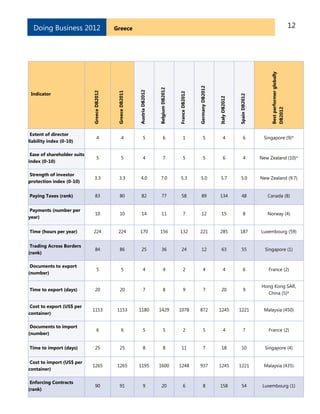

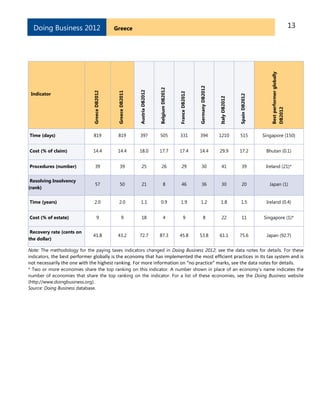

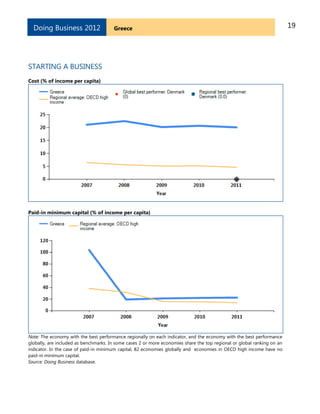

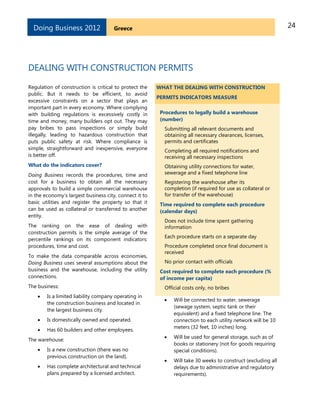

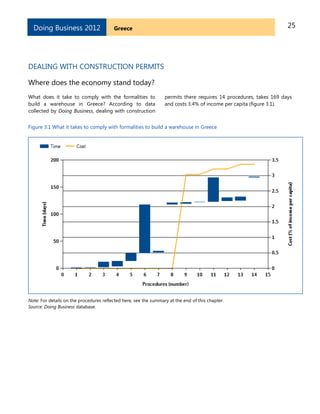

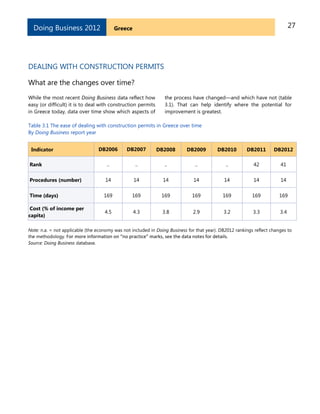

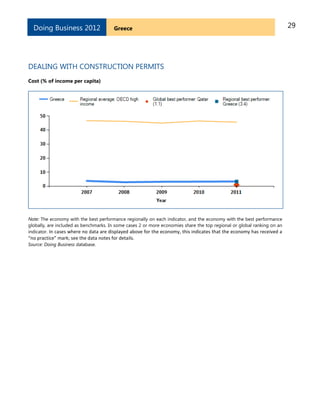

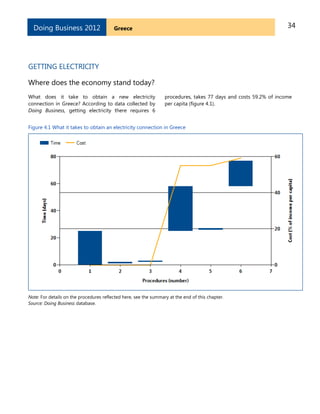

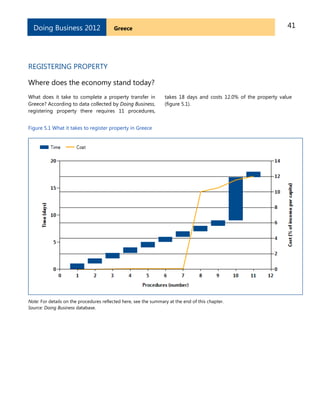

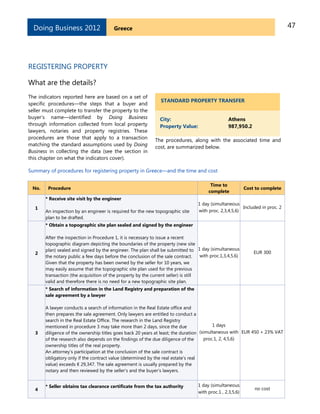

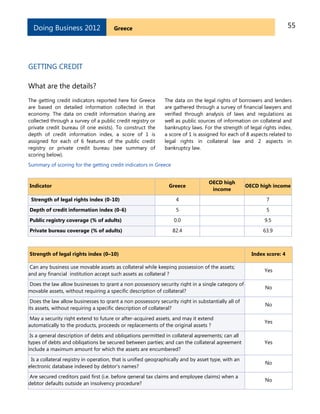

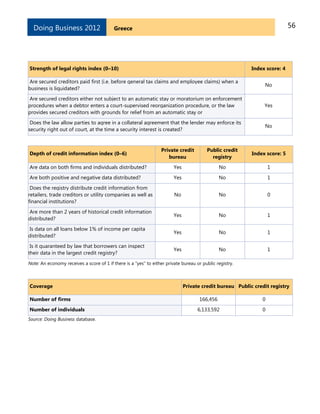

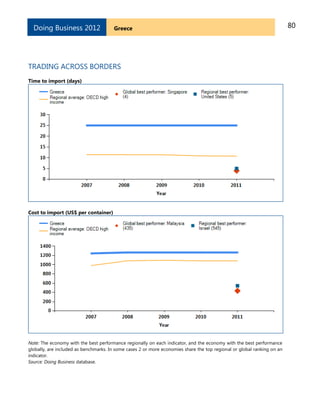

Greece ranks 100 out of 183 economies on the ease of doing business. While it ranks relatively high on dealing with construction permits (41), it lags in areas like starting a business (135), registering property (150), and protecting investors (155). The country performs better on indicators like procedures and time to export but scores poorly on costs associated with getting electricity, paying more taxes than most comparator economies, and having weak legal rights for creditors. Overall, Greece has work to do in simplifying regulatory processes and strengthening legal protections to facilitate business development.