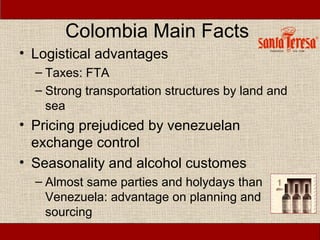

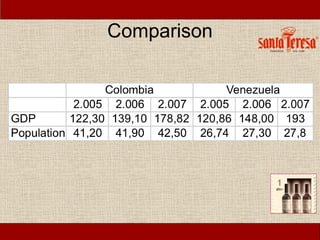

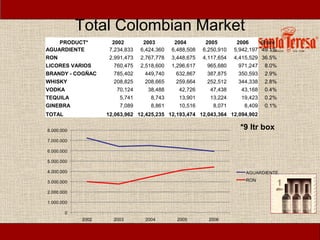

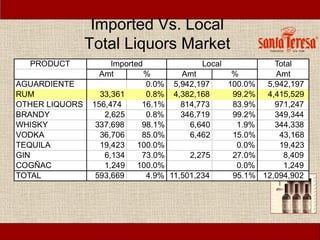

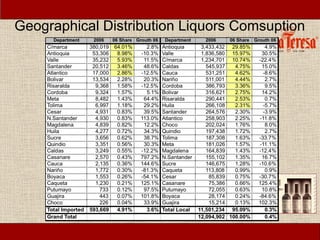

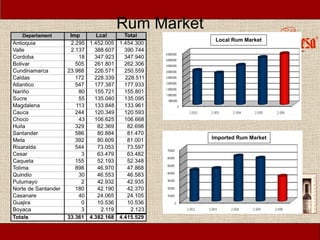

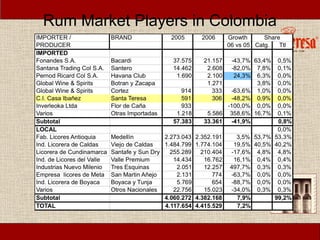

The document discusses Ron Santa Teresa's consideration of expanding internationally. It notes that the internal rum market is decreasing while the international rum market is growing, motivating expansion. It also cites risks of political and economic instability in the internal market. The document provides recommendations on segmentation, targeting, positioning, and distribution channels for international expansion. It then analyzes the rum market and key competitors in Colombia as an initial target market due to logistical advantages and cultural similarities to Venezuela. Other potential target countries are mentioned.