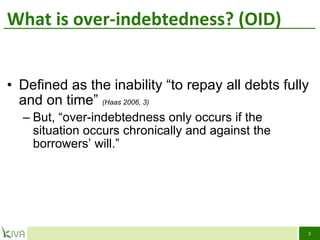

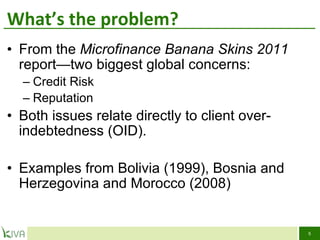

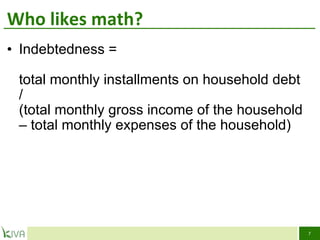

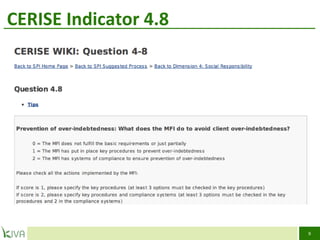

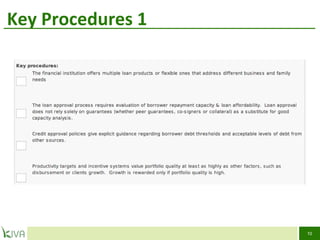

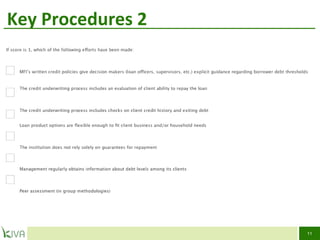

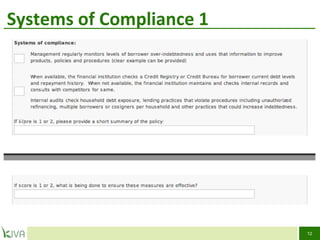

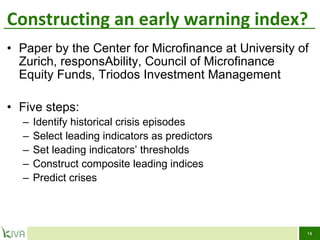

The document discusses client over-indebtedness (OID) in microfinance. It defines OID as the inability to repay all debts fully and on time. While multiple indebtedness and OID are often confused, OID only occurs when the situation is chronic and against the borrower's will. The two biggest concerns in microfinance globally related to OID are credit risk and reputation risk. The document also presents methods for constructing an early warning index to predict crises related to over-indebtedness by identifying historical crises, selecting leading indicators, and applying the index.